Rising yields roiling the markets can make fixed income investing akin to navigating murky waters, but those fears can be allayed with ETFs like the Vanguard Total Bond Market Index Fund ETF Shares (BND).

BND presents bond investors with an all-encompassing, aggregate solution to getting U.S. bond exposure. It’s an ideal solution for investors seeking to complement their equities exposure, especially as a crucial component of a retirement portfolio.

“The ‘income’ aspect of fixed income tends to be what gets the most attention,” said Douglas Robinson, founder and president of RCM Robinson Capital Management LLC. “But a bond portfolio, if structured correctly, can play a critical role in reducing volatility and drawdowns that is ultimately far more important.”

Per its fund description, BND seeks the performance of the Bloomberg U.S. Aggregate Float Adjusted Index. This index represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than one year.

“If you’re looking for diversified exposure to “the bond market” as a whole, the Vanguard Total Bond Market ETF (BND, $85.83) is likely your best bet. It’s large, liquid and has some of the lowest expenses you’re going to find in the industry,” a Kiplinger article noted.

“BND’s portfolio of over 10,000 bonds is invested about 65% in U.S. Treasury or agency mortgage bonds, with the remaining 35% invested primarily in investment-grade corporate bonds or non-agency mortgage bonds,” the article added. “This is a high-quality bond portfolio that is unlikely to ever give you a headache.”

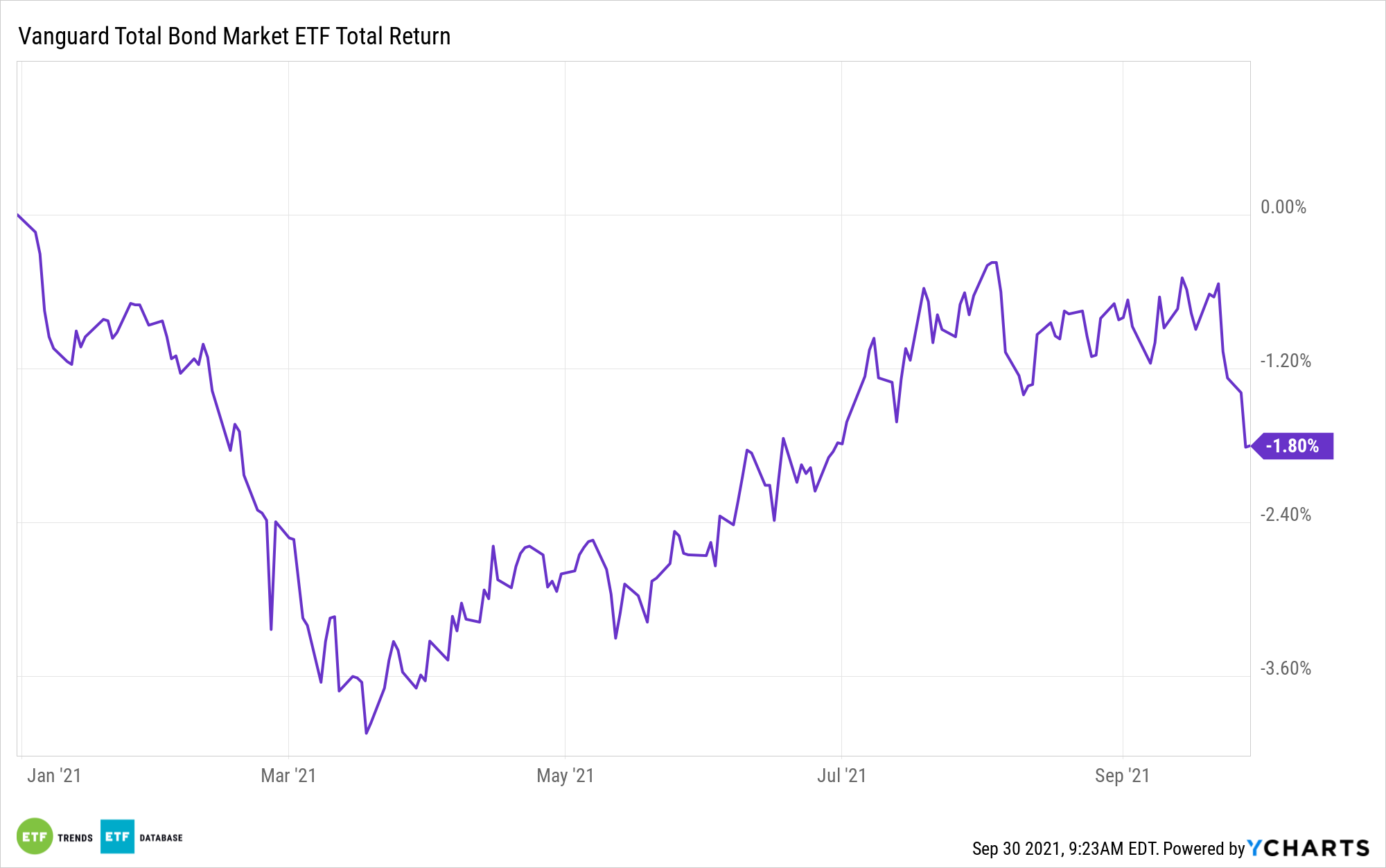

Tolerable Risk From Rising Yields

As mentioned, bond investors can use BND as a traditional hedging component when the equities market goes awry or as we’ve seen lately, when yields rise. Short-term traders can also use the ETF, given its dynamic ability to be bought and sold quickly in the open market.

“The average duration of BND’s portfolio is 6.8 years,” the Kiplinger article explained further. “In plain English, that means that a 1% increase in interest rates should correspond to an approximate 6.8% decrease in the fund’s price, and vice versa.”

“So, while BND’s shares might be slightly more at risk from rising yields than the other bond funds featured here, that risk is generally very tolerable,” the article added. “It’s unusual for the share price to move more than a couple of dollars in a given year.”

For more news, information, and strategy, visit the Fixed Income Channel.