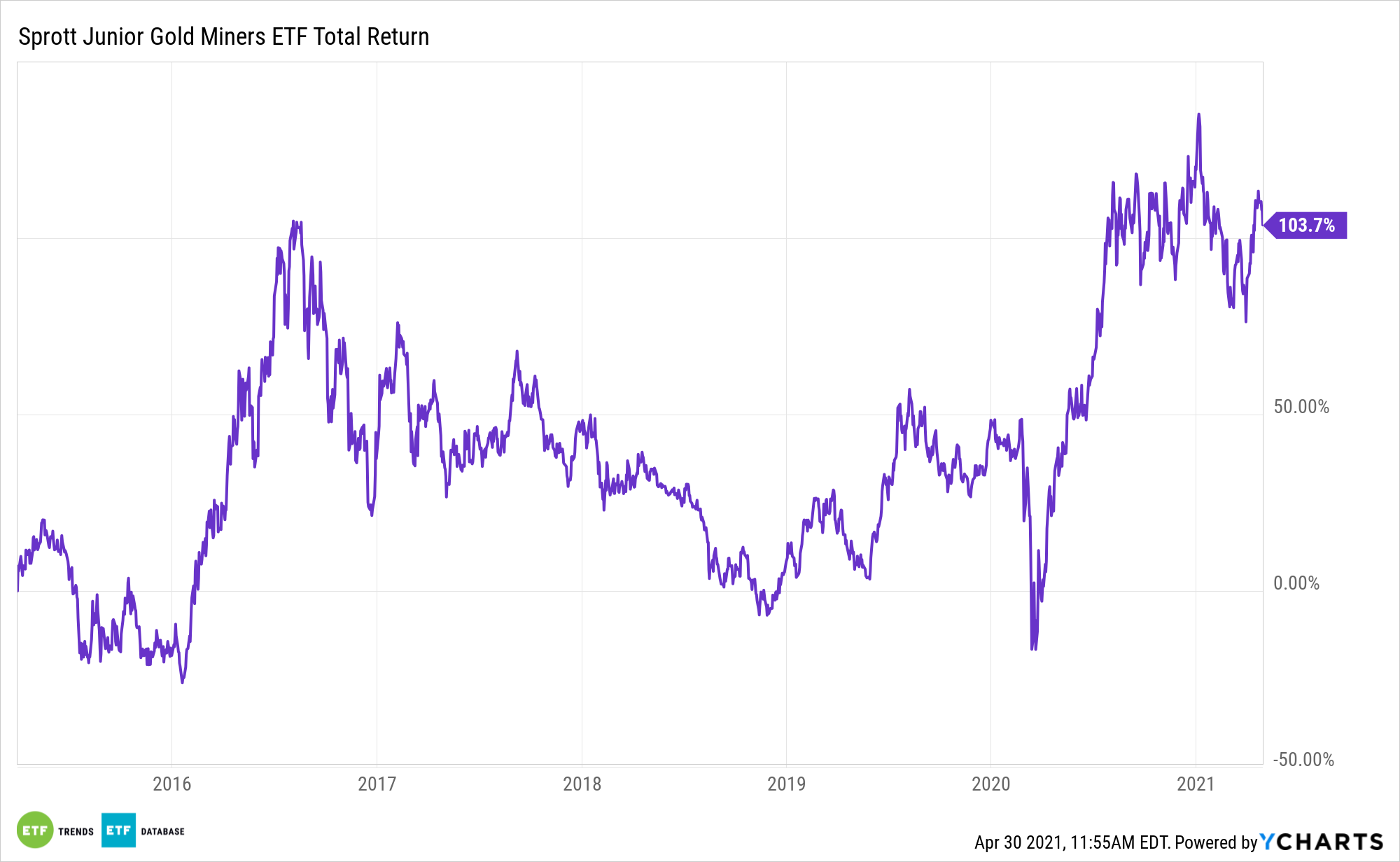

Rising interest rates and resurgent economic growth weighed on gold and bullion miners in the first quarter, but consumer demand for the yellow metal remains robust, and that could be a spark for the Sprott Junior Gold Miners ETF (NYSEArca: SGDJ) as 2021 moves along.

SGDJ tracks small cap gold miners, but weighs its components based on revenue growth and price momentum. The ETF focuses on price momentum, which helps identify leading junior gold miners driven by factors like new discovery, mine development, or joint ventures.

While gold-backed exchange traded funds saw some redemptions in the first three months of the year, consumers embraced lower relative gold prices.

See also: This Bank Sees Gold Reaching $2,000/oz This Year

“The opportunity to buy at lower prices, relative to the highs seen last year, boosted consumer demand, particularly as many markets continued to emerge from lockdown and economic recovery lifted sentiment,” according to research from the World Gold Council (WGC).

Looming Tailwinds for ‘SGDJ’

With inflation heating up and the potential for interest rates to normalize, SGDJ has some short-term catalysts to consider.

That and the fact that junior miners are also viewed as inexpensive and credible takeover targets as large cap miners look to effectively replenish depleted reserves. And don’t forget the consumers and investors that opt for direct holdings.

“Jewellery demand of 477.4t was 52% higher y-o-y . The value of jewellery spending – US$27.5 billion (bn) – was the highest for a first quarter since Q1 2013,” notes the WGC. “Bar and coin investment of 339.5t (+36% y-o-y) was buoyed by bargain-hunting, as well as by expectations of building inflationary pressures.”

Gold and SDGJ have some other favorable factors, too.

“Q1 saw continued healthy levels of net buying by central banks: global official gold reserves grew by 95.5t, 23% lower y-o-y, but 20% higher q-o-q,” adds the WGC. “Gold used in technology grew 11% y-o-y in Q1 as consumer confidence continued to recover. Demand of 81.2t was just above the five-year quarterly average of 80.9t.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.