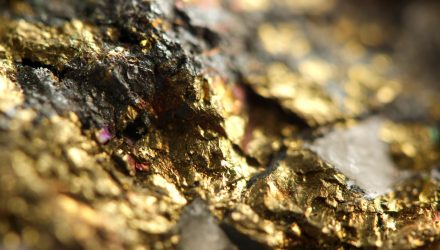

Meanwhile, fundamentals like rising inflation and gold supply concerns may contribute to stronger pricing. Gold may be past its peak supply as exploration budgets have collapsed. Gold miners are also finding fewer large deposits, which have further weighed on the supply outlook.

“Inflation can be understood as the destruction of wealth. Every time consumer prices head higher, a dollar loses some of its value, whether in your pocket or your savings account. Inflation can also weigh on stock prices, as some investors anticipate it cutting into corporate earnings. They might therefore decide to move their money into other assets,” according to U.S. Global.

Dwindling supply is another factor that could support higher gold prices and potentially benefit miners of the yellow metal.

“If gold demand were to spike unusually high, there’s a strong probability that not enough gold would be available. We would expect the metal to be traded at a premium,” said U.S. Global.

For more articles on the latest Gold ETF trends, visit our gold category.