Healthcare innovation isn’t the result of the coronavirus pandemic. Nor will it be a relic of the global health crisis, but the concept is getting more attention because of COVID-19.

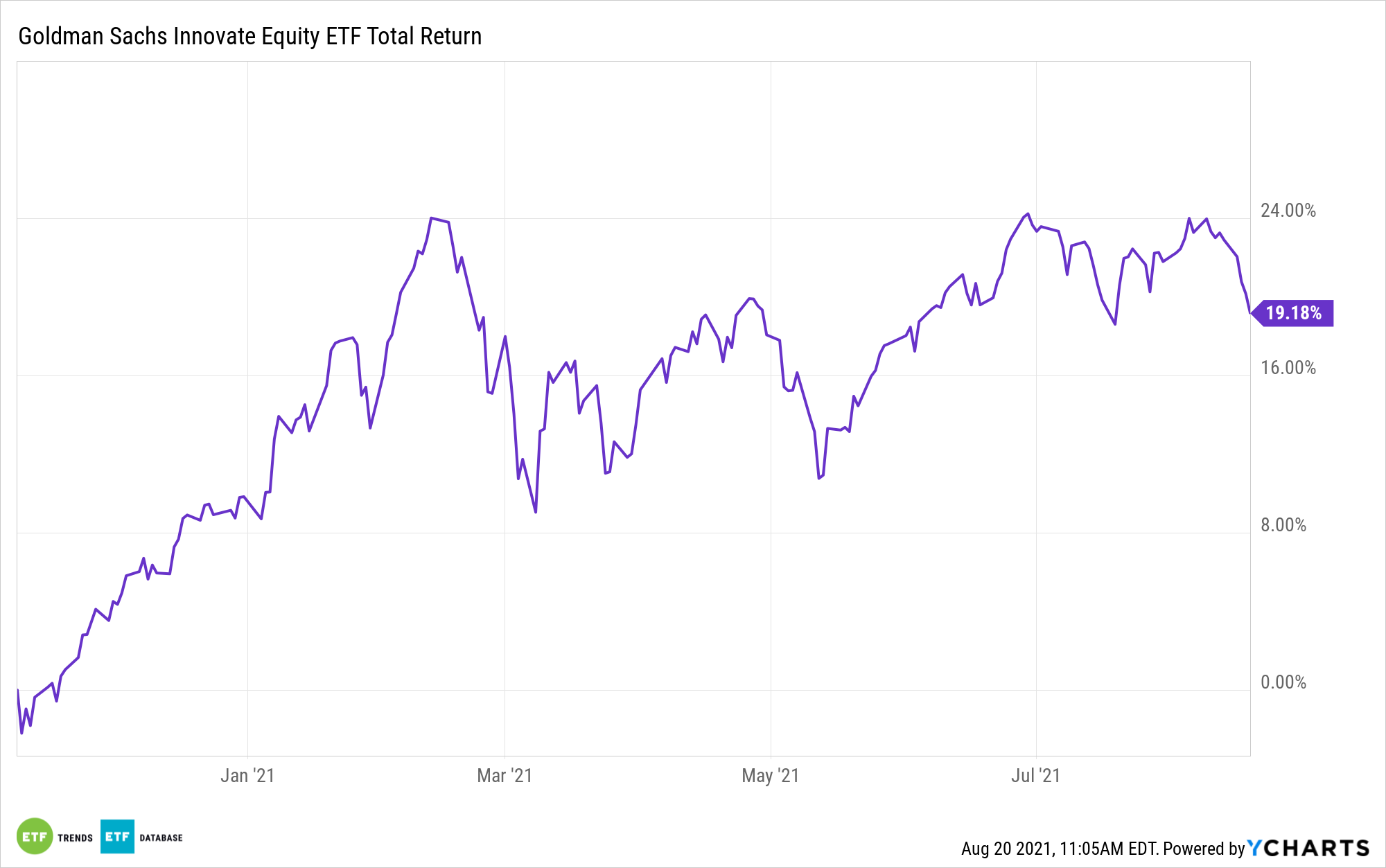

Truth is, healthcare was innovating prior to the pandemic, but the coronavirus has called more attention to the sector’s innovative qualities. There are multiple ways for investors tap into that trend, including broader emerging growth exchange traded funds like the Goldman Sachs Innovate Equity ETF (GINN).

Among the five disruptive themes featured in GINN is “human evolution,” which implies some healthcare exposure. To that end, healthcare is the ETF’s second-largest sector allocation at 19.8%, or 600 basis points above the S&P 500’s weight to the sector. GINN’s above market weight exposure to healthcare is relevant for multiple reasons.

“If any good at all is to come of the pandemic, it is already being seen in the rapid and innovative response of the healthcare and medical technology world to a profound and urgent need. Stretching far beyond the development of effective vaccines, this response offers enormous investment potential,” according to BNP Paribas research.

Expanding Healthcare Opportunities

While it’s not a dedicated healthcare ETF, GINN is relevant as a play on the sector’s growth traits because of the fund’s diverse lineup. For example, GINN has an almost 35% weight to technology, which significantly intersects with innovative healthcare.

“Telehealth/telemedicine – the remote diagnosis and treatment of patients unable to visit a clinic or surgery – has proved not only a life-saver but to be highly cost-efficient. According to some reports, video and online medical appointments rose by more than 4 000% in 2020,” notes BNP Paribas.

Telemedicine is just one example of GINN’s utility as an indirect disruptive healthcare investment. Investors should also consider the fund’s other points of emphasis, including big data and the manufacturing revolution – two themes with clear implications in the healthcare space.

“One technology consulting group claims that the reliance on big data will play a key role in the future of medical technologies, along with software that allows clinicians to sift efficiently through heaps of information,” says BNP Paribas. “Artificial intelligence, virtual reality and augmented reality will contribute to helping doctors weave their way through an increasingly digital world.”

The bottom line is that healthcare is rapidly evolving, but many standard sector and broad market ETFs don’t adequately address that evolution.

For more news and information, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.