If there’s a hurdle that sustainable investing needs to clear, it’s not appeal to a broad audience. Rather, it’s the sheer fluidity of what qualifies as sustainability and how funds apply that term.

Translation: Funds employing succinct, straightforward approaches may possess advantages over more complex counterparts. The Goldman Sachs Future Planet Equity ETF (GSFP) is an example of an exchange traded fund with sustainable intentions that investors can easily wrap their heads around. That’s vital at a time when the idea of sustainability, though appealing from an investment perspective, remains confusing to investors.

“To many investors, however, the world of sustainable investing can be a confusing mix of terms and approaches. That’s mainly because of a lack of consensus over terminology and, perhaps more significantly, because sustainable investing does not represent a single, distinct investment approach,” says Morningstar analyst Jon Hale.

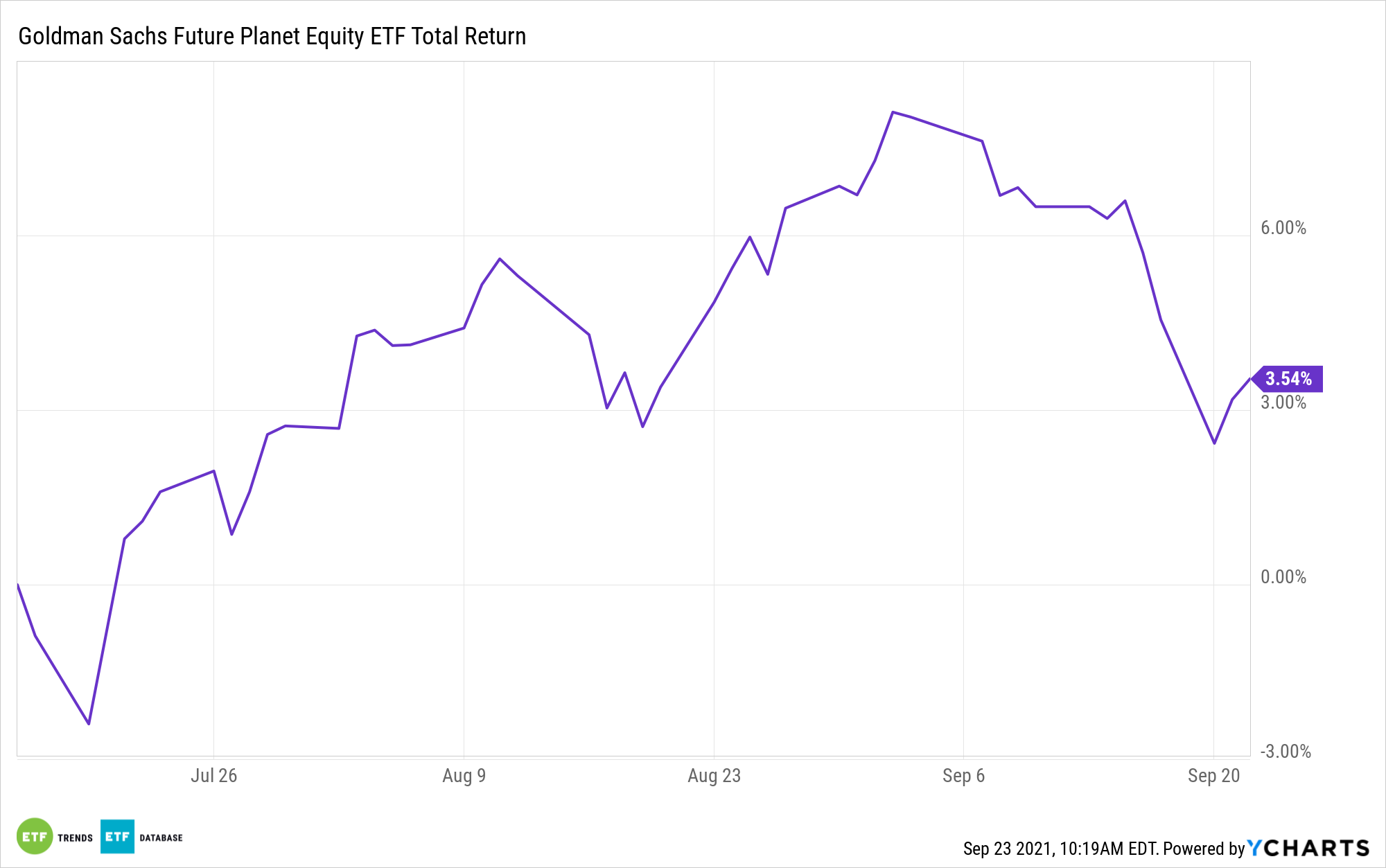

For its part, GSFP, which debuted in July, seizes upon the theme of sustainability in a simple form. The Goldman Sachs ETF focuses on companies working to reduce greenhouse gas emissions required across a variety of industries. In plain English, GSFP is suitable for climate-aware, carbon neutral-focused investors. Moreover, GSFP, though new, could be on a path to proving to investors that they don’t need to sacrifice upside to employ a climate-aware strategy.

“It’s important to keep in mind that sustainable investing is investing, first and foremost. It seeks competitive returns. There is absolutely nothing concessionary about this intent when investing in public stocks and bonds. But it also recognizes that investment returns are part of a bigger picture that includes concerns about people and planet, as well as profits,” adds Hale.

This low-maintenance sustainable ETF allocates over 77% of its weight to industrial, materials, and technology stocks — appropriate allocations for an ETF designed to feature climate-focused companies. Those sector allocations also speak to avoiding some of the complexities and pitfalls often associated with sustainable strategies.

“The assumption that sustainable investing is a single unified investment approach had led to investor confusion and a mismatch between investor expectations and investment outcomes. It is more accurate to say that sustainable investing covers a range of approaches that are used to apply a sustainability lens to investments,” notes Hale.

For more news, information, and strategy, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.