The current market environment affords ample space for both bullish and bearish silver investors.

Given that, which direction should prospective silver investors go? On one hand, a global economic recovery should be feeding into higher risk profiles for investors, causing them to dump precious metals and load up on stocks.

However, there’s always a push and pull dynamic to the markets. In silver’s case, falling yields could be pushing against the narrative of stronger growth as the economy pulls itself of the pandemic doldrums.

“A feature in the marketplace recently has been falling U.S. government bond yields amid notions that U.S. and global economic growth has leveled off from the stronger pace seen coming out of the pandemic’s shackles,” a Kitco News article from Jim Wyckoff explained. “Such can be extrapolated to easier monetary policies for a longer time from the major world’s major central banks. Adding to concerns about less robust global economic growth is a new strain of Covid-19 that is surging in some parts of the world at the same time vaccinations have tailed off.”

From a technical perspective, there’s still not a stronger case for either the self-styled bull or bear.

“The silver bulls and bears are on a level overall near-term technical playing field,” Wyckoff added. “Silver bulls’ next upside price objective is closing September futures prices above solid technical resistance at $28.00 an ounce. The next downside price objective for the bears is closing prices below solid support at the June low of $25.58. First resistance is seen at the overnight high of $26.375 and then at $26.545. Next support is seen at last week’s low of $25.82 and then at $25.58.”

Snagging Silver Exposure

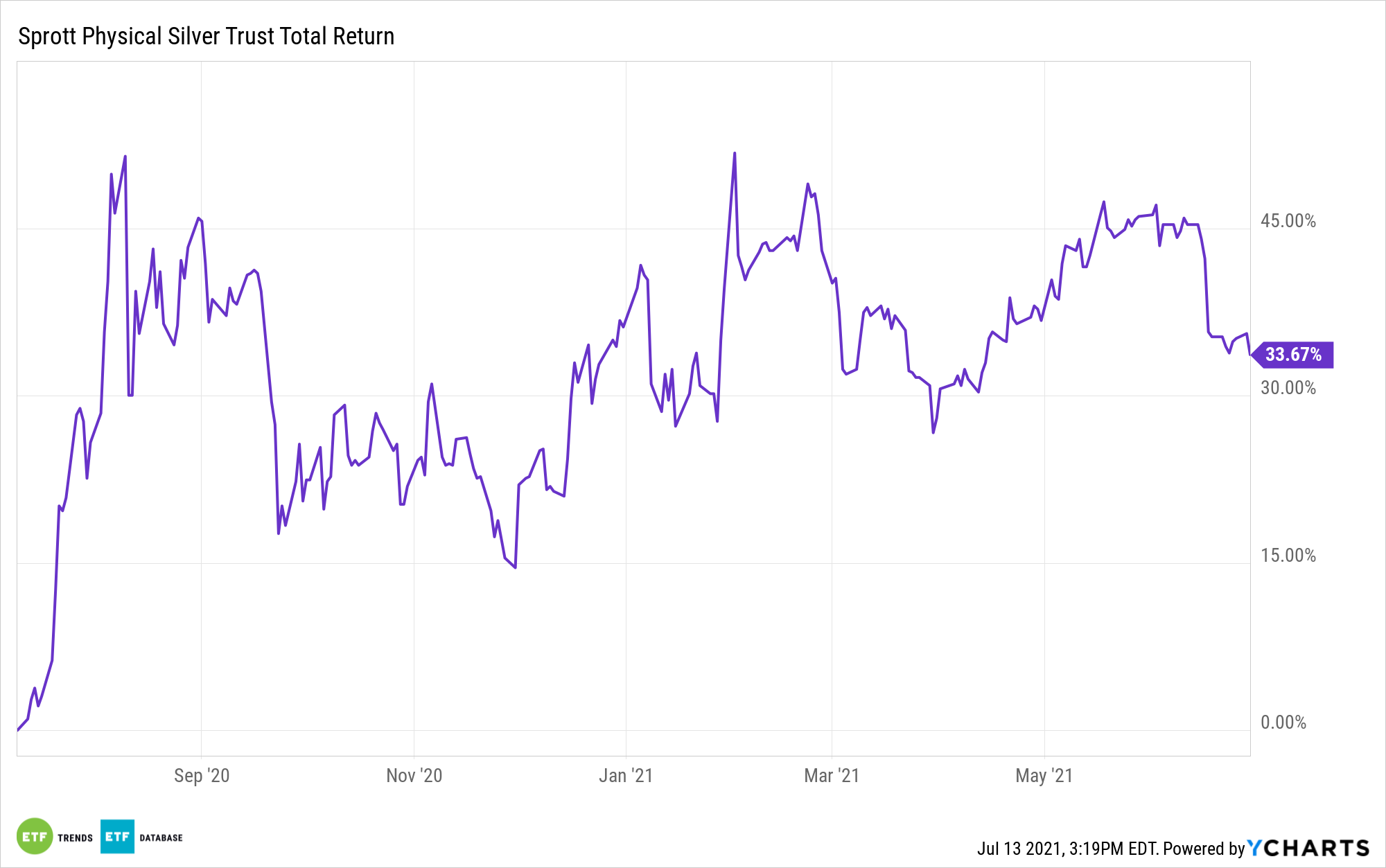

For investors sensing an opportunity to hold silver, rather than opt for the physical metal, there’s another option: the Sprott Physical Silver Trust (PSLV). PSLV is a closed-end trust that holds unencumbered, fully-allocated London Good Delivery bars of silver bullion, stored in the custody of the Royal Canadian Mint.

Shareholders also have the ability to redeem their shares for physical bullion anywhere in the world (subject to certain minimum conditions). Such redemptions do not dilute the trust’s exposure for remaining shareholders. PSLV’s expense ratio comes in at 0.62%.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.