Gold is one of the assets Bitcoin is most frequently compared with, and the latter’s most recent ascent to an all-time high could be a spark for the precious metal.

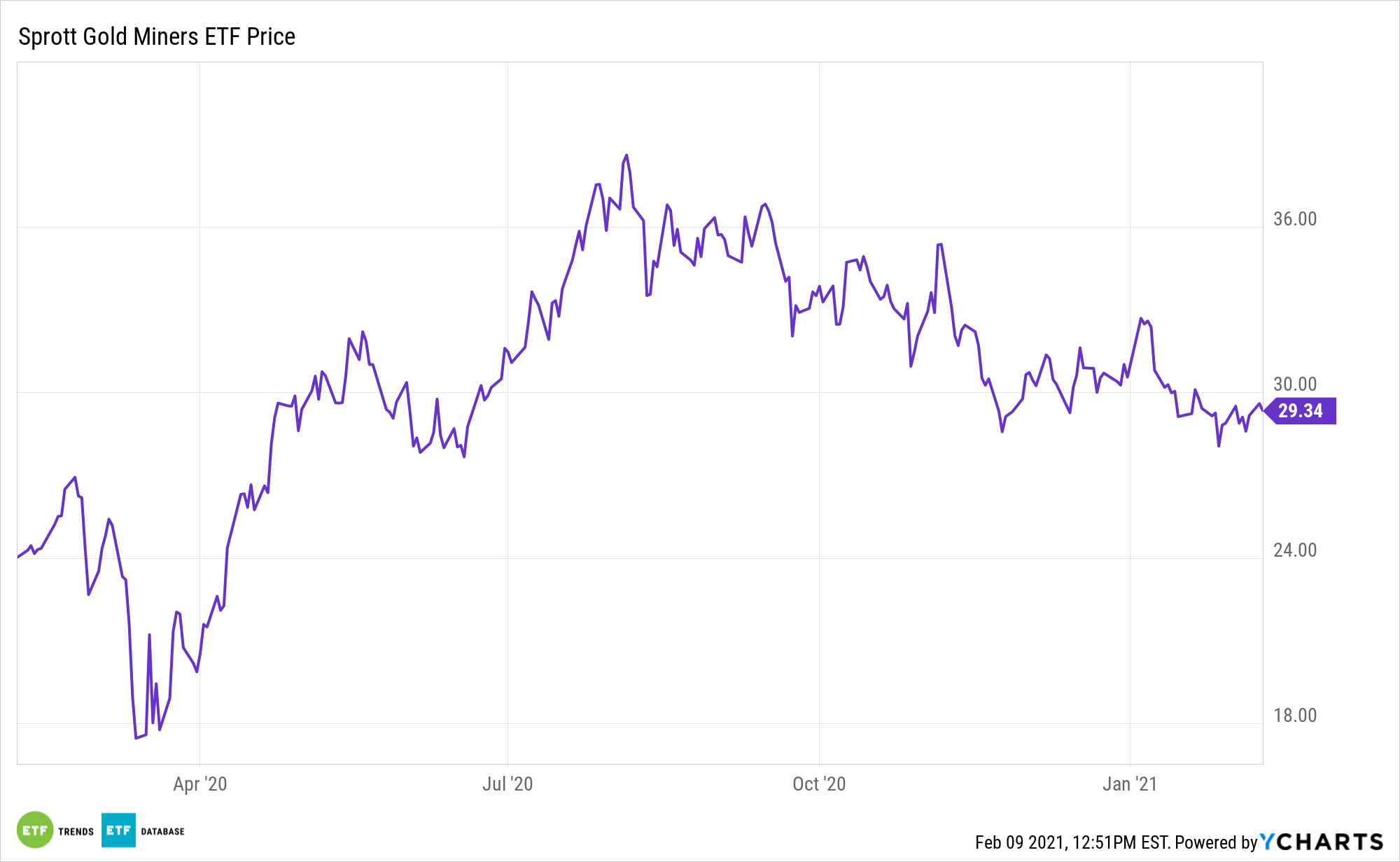

If correlations between the two assets tighten, the Sprott Gold Miners ETF (NYSEArca: SGDM) will benefit.

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

In the eyes of some market observers, Bitcoin is still searching for its place in the asset allocation spectrum. Many backers of the digital currency do compare it to gold.

Gold bugs say Bitcoin is too volatile to be considered a legitimate safe-haven investment and that cryptocurrencies have a weak case as stores of value. Indeed, long-term data show loose correlations between Bitcoin and bullion. However, the coronavirus outbreak has forced some tightening in the gold/Bitcoin relationship.

Good News for SGDM

Yesterday, it was “a happy Monday for crypto investors as bitcoin surged to new record highs above $44,000 on the news that Tesla not only invested $1.5 billion in bitcoin but also said it would begin accepting the cryptocurrency as a form of payment,” reports Anna Golubova for Kitco News.

Sprott’s SGDM fits into this scenario because Tesla is also accepting gold and bullion ETFs as a form of payment. That could lift prices of the yellow metal, which is usually a plus for mining assets. Those equities and funds often overshoot gold’s price action.

SGDM follows mid- to large-cap gold miners, but the underlying index weighs components based on quarterly revenue growth on a year-over-year basis and the quality of its balance sheet as measured by long-term debt to equity. As such, by focusing on balance sheet strength, the fund has greater exposure to companies with a lower long-term debt to equity ratio, which have a greater ability to weather potential downturns.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.