Exchange traded funds offering exposure to climate-aware and otherwise sustainable investing concepts are increasingly popular with investors.

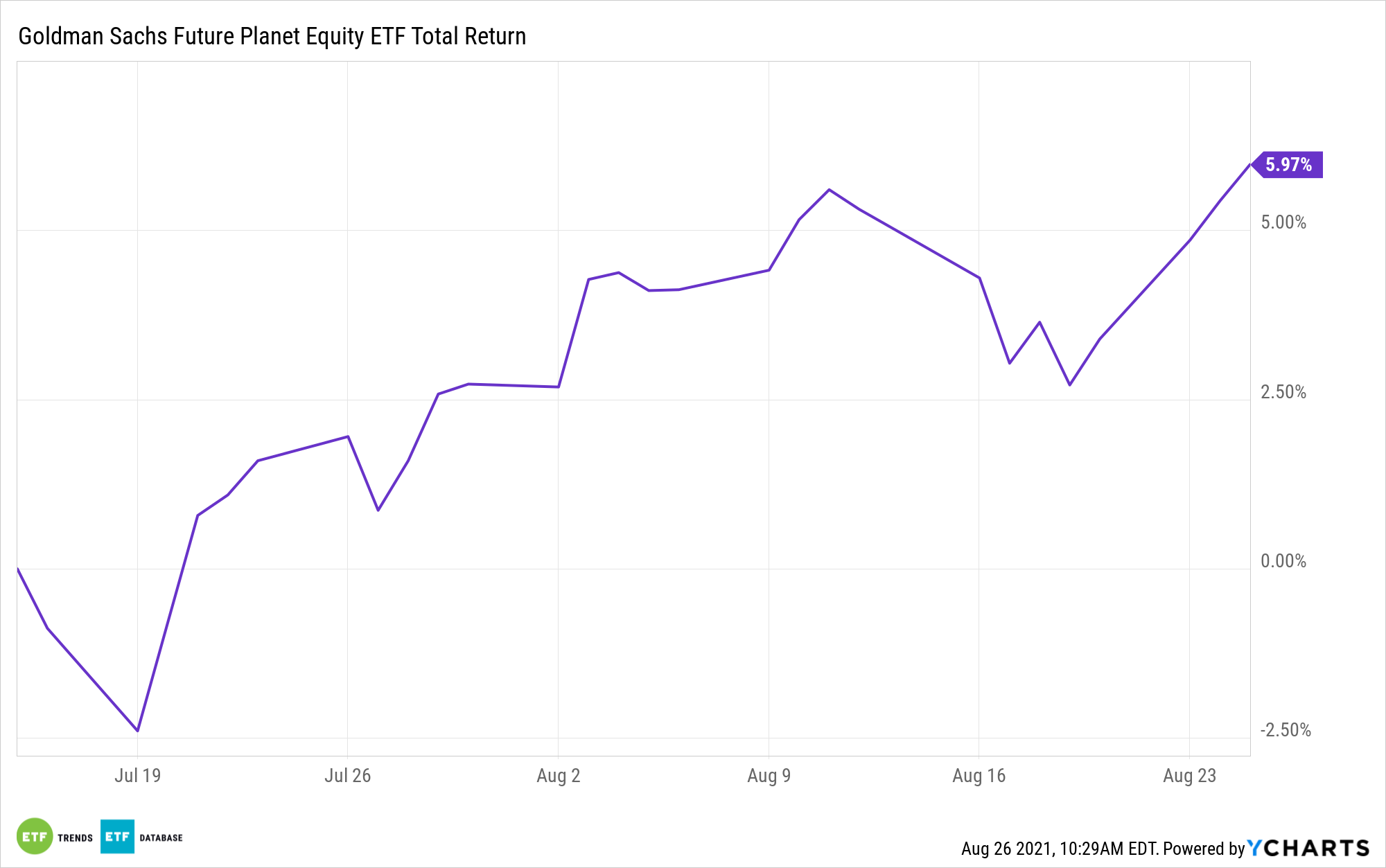

That popularity could really take off, benefiting products such as the Goldman Sachs Future Planet Equity ETF (GSFP), with more investor education.

Over the past couple of years, environmental, social, and governance (ESG) funds are answering concerns about performance, but as investors grow increasingly knowledgeable and the definition of sustainable investing expands, more questions arise and the need for education compounds.

Investors’ knowledge level of what constitutes sustainable investing is stagnating, confirming the need for education on this fund segment.

“A recent Gallup survey of U.S. adults with $10,000 or more in investments finds no change over the past year in these investors’ awareness of sustainable investing — also known as “responsible investing,” “social impact investing,” or “environmental, social and governance” investing,” according to the polling firm.

For its part, the actively managed GSFP is nearly six weeks old and has almost $58 million in assets under management. Undoubtedly, that’s an impressive tally for such a young ETF, but the Goldman Sachs ETF could easily grow as investors become more comfortable with sustainable investing — comfort that for many is lacking today.

“A quarter of investors say they have heard a lot (6%) or a fair amount (19%) about this type of investing. Another third have heard a little about it, while four in 10 have heard nothing,” adds Gallup.

Fortunately, GSFP’s approach is straightforward. It is a global fund with 52 holdings primarily spread across the industrial, materials, and technology sectors. GSFP components are engaged, in some form, in the fight against climate change or have leverage to the sustainability revolution.

One thing that could help the fortunes of GSFP and rival funds is progress in the fight against the coronavirus, because the pandemic may have stunted investor education on sustainable trends.

“Investors’ interest in sustainable investing is significantly lower than it was just before the start of the coronavirus pandemic,” notes Gallup. “After initially dipping from 52% in February 2020 to 46% in May and staying at that level in August, the percentage who are very or somewhat interested is now 42%. Meanwhile, the percentage not at all interested has increased from 18% to 28%, and the 29% “not too interested” has stayed about the same.”

For more news and information, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.