One of the primary concerns investors express regarding environmental, social, and governance (ESG) strategies is whether or not these strategies improve outcomes or lead to leaving money on the table.

While the recent performances of many ESG funds answer that question in positive fashion, some market observers argue that given the fluidity and sometimes controversial elements pertaining to social and governance investing, leaning into exchange traded funds with climate and environmental focuses is the way to go.

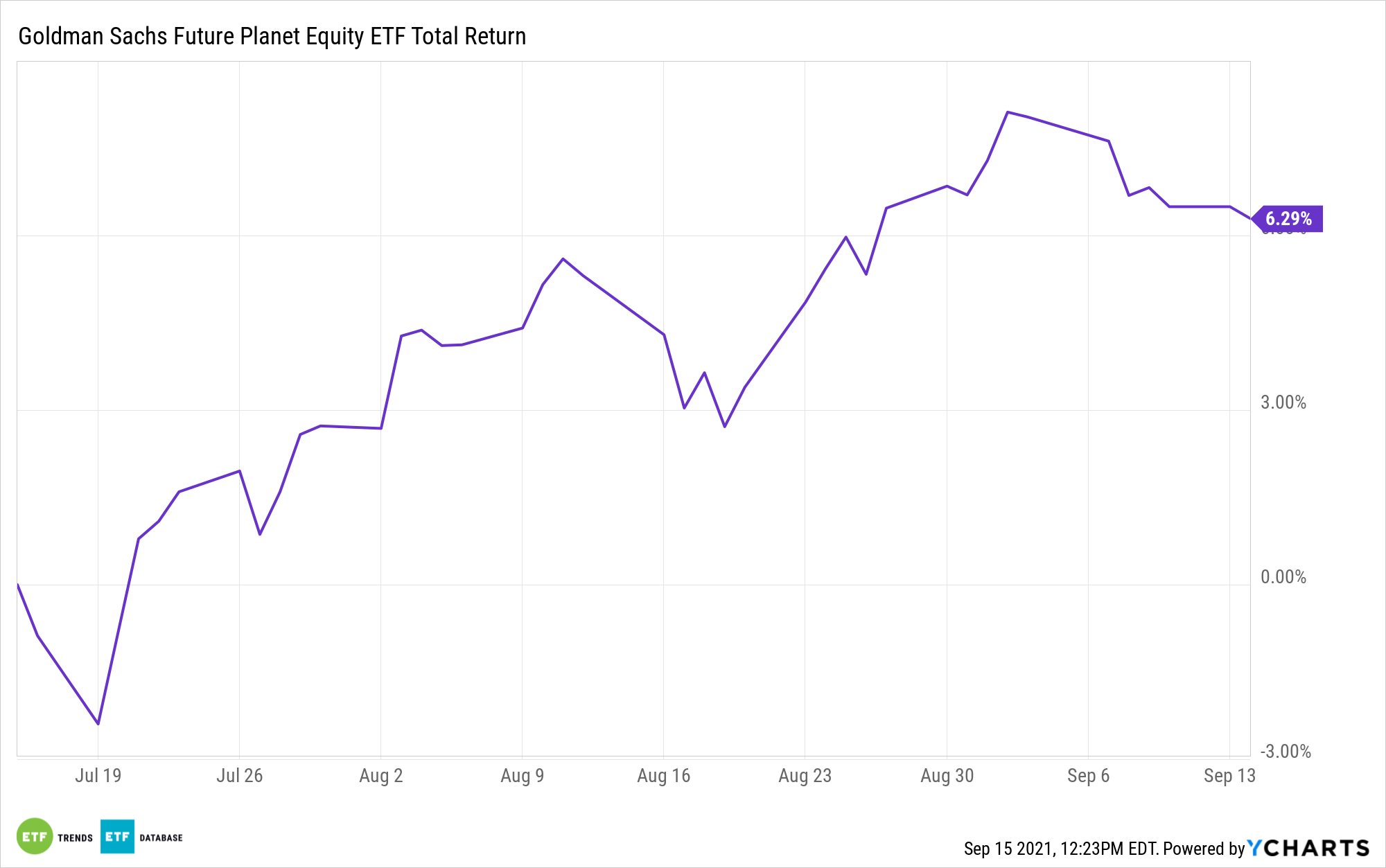

Enter the Goldman Sachs Future Planet Equity ETF (GSFP), which focuses on companies engaged in the global sustainability revolution. Focusing on climate-aware companies could pay off over the long haul for GSFP investors because some broader ESG strategies frequently perform in line with the market.

“On an overall basis and across the three largest asset classes, ESG funds have consistently ranked around the middle of their peer groups—sometimes a bit below the middle, sometimes a bit above, but never dramatically worse,” according to Charles Schwab research.

GSFP has some points in its favor. For starters, the “E” in ESG is the most easily defined part of that style and arguably the least controversial. Owing to those factors, it’s also the one that commands the most attention. To that end, companies and governments are taking action on climate awareness and many are spending big dollars to that effect. Moreover, that spending is still in its early inning, highlighting potential opportunities with ETFs like GSFP that emphasize clean energy and climate-aware companies.

Another point in GSFP’s favor is that it’s actively managed, making it somewhat unique in a landscape dominated by passive funds. As an active fund, GSFP can not only increase exposure to climate-aware and renewable energy companies as is warranted, its managers can more effectively manage risk, which is essential in ESG investing.

“When it comes to the risk of an investment portfolio like a mutual fund, one common measure is the standard deviation of returns. The higher the standard deviation, the bigger the swings the fund has experienced, both up and down. Stocks, for instance, tend to have much higher standard deviations than bonds,” adds Schwab.

While the Schwab research confirms that ESG funds hold up relatively well during market swoons and that some have the potential to outperform over the long-term, GSFP’s climate focus is practical for a broad audience of investors.

For more news, information, and strategy, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.