For investors looking to park cash in something other than a low-yielding money market fund, there are several options available. One is ultra-short bond funds, which Vanguard can offer with exchange traded funds (ETFs) like the Vanguard Ultra-Short Bond ETF (VUSB).

“Ultra-short bond funds have become popular because they offer higher yields than money market funds — their portfolios contain higher-coupon bonds that are about to mature,” a Zacks article noted. “Depending on the fund specifications, the portfolios can contain Treasury, government agency, mortgage-backed and corporate bonds that will mature within 12 months. These funds are appropriate for the same people and institutions that invest in money market funds, provided those investors are aware of the risk involved.”

This is where ultra-short bonds can strike a balance between money market funds, which can’t offer higher yield, and short-term bond funds, which have higher duration risk. Furthermore, VUSB minimizes credit risk by focusing on more stable, high-quality debt issues.

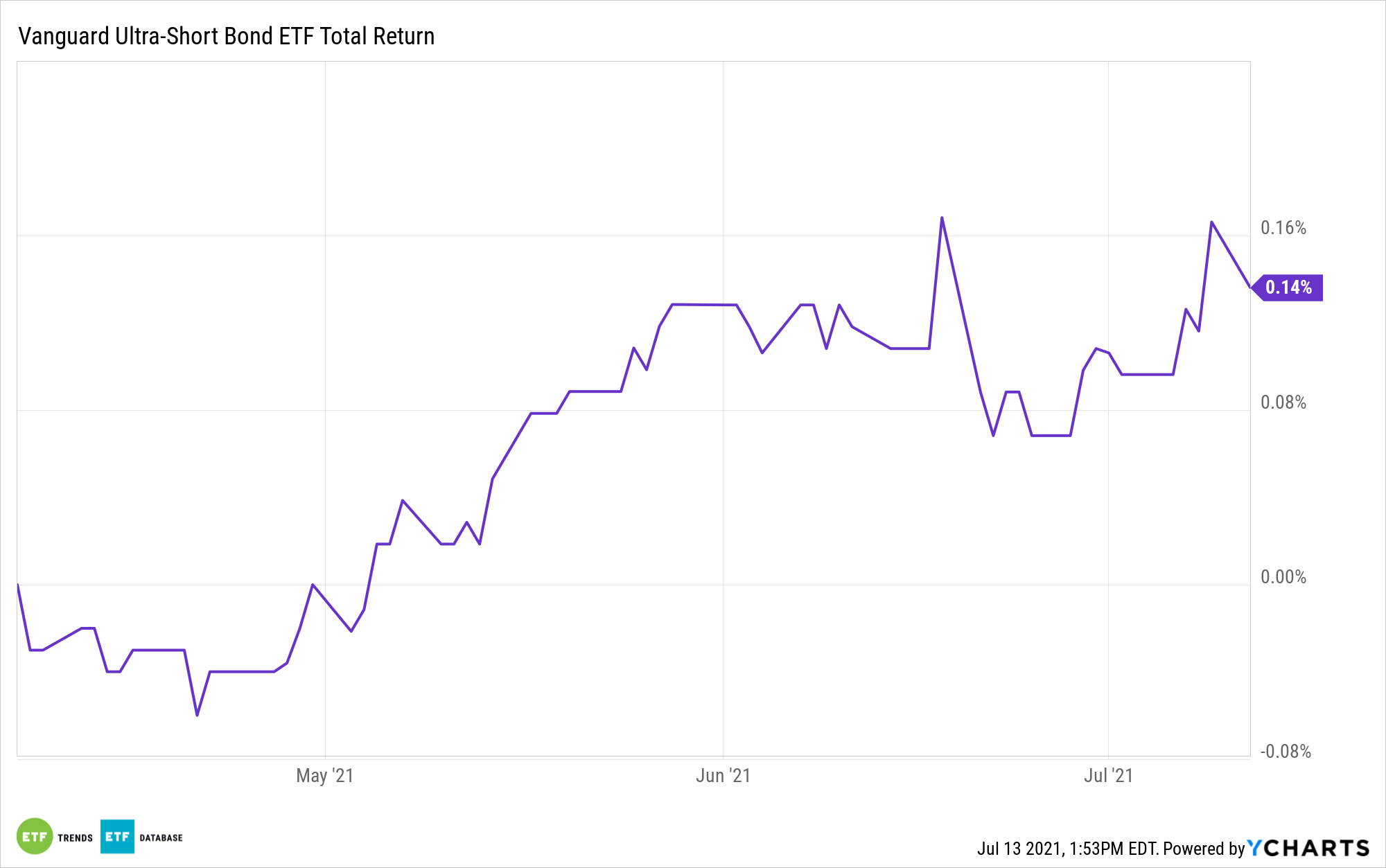

With its low 0.10% expense ratio, VUSB’s investment objective is to seek to provide current income while maintaining limited price volatility. The fund invests in a diversified portfolio of high-quality and, to a lesser extent, medium-quality fixed income securities. It offers a dollar-weighted average maturity of 0 to 2 years.

Under normal circumstances, the fund will invest at least 80% of its assets in fixed income securities. The fund is designed to give investors low-cost exposure to money market instruments and short-term high-quality bonds, including asset-backed, government, and investment-grade corporate securities.

Knowing the Risks

As with any investment, there are inherent risks associated with ultra-short bond funds. Understanding these risks better-prepares for potentially incorporating bond funds into their portfolios.

“During periods of very low market interest rates, many of those portfolio bonds have coupon rates higher than current interest rates,” the Zacks article explained. “When a bond has a higher coupon rate than current interest rates, it is called a premium bond, because its price is higher than par, or the $1,000 face value of the bond.”

“When bought into the portfolio, the higher price paid is more than the principal received at maturity, so there is principal loss if the bond is held to maturity,” the article added. “The higher interest payments can make up for the loss of principal, making the total return on investment higher than with money market funds. Some ultra-short funds seek higher yields available in corporate bonds or those that can be affected by economic difficulties.”

For more news, information, and strategy, visit the Fixed Income Channel.