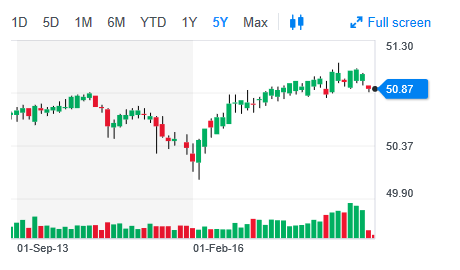

Likewise, FLOT has been the beneficiary of the index’s serendipitous run up the past year with its 1.99 percent return. Year-to-date, FLOT is up 1.06 percent and 1.39 percent within the last three years.

![]()

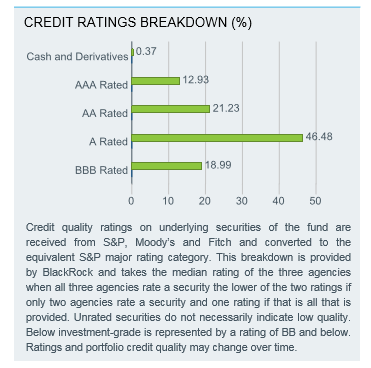

In addition, FLOT concentrates its loan portfolio within the banking industry with A-Rated or better credit ratings. This is beneficial in the shorter-termed duration fixed income space in terms of hedging default risk by the underlying loans represented in the portfolio.

With its floating rate component, FLOT will shield the investor against interest rate hikes, particularly if further economic data portends to more hawkish signs of economic growth.

With its floating rate component, FLOT will shield the investor against interest rate hikes, particularly if further economic data portends to more hawkish signs of economic growth.

FLOT benefits review:

- Exposure to U.S. floating rate bonds, whose interest payments adjust to reflect changes in interest rates

- Access to 300+ shorter-term investment-grade bonds in a single fund

- Use to put cash to work and manage interest rate risk

For more trends in fixed income, visit the Fixed Income Channel.