It was a year to remember for bond-focused exchange traded funds (ETFs) in 2021, with Vanguard topping the charts when it came to fund flows.

The Federal Reserve looking to scale back its bond purchases last year didn’t tamp down demand for investors looking to get bond exposure. With a trillion-dollar infrastructure plan becoming law, municipal bonds were a highlight, but demand across the spectrum of bonds was significant.

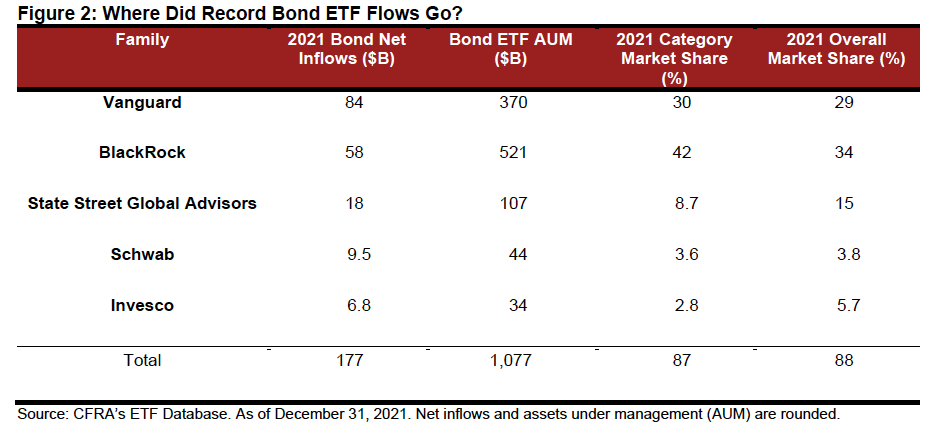

“A record $207 billion flowed into U.S. listed bond ETFs in 2021,” CFRA notes in their “Funds in Focus” report. “While many bond funds declined in value, investors gain comfort in using them for both strategic asset allocation purposes and more targeted tactical ones. The 10 bonds with the highest net inflows gathered $106 billion of new money, equal to more than 50% of the category’s cash haul.”

As mentioned, Vanguard took in the lion’s share of bond net inflows. With a wide array of fixed income products, Vanguard offers investors tailored exposure to the bond markets for strategic allocation or simple core bond exposure.

“With $84 billion of net inflows, Vanguard pulled in the most bond money in 2021,” CFRA says. “Vanguard was the second largest provider of U.S. listed ETFs, and its $370 billion in year-end bond ETF assets garnered 30% of the category’s market share. Last year was a particularly strong one for Vanguard, as the asset manager’s bond net inflows exceeded those of larger peer BlackRock.”

“With the Federal Reserve likely raising interest rates in 2022, tactical investors have a wide array of lower duration products available to rotate toward,” CFRA adds.

Get Aggregate Bond Exposure in 2022

Investors looking to get aggregate bond exposure with one of Vanguard’s funds can opt for the Vanguard Total Bond Market Index Fund ETF Shares (BND). As mentioned, BND presents bond investors with an all-encompassing, aggregate solution to getting U.S. bond exposure.

It’s an ideal solution for investors seeking to complement their equities exposure. BND seeks the performance of the Bloomberg U.S. Aggregate Float Adjusted Index, which represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than one year.

Bond investors can use BND as a traditional hedging component when the equities market goes awry. Short-term traders can also use the ETF given its dynamic ability to be bought and sold quickly in the open market.

For more news, information, and strategy, visit the Fixed Income Channel.