The reopening of China after its strict zero-COVID policy has set the country on a path to recovery — and investors and analysts have taken notice. Not only have China stocks been going up at a steady rate after Beijing has eased up on restrictions, but economists are also more bullish on the region’s growth prospects going forward.

After lifting its COVID restrictions faster than expected, China’s economy is now forecast to expand 5.1% in 2023 and 5% next year, according to the median estimate in a Bloomberg survey of economists. The projections were higher than 4.8% and 4.9%, respectively, in last month’s poll.

“Chinese stocks have already surged almost 50% since late October as Beijing pivots away from policies that battered stocks over the last couple of years, from zero-COVID to crackdowns on the internet and property sectors,” according to Barron’s. “But Chinese policymakers are singing a new tune, vowing to prioritize growth and even easing restrictions on developers to stabilize the real estate market.”

This about-face from Beijing has led UBS Wealth Management’s global chief investment strategist Mark Haefele to identify China as the “most preferred” in Asia and recommend that investors give Chinese companies from various industries a second look.

Investors wanting to increase their exposure to the world’s second-largest economy as it reopens may want to consider the Xtrackers MSCI All China Equity ETF (CN). CN seeks investment results that correspond generally to the performance of the MSCI China All Shares Index, an index designed to capture large- and mid-cap representation across all China securities listed in China and Hong Kong, as well as in the U.S. and Singapore.

The ETF seeks to gain exposure to the China A-share components of the index by investing in affiliated funds, the Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) and the Xtrackers Harvest CSI 500 China AShares Small Cap ETF (ASHS).

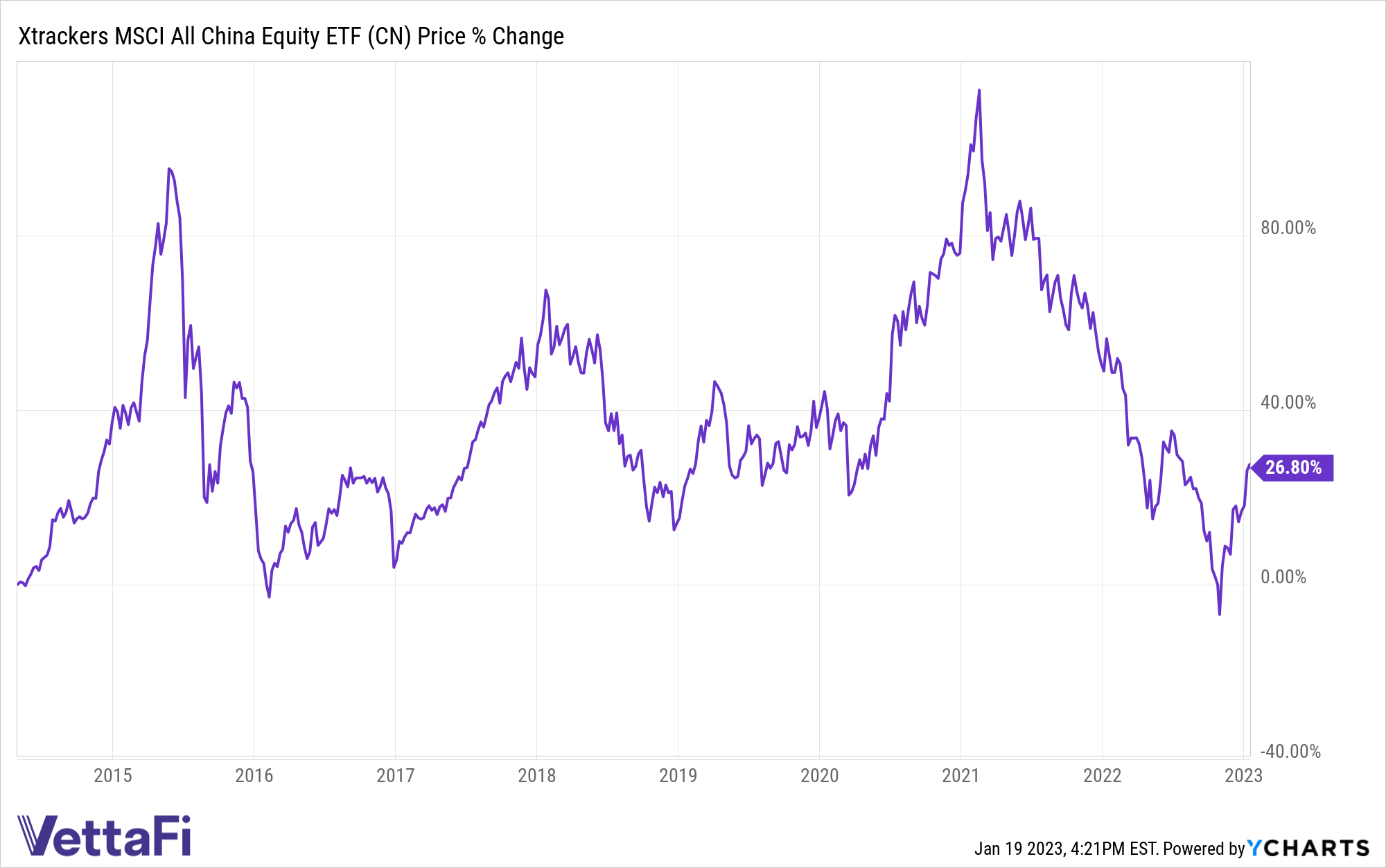

CN is up nearly 27% from its inception.

“Advisors have rediscovered the benefits of investing in emerging markets like China in 2023, as the rewards have exceeded the risks,” said Todd Rosenbluth, head of research at VettaFi. “CN is a rare China ETF to provide broad exposure including A shares and more traditional Hong Kong and U.S listed securities of Chinese companies.”

CN has an expense ratio of 0.50%.

For more news, information, and analysis, visit the Global Diversification Channel.