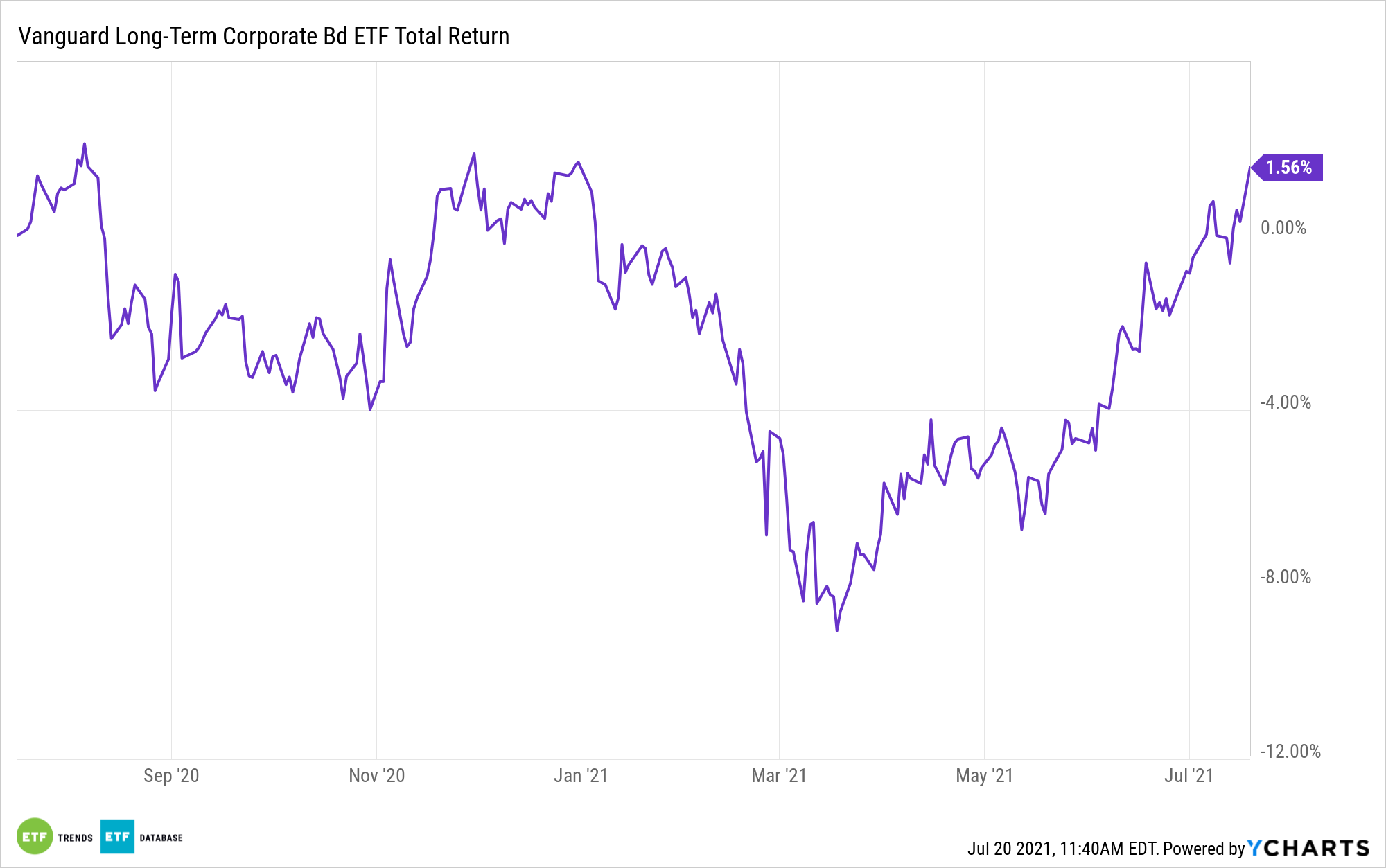

In a fixed income landscape dominated by low yields and pandemic fears, long-term corporate bonds are earning their place at the table with exchange traded funds (ETFs) like the Vanguard Long-Term Corporate Bond Index Fund ETF Shares (VCLT).

Exactly which type of investor is best suited for long-term corporate bonds? For one, the risk-on, yield-hungry investor.

“Long-term corporate bonds typically offer higher returns in comparison to their short-term or intermediate-term counterparts,” an Investopedia article explained. “However, long-term corporate bonds are much more sensitive to interest rate changes, and they are likely to show a lot of volatility when interest rates in the United States rise.”

“Investors interested in diversifying their portfolios with long-term corporate bonds have several compelling high-yielding exchange-traded funds (ETFs) to choose from,” the article added, noting that VCLT is one of the premier options.

As per the fund description, VCLT seeks to track the performance of a market-weighted corporate bond index with a long-term dollar-weighted average maturity. The fund carries a low 0.05% expense ratio.

Furthermore, the fund employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. 10+ Year Corporate Bond Index. This index includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by industrial, utility, and financial companies, with maturities greater than 10 years. Under normal circumstances, at least 80% of the fund’s assets will be invested in bonds included in the index.

High-Quality Debt Exposure

While the global economic recovery is stagnating in certain areas due to new variants of Covid-19, getting quality debt exposure is also a must. VCLT focuses on investment-grade debt issues that have a lower risk of default—with bond maturity dates beyond 10 years.

“The Vanguard Long-Term Corporate Bond ETF (VCLT) was started in November 2009 to track the investment results of the Bloomberg Barclays U.S. 10+ Year Corporate Bond Index, which is composed of high-quality U.S. corporate bonds that mature mostly in 20 years or more,” the Investopedia article said.

“The fund has $5.5 billion in total fund assets and 2,461 bonds in its portfolio,” the article added. “The ETF’s bond holdings are concentrated on industrials (69.5%), financial services companies (17.3%), and utilities (11.8%). Yield-to-maturity for the fund’s portfolio stands at 3.4% and the average duration is 14.6 years.”

For more news, information, and strategy, visit the Fixed Income Channel.