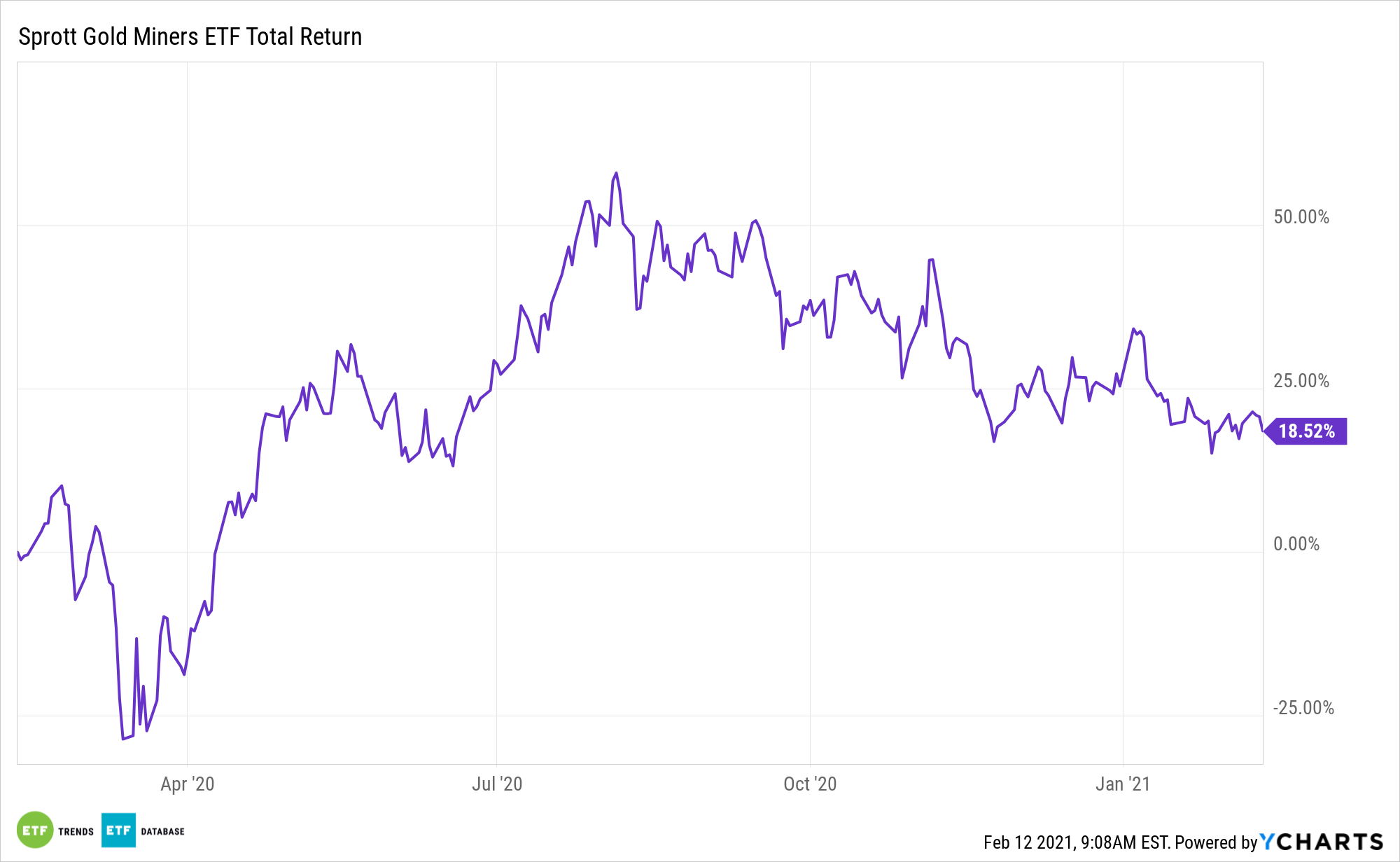

Gold is scuffling a bit to start 2021, but gold bullion, miners, and the Sprott Gold Miners ETF (NYSEArca: SGDM) will be back.

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

“Obviously, short term, there’s a lot of factors that are causing some push and pull, which has kept gold trading within a very tight range. But from my perspective, I think the fundamentals for rising gold prices are very strong over the next year. I expect gold prices to eventually break out and head to new records sometime in the next year or two,” said Ed Moy, the chief investment strategist at Valaurum, in an interview with S&P Global Market Intelligence.

SGDM Can Reward Patient Investors

A return to a risk-on sentiment helped to fuel a sell-off in gold, but as selling pressure begins to subside, look for investors to come back to the precious metal. ETF investors looking for gold exposure should consider SGDM.

Recently, the U.S. Federal Reserve decided to keep interest rates static for the time being, which should have kept the dollar at bay. However, the greenback is rallying thanks to strength in the equities market — a major factor for gold prices moving forward.

Stimulus “gave a lot of investors confidence that the government was doing whatever it could to soften the effects of the economic crisis. Gold corrected. In the case of the financial crisis, it corrected by about 30%,” said Moy to S&P Global. “Then the realization happened that, with all the stimulus, there was still a lot of economic uncertainty, and the fear of inflation set in. You saw over the course of three years, even past the financial crisis, gold then hit a new historic high in 2011. The same things were happening when COVID-19 first started breaking out. Lockdowns started coming into place, people panicked, they went into gold. Gold actually shot up to a new high, and the government … [is]basically throwing more at it than what happened during the financial crisis. Plus, with the vaccine, people started relaxing.”

SGDM follows mid- to large-cap gold miners, but the underlying index weighs components based on quarterly revenue growth on a year-over-year basis and the quality of their balance sheets as measured by long-term debt to equity. By focusing on balance sheet strength, the fund has greater exposure to companies with a lower long-term debt to equity ratio, which have a greater ability to weather downturns.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.