The Vanguard Tax-Exempt Bond ETF (VTEB) is one of the biggest players in the municipal bond exchange-traded fund (ETF) market, and it could become more diverse if it follows the same path as its peer.

In particular, VTEB could mirror the recent move by BlackRock with the iShares National Muni Bond ETF (MUB) by tracking the ICE AMT-Free US National Municipal Index. Either way, investors have been demanding municipal bonds with their stable credit quality and tax advantages.

“Demand for these ETFs has been climbing recently with the municipal bond category gathering $21 billion in the one-year period ended July 19,” a CFRA Funds in Focus report noted. “Investors are increasingly comfortable using fixed-income ETFs and receive significant diversification benefits compared to owning individual bonds and typically cost less than a municipal bond mutual fund.”

VTEB tracks the Standard & Poor’s National AMT-Free Municipal Bond Index, which measures the performance of the investment-grade segment of the U.S. municipal bond market. MUB seeks to track the investment results of the S&P National AMT-Free Municipal Bond Index, which also measures the performance of the investment-grade segment of the U.S. municipal bond market.

The sampling approach means that both funds hold a subset of bonds within the index to replicate the debt’s yield, duration, and credit quality. This method allows the funds to avoid trading expensive bonds that could harm performance and, in addition, minimize tracking errors.

Accessing Other Municipal Credit Profiles

A move from the S&P index to the ICE index could expose VTEB to other credit profiles in the municipal bond universe. As the CFRA research report noted, “the ICE AMT-Free US National Municipal Index had approximately 23,000 holdings at the end of June 2021, nearly double the approximately 13,000 that were part of the S&P National AMT-Free Municipal Bond Index.”

One of the benefits of a potential move to the ICE index is access to higher credit quality. Top-quality municipal bonds are already lauded for their stability, and more exposure to these credit profiles can fortify an investor’s fixed income portfolio.

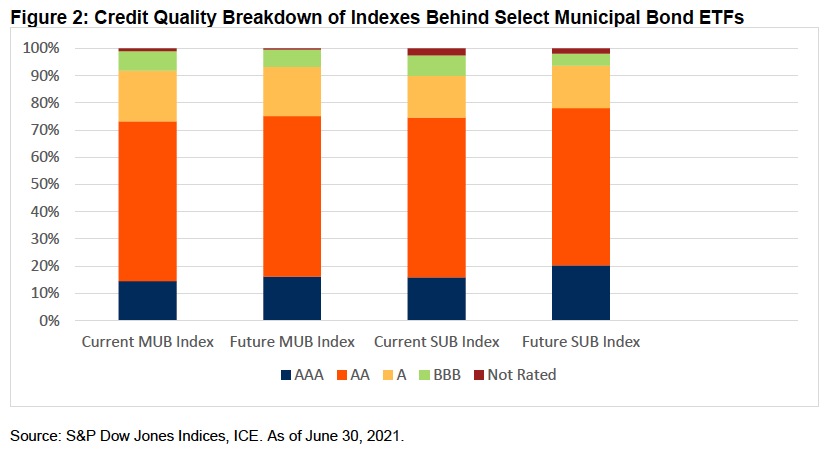

“While there is high overlap between the two investment-grade focused benchmarks, the ICE one also has a stronger credit profile with more exposure to highly liquid AAA-rated bonds (16.1% vs. 14.5%) and less exposure to less accessible BBB-rated securities (6.3% vs. 7.3%) at the end of the second quarter of 2021 as shown in Figure 2,” the report added further.

For more news, information, and strategy, visit the Fixed Income Channel.