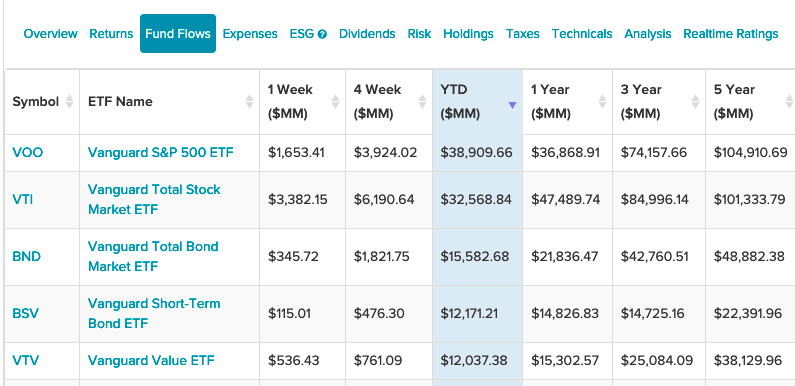

With the S&P 500 inching to new highs, it’s no wonder that equities are seeing the majority of fund flows in Vanguard’s ETF suite, but a pair of bond funds are also receiving strong flows year-to-date.

As part of the top five in fund flows YTD, bond funds like the Vanguard Total Bond Market Index Fund ETF Shares (BND) and the Vanguard Short-Term Bond Index Fund ETF Shares (BSV) are making the cut.

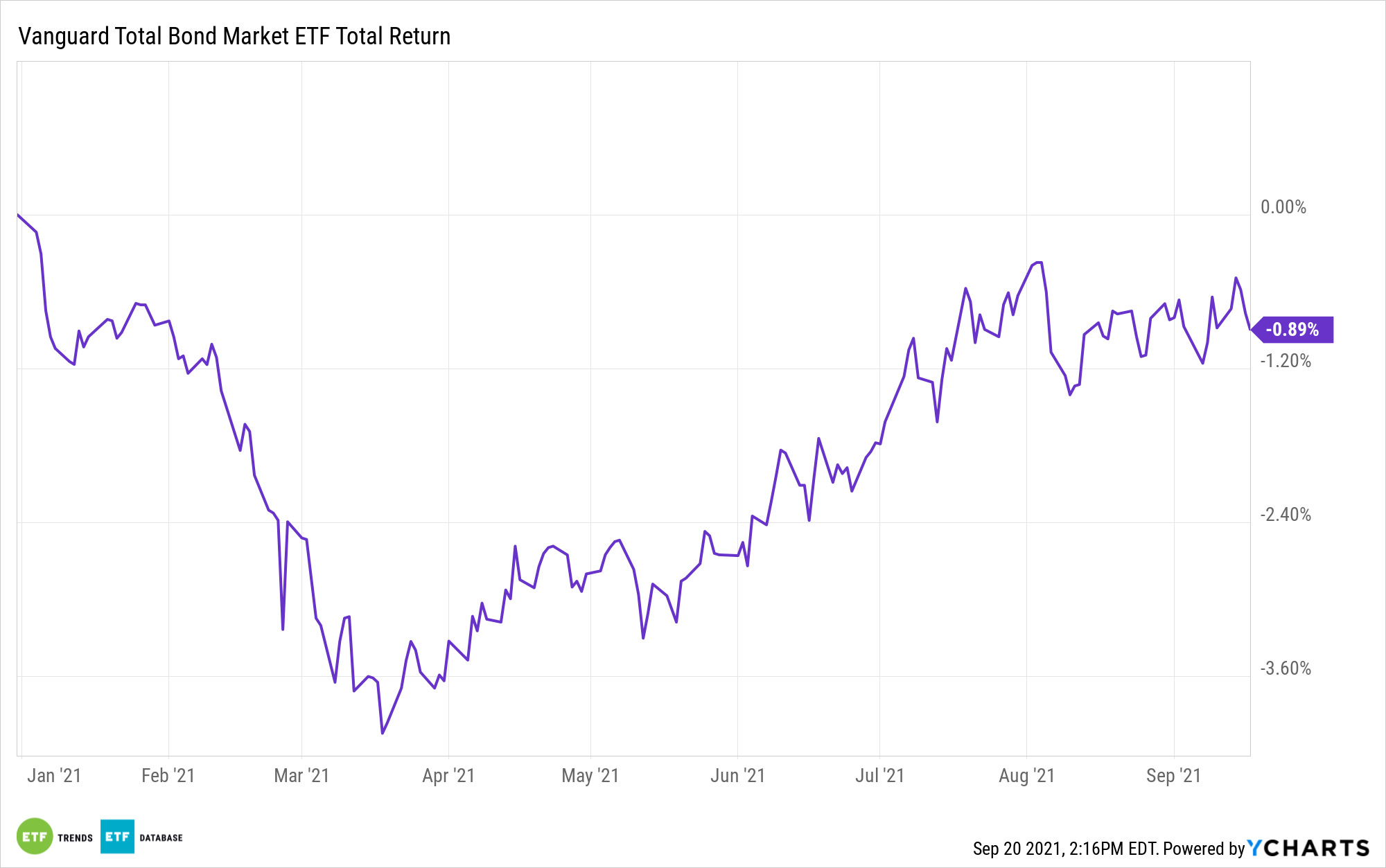

BND presents bond investors with an all-encompassing, aggregate solution to getting U.S. bond exposure. It’s an ideal solution for investors seeking to complement their equities exposure.

BND seeks the performance of the Bloomberg U.S. Aggregate Float Adjusted Index. This index represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than one year.

Bond investors can use BND as a traditional hedging component when the equities market goes awry. Short-term traders can also use the ETF given its dynamic ability to be bought and sold quickly in the open market.

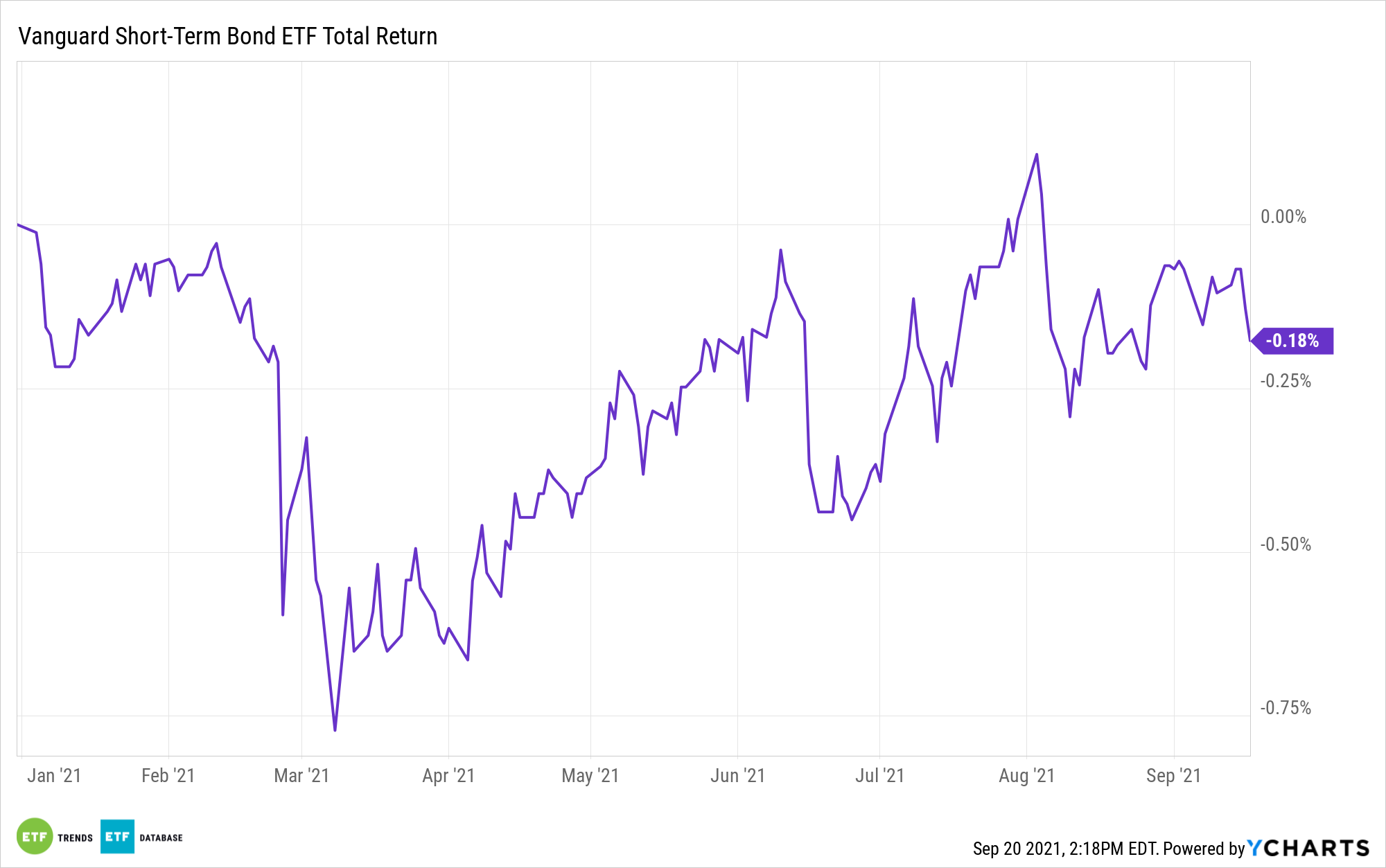

A Short-Duration Option

Short duration has been seeing high interest, especially with the threat of inflation looming. While the Federal Reserve has been hesitant to pull the trigger on rate rises this year, next year could present a different story as consumer prices keep ticking higher.

BSV seeks to track the performance of the Bloomberg U.S. 1–5 Year Government/Credit Float Adjusted Index. This index includes all medium and larger issues of U.S. government, investment-grade corporate and international dollar-denominated bonds that have maturities between one and five years and are publicly issued.

All of the fund’s investments will be selected through the sampling process, and at least 80% of its assets will be invested in bonds held in the index.

Highlights of BSV:

- Seeks to track the performance of the Bloomberg U.S. 1–5 Year Government/Credit Float Adjusted Index, a market-weighted bond index that covers investment-grade bonds with a dollar-weighted average maturity of one to five years.

- Invests in U.S. government, high-quality (investment-grade) corporate and investment-grade international dollar-denominated bonds.

- Follows a passively managed, index sampling approach.

For more news, information, and strategy, visit the Fixed Income Channel.