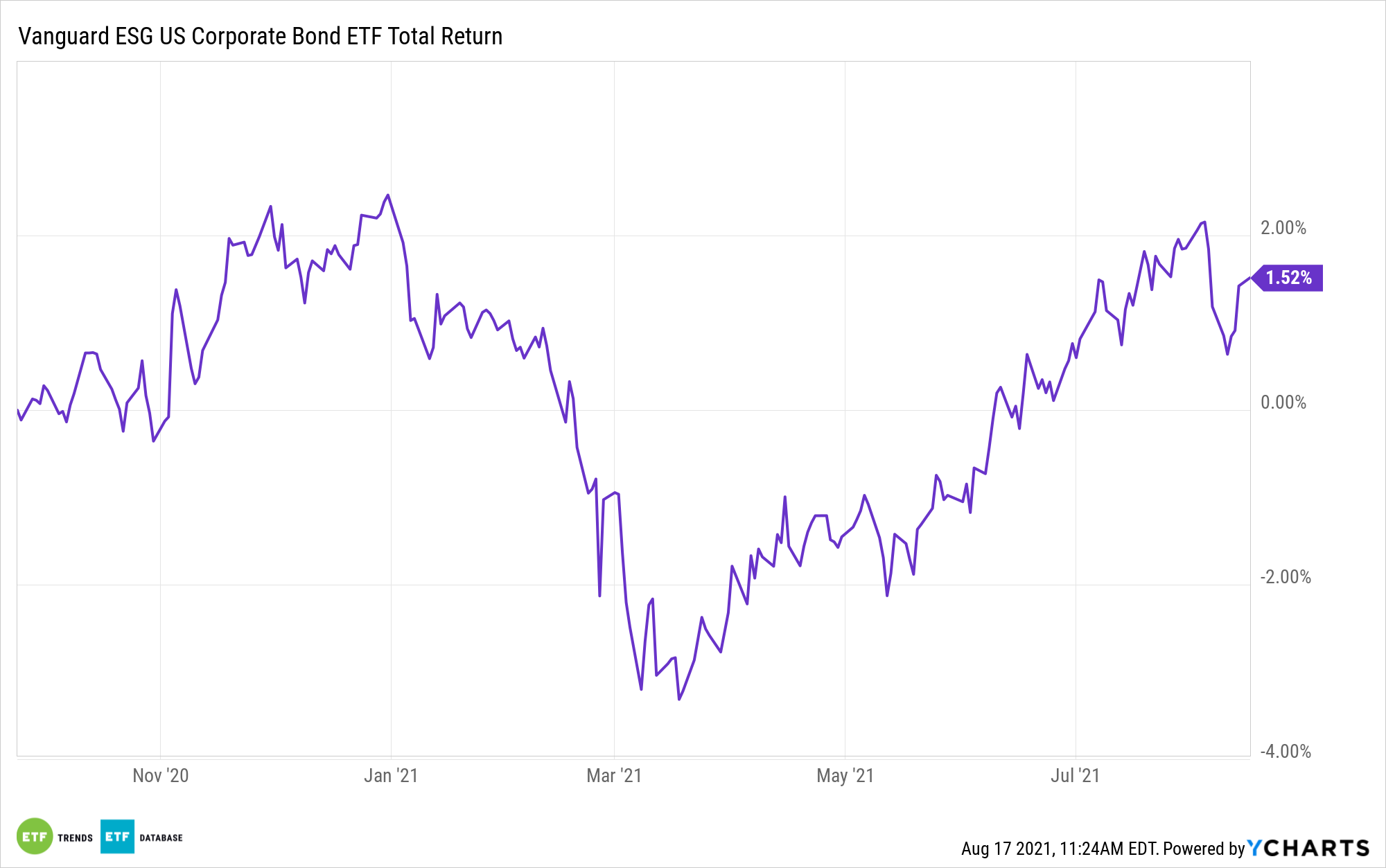

The environmental, social, and governance (ESG) space has its eyes on fixed income. One exchange traded fund (ETF) to target is the Vanguard ESG U.S. Corporate Bond ETF (VCEB).

A State Street Global Advisors (SSGA) report noted the growing interest in fixed income in the ESG community. 61% of fixed income investors who participated in a survey said they would be prioritizing the inclusion of ESG factors in their fixed income portfolio over the next few years.

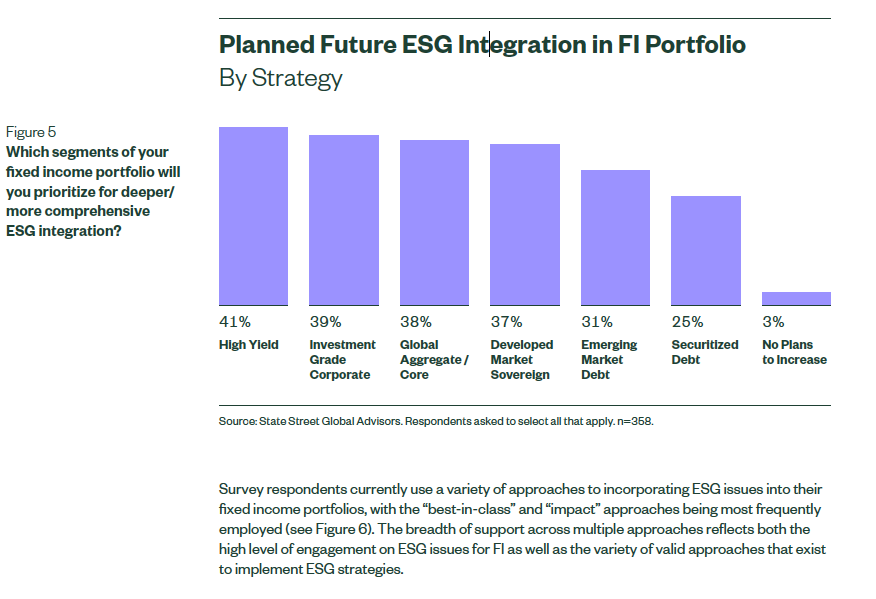

“The survey confirmed that ESG has become a clear priority for fixed income investors,” the SSGA report said, noting a breakdown of reach region: Australia 80%, Europe 61%, and North America 57%. “Many segments of respondents’ fixed income portfolios will be prioritized for deeper/more comprehensive ESG integration over the next three years, led by HY and IG Corporate (see Figure 5). Among North American respondents, DM Sovereign was most likely to be prioritized.”

Yet investors still want yield, especially in today’s low-rate environment.

“Among European respondents, High Yield was most likely to be prioritized,” the report added. “Interestingly, more than half (58%) of all respondents noted that they are most likely to use ETFs as their preferred fund vehicle for increasing allocations to FI ESG strategies over the next three years.”

An ESG Option in the Corporate Bond Space

Fixed income investors can combine corporate bond yield and ESG principles with VCEB. The fund seeks to track the performance of the Bloomberg Barclays MSCI US Corporate SRI Select Index, which excludes bonds with maturities of 1 year or less and with less than $750 million outstanding, and is screened for certain ESG criteria by the index provider, which is independent of Vanguard.

VCEB highlights:

- Provides debt issues screened for certain ESG criteria.

- Specifically excludes bonds of companies that the index sponsor determines are involved in, and/or derive threshold amounts of revenue from certain activities or business segments related to: adult entertainment, alcohol, gambling, tobacco, nuclear weapons, controversial weapons, conventional weapons, civilian firearms, nuclear power, genetically modified organisms, or thermal coal, oil, or gas.

- Excludes bonds of companies that, as determined by the index sponsor, do not meet certain standards defined by the index sponsor’s ESG controversies assessment framework, as well as firms that fail to have at least one woman on their boards.

For more news, information, and strategy, visit the Fixed Income Channel.