Gold prices are faltering to start 2021, but with the dollar still weak and inflationary pressure on the horizon, investors have solid reasons to go with the yellow metal.

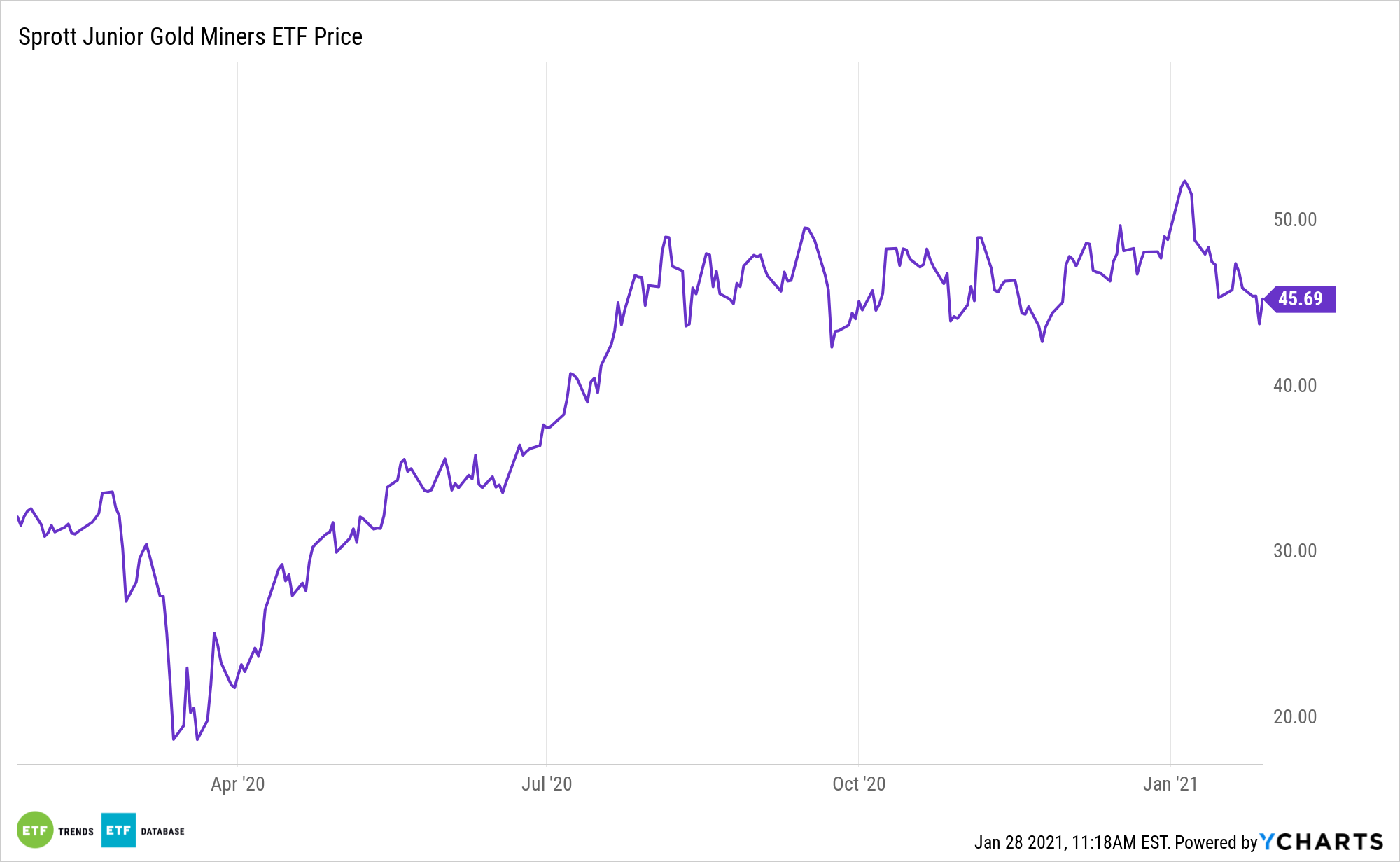

Those macro factors, among others, highlight opportunity with exchange traded funds such as the Sprott Gold Miners ETF (NYSEArca: SGDM) and the Sprott Junior Gold Miners ETF (NYSEArca: SGDJ).

SGDJ tracks small cap gold miners, but weighs its components based on revenue growth and price momentum. By focus identify leading junior gold miners driven by factors like new discovery, mine development, or joint ventures. Pricey stocks also speak to gold benefits.

“The S&P 500 price-to-sales ratio is at unprecedented levels and analysis by Crescat Capital suggests that the 15 factors that make up their S&P 500 valuation model are at – or very near – record highs,” according to the World Gold Council (WGC). “Going forward, we believe that the very low level of interest rates worldwide will likely keep stock prices and valuations high. As such, investors may experience strong market swings and significant pullbacks. These could occur, for example, if vaccination programmes take longer to distribute – or are less effective – than expected, given logistical complexities or the high number of mutations reported in some strains.”

The SGDM ETF: Ready for Inflation

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to Sprott.

Adding to the case for SGDM is improving cash flow for many gold miners, the result of rising gold prices and prudent balance sheet management.

Should inflation come to pass this year, gold’s utility will be on display.

“Gold has historically performed well amid equity market pullbacks as well as high inflation. In years when inflation was higher than 3%, gold’s price increased 15% on average. Notably too, research by Oxford Economics shows that gold should do well in periods of deflation. Such periods are typically characterised by low interest rates and high financial stress, all of which tend to foster demand for gold,” notes the WGC.

For more on precious metals, visit our Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.