Environmental, social, and governance (ESG) investing isn’t a new concept, but the fact that it gained broader acceptance and traction in recent years combined with the proliferation of related exchange traded funds, it’s being given a new treatment.

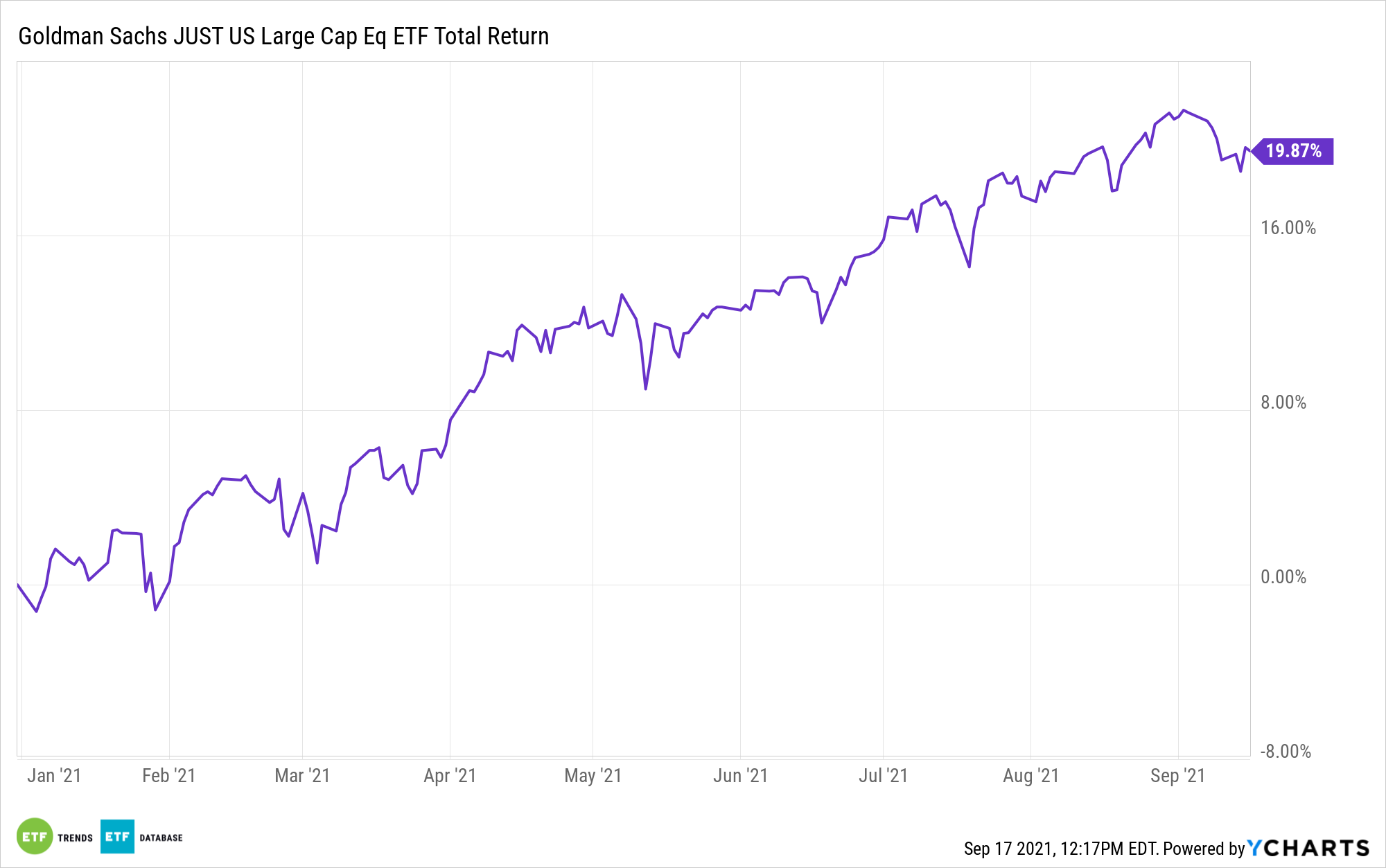

With that comes plenty of criticism. Investors willing to look for the forest through the trees may find opportunities with ETFs, such as the Goldman Sachs JUST U.S. Large Cap Equity ETF (JUST), even as critiques of ESG strategies mount.

Earlier this week, NYU finance professor Aswath Damodaran called ESG a “mistake,” while Tariq Fancy, the former chief investment officer for sustainable investing at BlackRock, recently bashed the concept. However, plenty of ESG funds are allaying investors’ concerns about performance and risk, and some market observers believe that the critics are missing the mark.

“Fancy and Damodaran draw a number of correct conclusions, most notably that ESG and sustainable finance haven’t yet accomplished their full objectives,” says Simon MacMahon, head of ESG and corporate governance research, Sustainalytics. “Yet they both throw the baby out with the bathwater by 1) blurring the lines between risk and impact, 2) not understanding what ESG has accomplished, and 3) failing to recognize that we are in the early innings of the adoption of ESG with many innings yet to play.”

JUST tracks the the JUST U.S. Large Cap Diversified Index, which goes beyond simple ESG metrics. Rather, the benchmark uses 88 filters to screen the Russell 1000 on “a variety of issues, including worker treatment, customer concerns and environmental impacts,” according to Goldman Sachs.

The breadth of JUST’s underlying index actually makes the fund more aligned with what ESG is trying to accomplish than many investors realize.

“The reality is that ESG products and research are more focused and targeted than that–with specific ratings, research, and approaches for the motivations of risk, impact, and values. ESG ratings firms are aiming to provide better, more comparable data and signals to support the analysis of factors that previously were challenging for investors to analyze,” according to MacMahon.

It pays to remember that the ESG movement is just getting started and, specific to JUST, that fund is allaying concerns about performance as it is higher by nearly 32% over the past 12 months.

“We are in the early innings when it comes to ESG. Moreover, ESG has been running uphill without a lot of the basic necessary requirements–such as robust corporate disclosures, even when it comes to material issues. The level of ESG adoption that we are seeing across regions and among different financial market participants is remarkable,” concludes MacMahon.

For more news, information, and strategy, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.