Environmental, social, and governance (ESG) bonds are making their rounds across the globe, and it appears that Asia is the next stop to see a major increase in volume next year.

According to a South China Morning Post article, JPMorgan said that the volume of ESG-linked bonds is set to double in 2022. Thus far this year, ESG bond issuance has already reached $58.6 billion as investors look to align their ESG goals like addressing climate change with their investing objectives.

“There are a number of factors that will drive growth of ESG bonds from increasing investor demand, greater adoption of ESG strategies by issuers and the need to finance them, to government policy and regulatory requirements,” said Jessica Chen, co-head of ESG financing for Asia ex-Japan at JPMorgan.

“We expect to see more harmonisation of local and global standards, greater alignment of ESG financing with issuers’ decarbonisation targets, and more focus on disclosure and transparency from both issuers and investors,” Chen added.

Corporate Bonds With an ESG Overlay

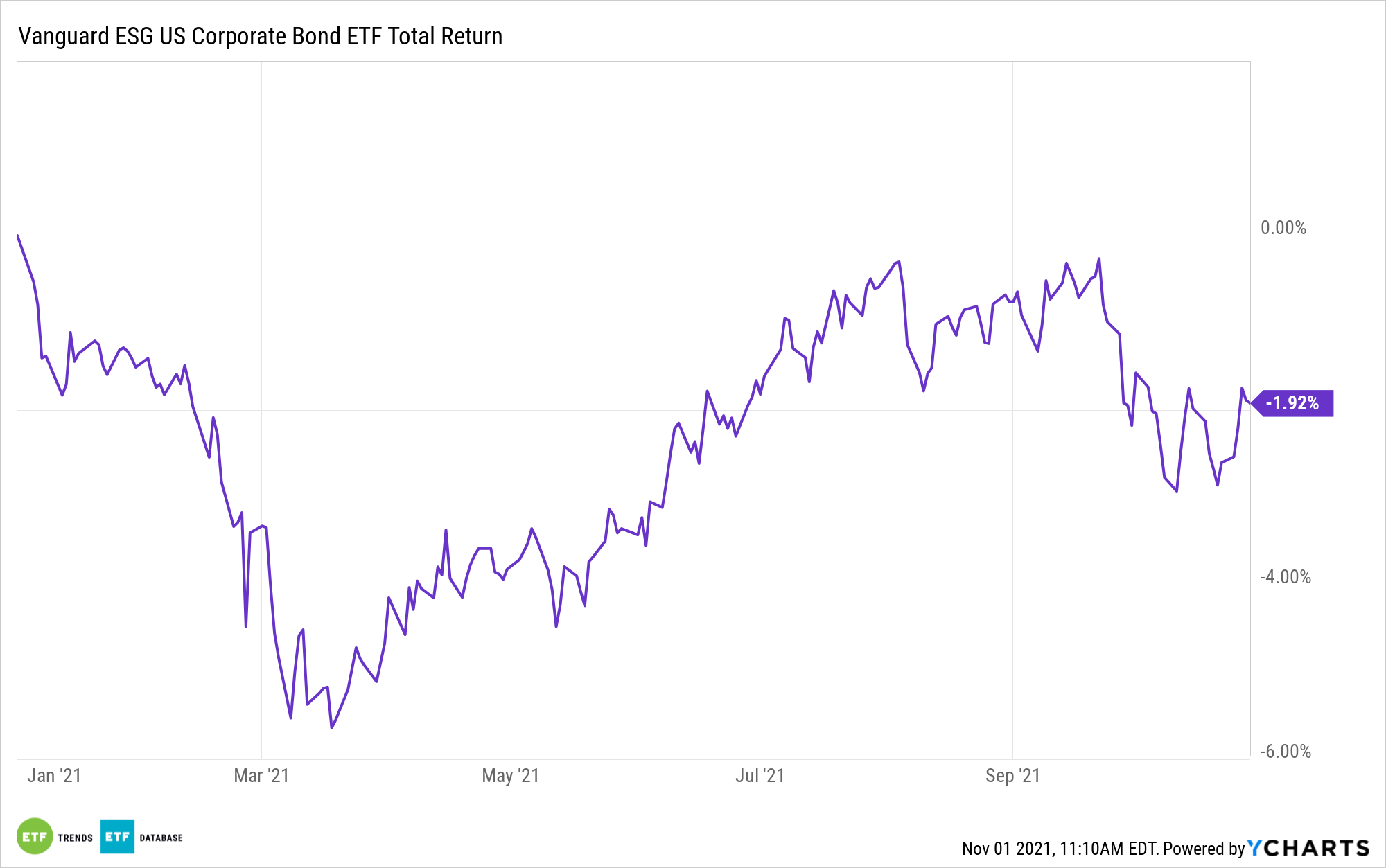

While demand for ESG bonds is set to rise in Asia, U.S. investors can opt for ETFs like the Vanguard ESG U.S. Corporate Bond ETF (VCEB). Fixed income investors can combine corporate bond yield and ESG principles with VCEB.

Per its fund description, VCEB seeks to track the performance of the Bloomberg MSCI US Corporate SRI Select Index. The index excludes bonds with maturities of one year or less and with less than $750 million outstanding, and is screened for certain ESG criteria by the index provider, which is independent of Vanguard.

VCEB highlights:

- Provides debt issues screened for certain ESG criteria.

- Specifically excludes bonds of companies that the index sponsor determines are involved in and/or derive threshold amounts of revenue from certain activities or business segments related to: adult entertainment, alcohol, gambling, tobacco, nuclear weapons, controversial weapons, conventional weapons, civilian firearms, nuclear power, genetically modified organisms, or thermal coal, oil, or gas.

- Excludes bonds of companies that, as determined by the index sponsor, do not meet certain standards defined by the index sponsor’s ESG controversies assessment framework, as well as firms that fail to have at least one woman on their boards.

For more news, information, and strategy, visit the Fixed Income Channel.