The growth factor is one of the traditional investment factors, but as equity investing evolves, so do factors, and growth is part of that equation.

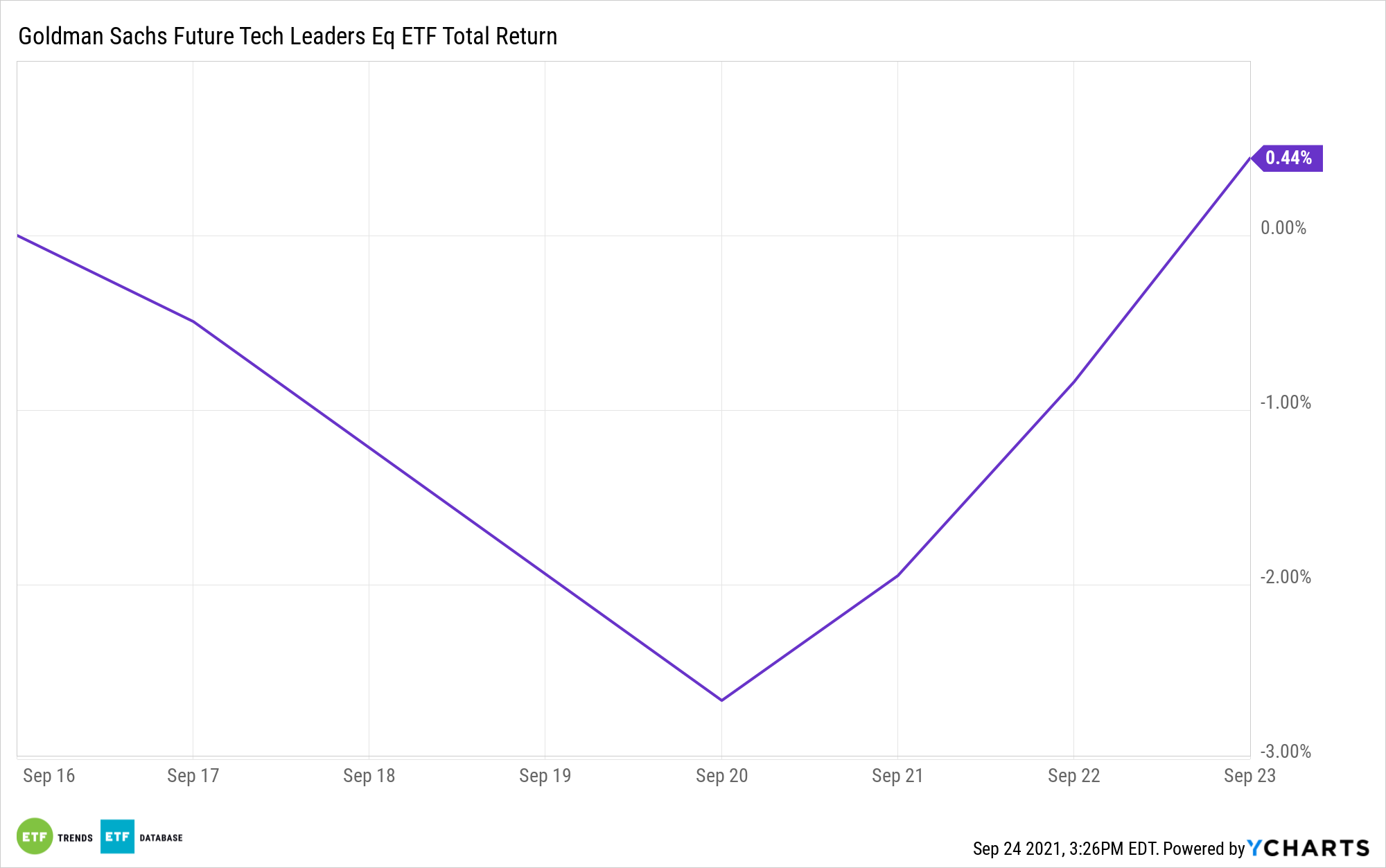

In recent years, growth investing developed an offshoot: disruptive and innovative growth. Stock picking in that vein is difficult, but exchange traded funds such as the Goldman Sachs Future Tech Leaders Equity ETF (GTEK) make disruptive growth investing easier for market participants.

GTEK, the newest addition to the Goldman Sachs stable of ETFs, provides an efficient, and, perhaps more importantly, an easy-to-understand avenue to a concept that many investors are undoubtedly attracted to but confused by at the same time. Some of that confusion is derived from fluidity in what defines disruptive growth and what sectors and industries are viable destinations for locating it.

“Adapting to the changing climate also includes advances in technology, such as in medicine, energy, transportation, space travel, artificial intelligence and computing. We need to analyze our current investments and consider updating our investment portfolios,” reports Scott Schwartz for InvestmentNews.

While disruptive growth stocks offer potential for stellar returns, there are a couple of things for investors to consider, and these factors speak to GTEK’s advantages. First, stock picking in this space is extremely difficult, underscoring the advantages of GTEK’s diversified basket approach.

Second, many of the funds in the disruptive growth space may be a bit too adventurous for some investors as these products stretch into industries with limited track records. Artificial intelligence is one thing, but tech-based food and agriculture aren’t concepts that all investors are familiar with as of yet. For its part, GTEK is heavily allocated to many of the basic (though far from boring) innovative growth concepts favored by broad swaths of investors. For example, some of the fund’s holdings are exposed to the fast-growing AI and robotics industries.

“AI is here to stay. It’s been around for a long time and is pervasive: Almost every modern technology has some element of AI. Many billions of investment dollars are committed to the AI industry, and more funds are flowing in daily. This technology is clearly woven deeply into the new climate. The problem is not where to look, it’s where not to look,” according to InvestmentNews.

Overall, GTEK has a 71.4% tech allocation, which is large though sensible in this case.

“Technological advances associated with modern and next-generation computing will very likely have a profound impact on the world. These effects include but are not limited to brain mapping, targeting pharmaceuticals, transportation efficiencies, financial optimization and climate modeling,” notes InvestmentNews.

For more news, information, and strategy, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.