Pay enough attention to the silver market this year and you’re sure to hear something about short covering and squeezes.

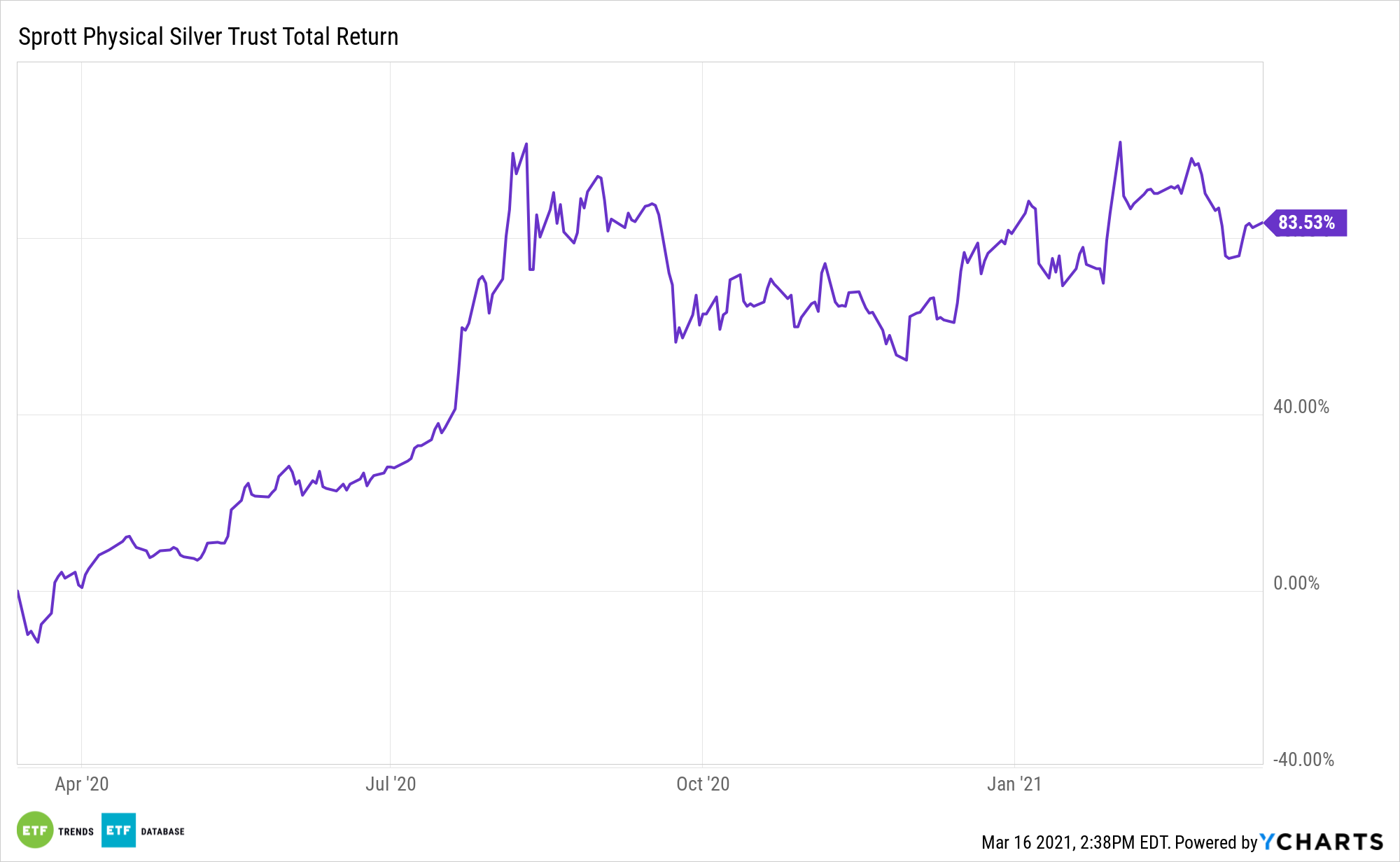

That chatter is starting up again, and it could be to the benefit of the Sprott Physical Silver Trust (NYSEArca: PSLV).

“Silver once again outperformed Gold today by gains, Silver is up just over 1%, while Gold gained only 0.24%. According to the CFTC data as of March 9, there is a 20,000 spread between the overall net positions on Silver Futures, with an edge going to short positions,” reports FX Empire.

PSLV is a closed-end fund that lets investors redeem large blocks of shares in exchange for delivery of silver bullion.

The Trust often trades at a premium to net asset value (NAV). Closed-end funds can see large premiums and discounts, while exchange traded funds have an arbitrage feature that tends to keep prices much more in line. PSLV does possess some unique benefits however and silver is gaining momentum as long-term idea.

PSLV, Silver Worth a Near-Term Look

Amid increased adoption of renewable energy sources, new, fast-growing end markets are emerging for silver. Translation: the expected influx of cash to the renewable energy industry thanks to Biden’s victory is seen as benefiting silver prices. Analysts are growing bullish on the white metal.

Silver prices and related ETFs have surged on improving fundamentals with demand-side support due to the coronavirus uncertainty, stimulus measures, and the recovering industrial sector. On the other side, supplies are dwindling as well.

“If Silver is not able to break and close above $26.75 and is rejected by this resistance area, the sharp fall may send it back to $24.90 and $24.35. If Silver is able to close above $26.75, then it might signal the bullish continuation of the precious metal, however the first scenario looks more relevant based on the chart analysis and the data from CFTC,” concludes FX Empire.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.