Breadth and depth are critical when embracing investment strategies purporting to focus on innovative market segments. However, many options in this still-young space are more focused and narrow than investors may realize.

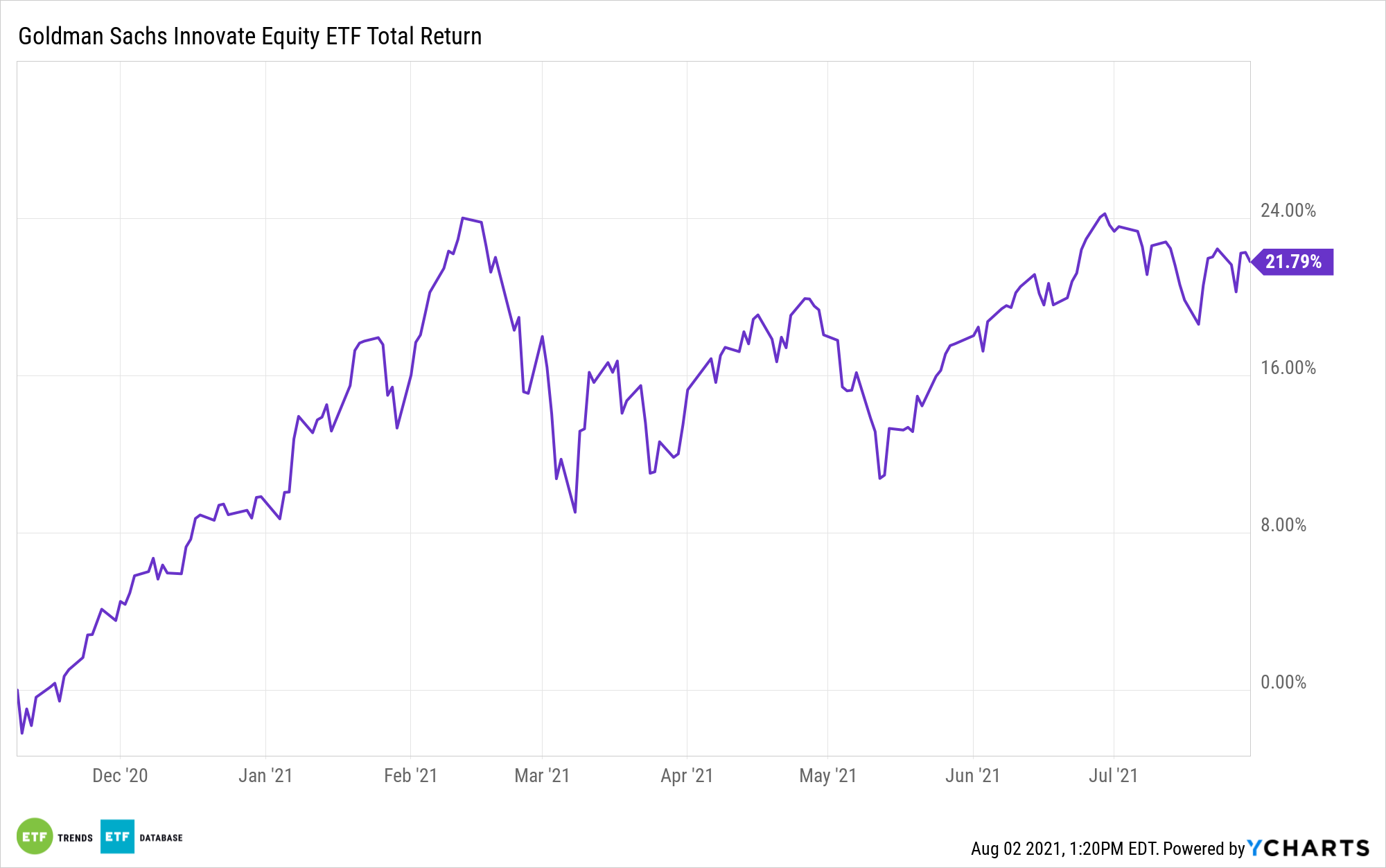

The Goldman Sachs Innovate Equity ETF (GINN) is a fund that solves that conundrum. GINN, which turns a year old in November, follows the Solactive Innovative Global Equity Index and holds 460 stocks, giving it a deep bench relative to some of the competing funds in this category.

GINN “seeks to provide investors exposure to the beneficiaries of technological innovation across all sectors, geographies and market capitalizations,” according to Goldman Sachs Asset Management.

A reflection of its holdings-level depth, GINN is also diversified at a theme level. Whereas some competing funds either zero in on one particular theme or aren’t diversified when it comes to thematic exposures, GINN covers a wide array of concepts. The Goldman Sachs fund features exposure to companies engaged in big data concepts, fintech, human evolution technologies/genomics, the manufacturing revolution, and modern consumer trends.

In plain English, GINN is an efficient avenue for investors seeking thematic exposure without the burden of stock-picking or focusing on a particular sector. In fact, the Goldman Sachs embodies the perks of combining traditional sector and more modern thematic investing.

“Sector investing offers targeted exposure to companies in specific segments of the economy like health care, energy, or information technology. Similarly, thematic investing typically offers focused exposure but, often cuts across sectors to align with a particular opportunity or objective,” according to Fidelity.

As is often the case with funds of this nature, GINN features a heavy dose of technology stocks. The fund devotes 35.1% of its weight to that sector – well above the S&P 500’s allocation to that group. GINN’s combined weight of 35.3% to the healthcare and consumer discretionary sectors is also well in excess of the S&P 500’s allocation of 25.67% to those groups.

While there is some sector concentration in this fund, holdings-level risk is mitigated by way of GINN not assigning weights of more than 2.5% to any of its components.

As is to be expected with disruptive growth strategies, GINN is lightly allocated to cyclical value and defensive sectors. For example, the utilities, consumer staples, real estate, materials, and energy sectors combine for just 4% of GINN’s roster.

For more news and information, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.