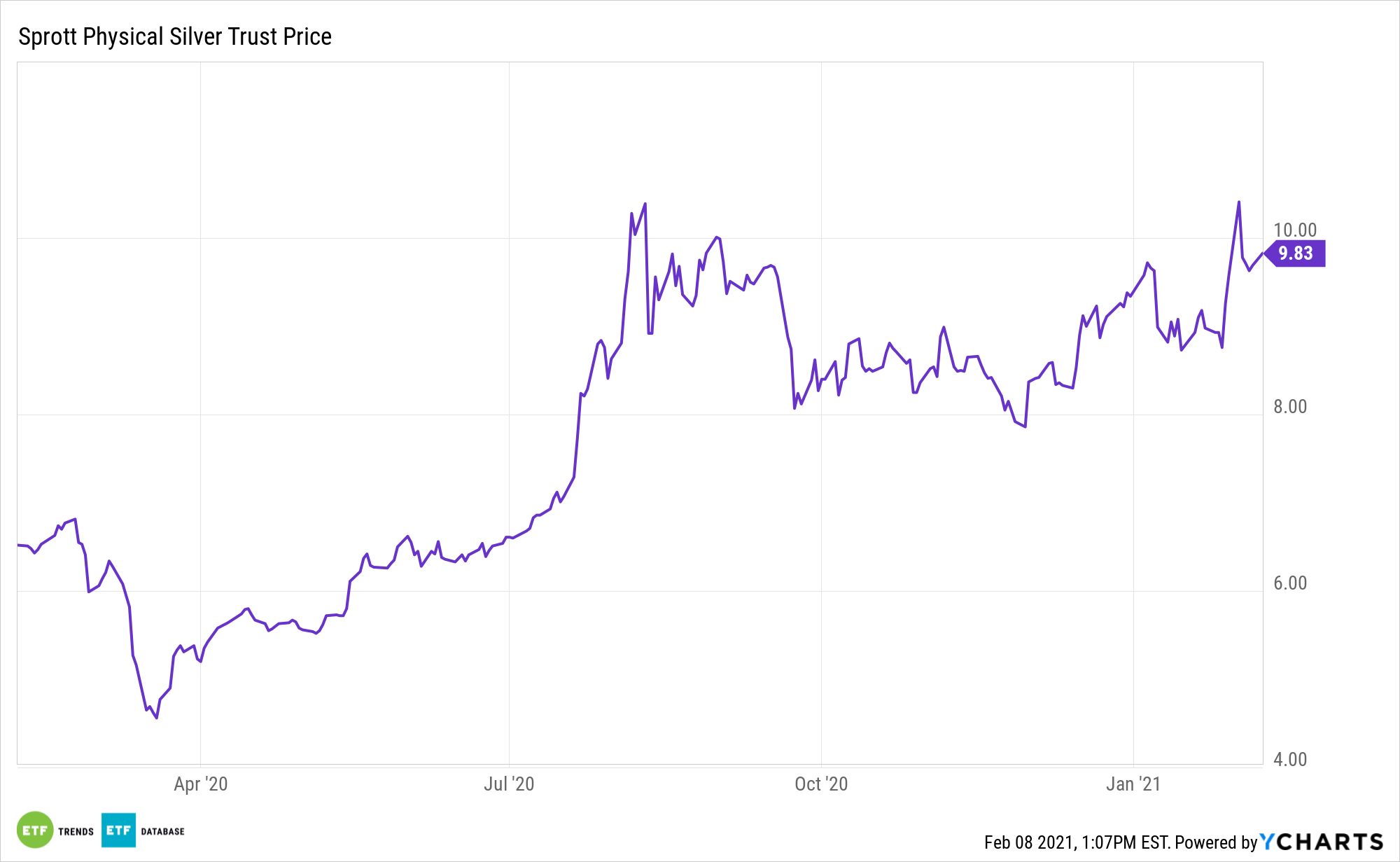

Silver prices and assets like the Sprott Physical Silver Trust (NYSEArca: PSLV) were in the spotlight in a big way last week amid talk of short squeeze orchestrated by some retail traders.

That momentum didn’t last long, but that doesn’t mean investors should gloss over PSLV. Some commodities market observers believe the white metal is still undervalued.

“Silver’s physical market was already stressed, with major world manufacturers and mines encountering more demand for certain fabricated bars and coins ‘than their ability to produce product since the Jan. 6 storming of the U.S. Congress.’ That episode created a demand surge for gold and silver, says Dana Samuelson, president of American Gold Exchange,” reports Myra Saefong for Barron’s.

PSLV “provides investors with exposure to physical silver at a time when demand is high, causing excessive premiums for coins and bars,” according to Sprott.

‘PSLV’ Still a Powerful Idea Today

PSLV is a closed-end fund that lets investors redeem large blocks of shares in exchange for delivery of silver bullion.

The Sprott Physical Silver Trust often trades at a premium to net asset value (NAV). Closed-end funds can see large premiums and discounts, while exchange traded funds (ETFs) have an arbitrage feature that tends to keep prices in line.

“Samuelson believes silver remains undervalued relative to gold by 10% to 30%. With gold in the $1,825 to $1,875 an ounce range, silver should be trading at $30 to $35, he says,” according to Barron’s.

PSLV “offers a potential tax advantage for certain non-corporate U.S. investors. Gains realized on the sale of the Trust’s units can be taxed at a capital gains rate of 15%/20% versus the 28% collectibles rate applied to most precious metals ETFs, coins and bars,” adds Sprott.

For more on precious metals, visit our Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.