It’s difficult to get away from a discussion on interest rates in the debt market as short-term bond exposure leads the top bond exchange-traded funds (ETFs) from Vanguard the past week.

Eyes are on the Federal Reserve this week to see if there’s any indication on what stance they’ll take on interest rates. Fund flows into short-term bond funds highlight the uncertainty of interest rate policy moving forward as the pandemic and inflation weigh on investors’ minds.

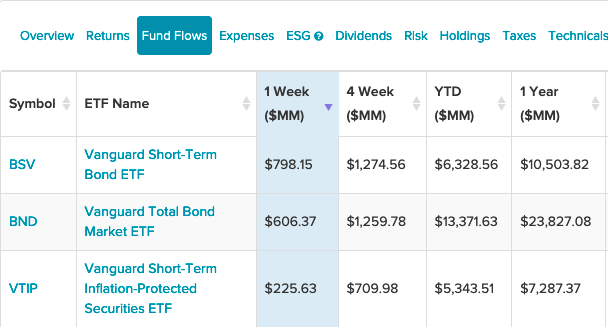

As such, there’s been a move into short-term exposure the past week in ETF fund flows for Vanguard products:

At the top of the flow list is the Vanguard Short-Term Bond Index Fund ETF Shares (BSV). BSV seeks to track the performance of the Bloomberg Barclays U.S. 1-5 Year Government/Credit Float Adjusted Index, which includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities between 1 and 5 years and are publicly issued.

Short-term bonds can help diversify a fixed income portfolio while limiting duration risk. With inflationary pressures increasing, the shorter duration limits the damage if interest rates rise in the interim.

Next up is an aggregate fund in the Vanguard Total Bond Market Index Fund ETF Shares (BND). BND seeks the performance of Bloomberg Barclays U.S. Aggregate Float Adjusted Index, which represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year.

As mentioned, inflation has been on the minds of investors, and should rates rise, inflation protection adds another layer of security for bonds. As such, the Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares (VTIP) has also been seeing strong fund flows the past week.

VTIP seeks to track the Bloomberg Barclays U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Year Index performance. The index is a market-capitalization-weighted index that includes all inflation-protected public obligations issued by the U.S. Treasury with remaining maturities of less than 5 years.

The manager attempts to replicate the target index by investing all, or substantially all, of its assets in the securities that make up the index, holding each security in approximately the same proportion as its weighting in the index.

For more news, information, and strategy, visit the Fixed Income Channel.