This year, let alone a few days in mid-March, is a good reminder of the role bonds and bond ETFs can play within a portfolio. Yes, there has been uncertainty as to whether the Federal Reserve will further raise interest rates in the coming days as it balances the risk of higher rates on the banking system and the broader economy with persistent inflation and job growth. However, a closer look at the leading stock and bond ETF’s total returns are telling and might make you rethink your asset allocation.

The largest U.S.-listed ETFs all invest in stocks, and the securities inside have declined in value over the past week and month, limiting the gains achieved to start the year.

The SPDR S&P 500 ETF (SPY), the iShares Core S&P 500 ETF (IVV), and the Vanguard S&P 500 ETF (VOO) all track the same index, so it’s no surprise that they performed similarly (down 2.4% in the week ended Wednesday March 15, but up 1.8% since the beginning of the year). The Vanguard Total Stock Market Index ETF (VTI) underperformed (down 3.1% in the ultra-short term, but up 1.7% for the year) due to the inclusion of smaller-cap companies outside of the S&P 500 Index.

Only the most growth-oriented ETF of the top five, the Invesco QQQ Trust (QQQ), was positive for the week, up 0.4%, and it rose 12% for the year. QQQ has no exposure to financial stocks that were under significant pressure. Even international equities struggled recently, with the Vanguard FTSE Developed Markets ETF (VEA) down approximately 4% in the past week and up only 1.4% as of mid-March 2023. Meanwhile, small- and mid-cap ETFs like the iShares Core S&P Small Cap ETF (IJR) and the iShares Core S&P Mid-Cap ETF (IJH) were down 6.7% and 7.3%, respectively, in the week, and declined 0.4% and 1.0%, respectively, year-to-date.

In contrast, the largest bond ETFs held up extremely well in part because of the income benefits to their total return and the relative safety. The Vanguard Total Bond Market ETF (BND) and the iShares Core Aggregate Bond ETF (AGG) were up 2.8% in the week and 2.9% year-to-date, as investors turned to U.S. Treasuries and investment-grade corporate bonds amid market uncertainty. Bond ETFs provide diversification and liquidity benefits over owning the bonds directly and now many sport higher yields than equities.

Meanwhile, the Vanguard Total International Bond Index (BNDX) invests primarily in investment-grade bonds from France, Germany, Japan, and other developed markets. BNDX was up 2.5% and 3.5% for the week and in 2023, respectively.

Even the iShares National Muni Bond ETF (MUB), which invests in general obligation and local municipal bonds around the United States, rose 1.7% for the year.

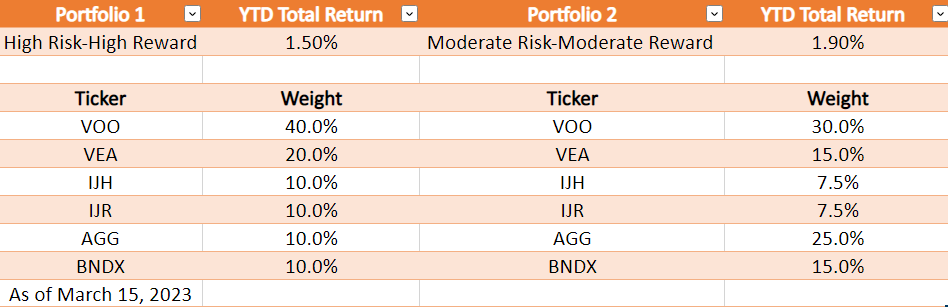

Advisors have long turned to bonds to provide income benefits and to reduce the volatility of their clients’ portfolios. While 2022 was a rare example showing that sometimes stocks and bonds can both decline in value, the start of 2023 is a reminder that a healthy stake in both asset classes is often prudent. For example, consider the following two portfolios on a total return basis.

One portfolio, called “High Risk-High Reward,” owns 80% in equities and 20% in fixed income which might have seemed appropriate a year ago given the low-rate environment. The portfolio breakdown consists of:

- 40% of overall assets in VOO

- 20% in VEA

- 10% in IJH

- 10% in IJR

- 10% in AGG

- 10% in BNDX

Year-to-date through March 15, this portfolio was up 1.5% on a total return basis.

The second portfolio, “Moderate Risk-Moderate Reward,” has 60% in equities and 40% in fixed income, to reflect the stability and income available through bond ETFs. The portfolio breakdown is:

- 30% of overall assets in VOO

- 15% in VEA

- 7.5% in IJH

- 7.5% in IJR

- 25% in AGG

- 15% in BNDX

In the past month, this portfolio was up 1.9% on a total return basis. With the obvious caveats that this is a short period of time and past performance is not indicative of future results, which portfolio would you prefer to be talking about with your clients?

For more news, information, and analysis, visit the Fixed Income Channel.