Investors looking for places to extract more yield out of this low-rate environment will be tempted to dabble in high yield, but there are better options, like the Vanguard High Dividend Yield Index Fund ETF Shares (VYM).

Not only are retail investors looking to get more yield out of riskier debt, institutional investors are bringing their war chests of capital into the high yield arena. Some money managers are even looking into the deepest waters in the sea of high yield debt.

“Record low interest rates on riskier corporate bonds are prompting money managers to look far afield in a bid to boost returns,” a Wall Street Journal report said. “Faced with yields once reserved for the safest types of government debt, some managers of speculative-grade bond funds are piling into debt with rock-bottom credit ratings. Others are buying smaller, more obscure securities that carry higher yields because they can be hard to sell.”

“No strategy is likely to be entirely satisfying because of the recent low-rate environment,” the report added. “The average speculative-grade U.S. corporate bond yield reached as low as 3.53% this summer, more than a percentage point lower than it had reached at any time before the Covid-19 pandemic, according to Bloomberg Barclays data stretching back to 1995.”

A High Dividend Option

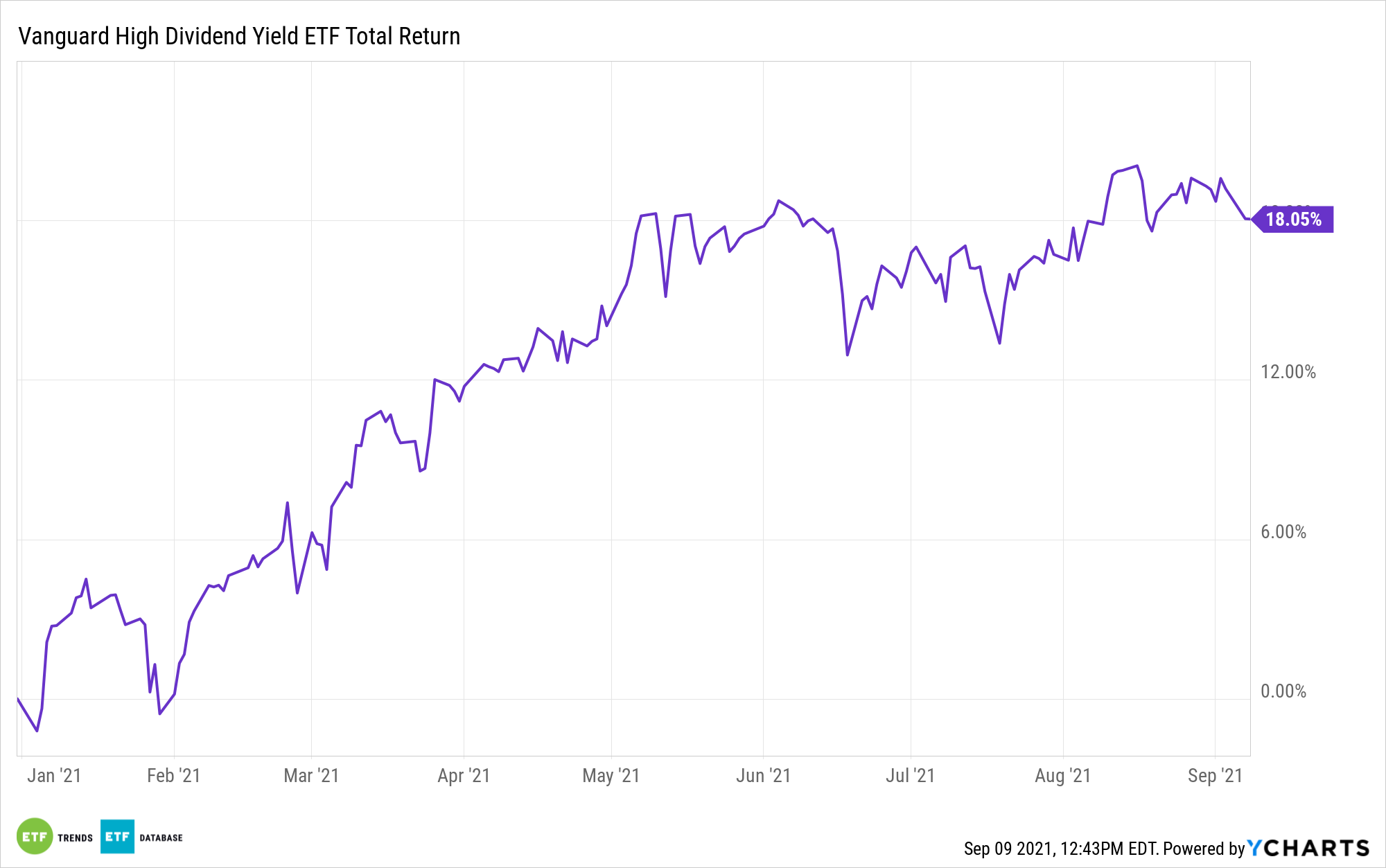

Dividends are an alternate route to high-yield debt with ETFs like VYM. The fund employs an indexing investment approach designed to track the performance of the FTSE High Dividend Yield Index, which consists of common stocks of companies that pay dividends that generally are higher than average.

The advisor attempts to replicate the target index by investing all, or substantially all, of their assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

In summary, VYM:

- Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high dividend yields.

- Provides a convenient way to track the performance of stocks that are forecasted to have above-average dividend yields.

- Follows a passively managed, full-replication approach.

For more news, information, and strategy, visit the Fixed Income Channel.