Insurance companies were big fans of fixed income ETFs in 2020, according to a CFRA “Funds in Focus” report.

Fixed income ETFs got a helping hand in 2020 during the height of the pandemic. To shore up the bond markets, the Federal Reserve stepped in to help prevent credit defaults.

The Fed cast a wide net into the debt market, picking up even risky high-yield assets. This included bond ETFs that focused on highly leveraged corporate debt that was less than investment grade.

Investors tailed the Fed’s actions by piling into fixed income ETFs as a safe haven scramble amid the equity volatility. Based on the CFRA data, insurance companies were no different.

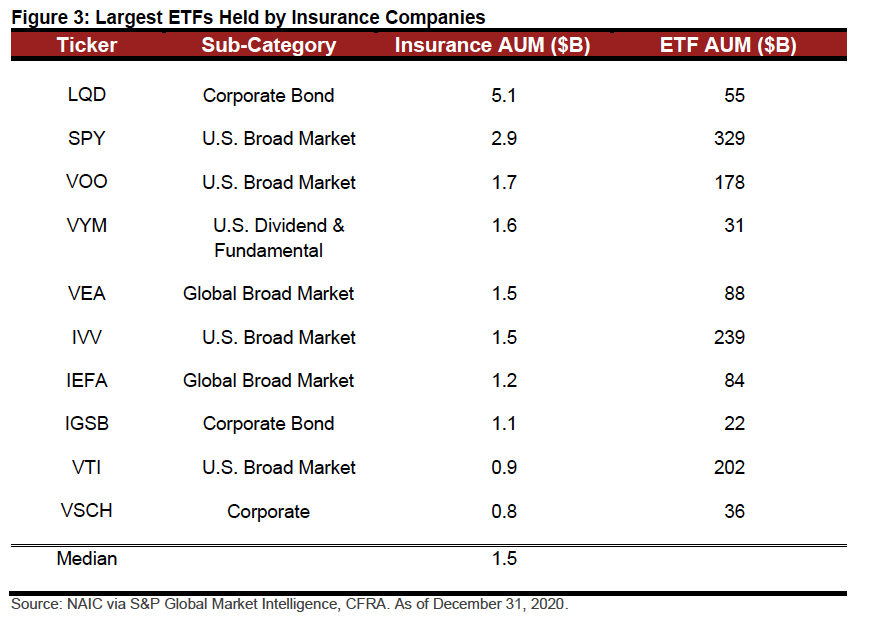

“Insurers were net sellers of equity ETFs last year despite a strong recovery from first-quarter lows, but the industry collectively added $5 billion to fixed income ETFs,” the report noted.

“A record 36% of U.S. insurance companies owned ETFs at the end of 2020,” the report said further. “While the $37 billion in ETF assets for this institutional investor segment represents a tiny fraction of the then $5.5 trillion in ETF assets held by all investors, it comprised an even smaller percentage of the $7.2 trillion of invested assets by insurance companies, according to research from S&P Dow Jones Indices based on NAIC data, creating what we see as significant potential. Those companies that previously used ETFs purchased even more ETF shares in 2020 after testing the waters in prior years.”

Vanguard’s ‘VCSH’ Sees High Demand

One bond ETF enjoying strong interest from insurance companies was the Vanguard Short-Term Corporate Bond Index Fund ETF Shares (VCSH). The fund lends investors corporate bond exposure while limiting duration risk.

VCSH seeks to track the performance of a market-weighted corporate bond index with a short-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. 1-5 Year Corporate Bond Index.

This index includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by industrial, utility, and financial companies, with maturities between one and five years. Under normal circumstances, at least 80% of the fund’s assets will be invested in bonds included in the index.

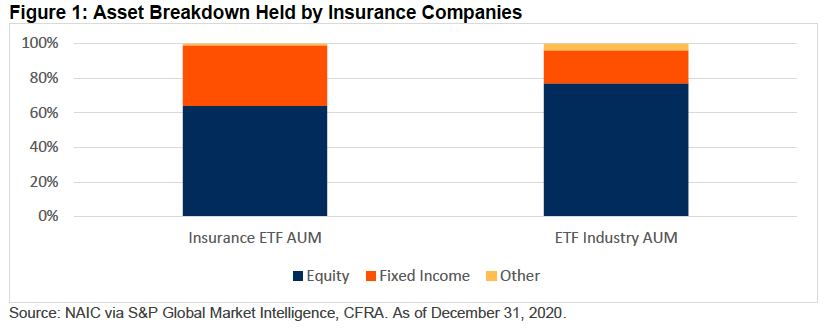

“While equity ETFs comprised most of the assets owned by insurance companies, ETF trading skewed toward fixed income products,” the report added. “In 2020, insurance companies traded $34 billion of fixed income ETFs and $28 billion of equity ETFs.”

For more news, information, and strategy, visit the Fixed Income Channel.

For more news, information, and strategy, visit the Fixed Income Channel.