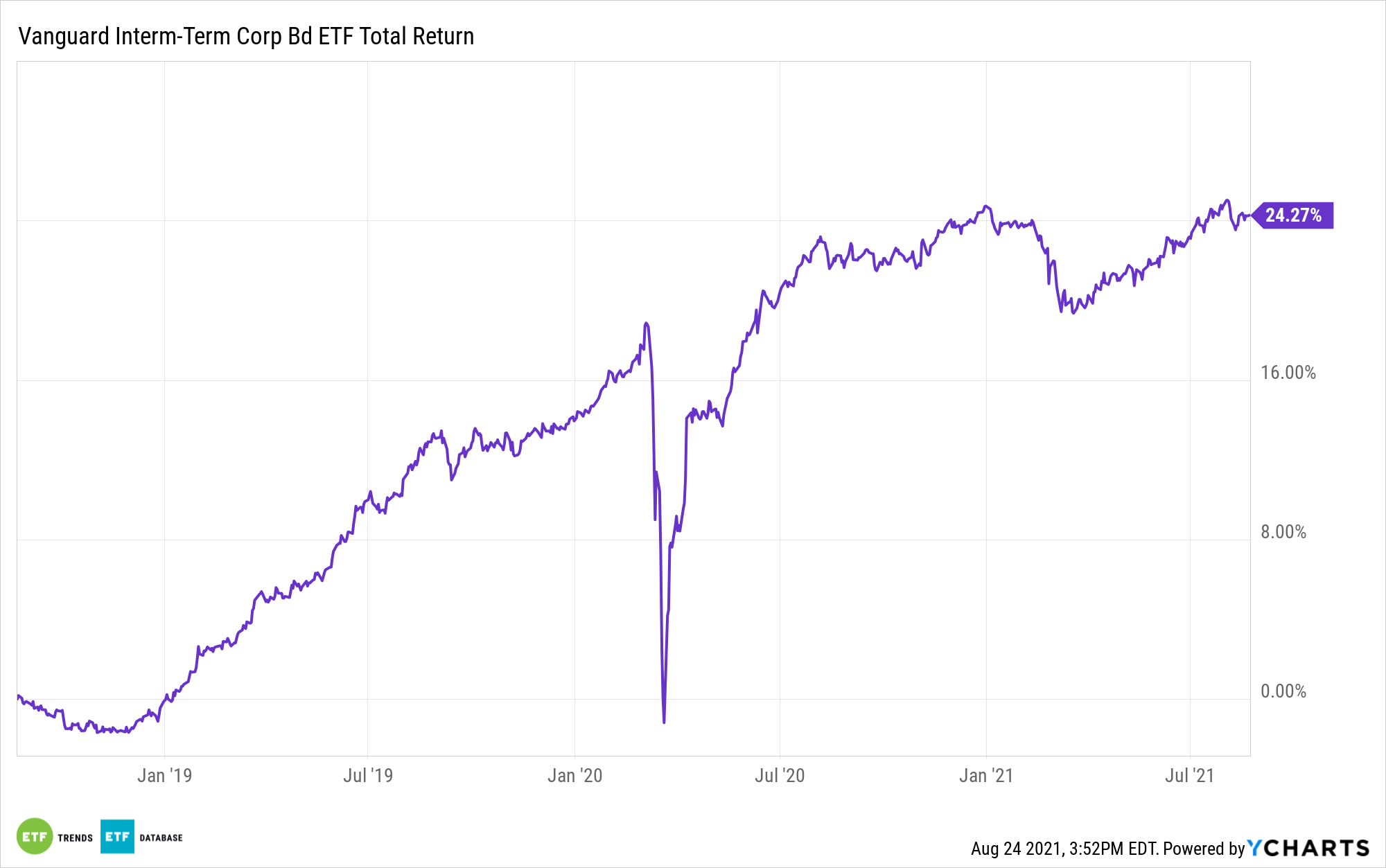

Intermediate bond exposure gives fixed income investors the Goldilocks option when it comes to duration—not too long and not too short. Enter the Vanguard Interim-Term Corporate Bond ETF (VCIT).

Corporate bonds can give bond investors more yield, albeit more risk, so if anything beyond a 10-year maturity doesn’t fit in an investor’s risk profile, VCIT is ideal for this type of targeted exposure. Furthermore, VCIT presents a viable option for investors who still want to obtain higher yields that short duration bonds can’t offer.

“Intermediate or medium-term debt is classified as debt that is due to mature in two to 10 years,” Investopedia explains. “Typically, the interest on these debt securities is greater than that of short-term debt of similar quality but less than that on comparably rated long-term bonds. The interest rate risk on medium-term debt is higher than that of short-term debt instruments but lower than the interest rate risk on long-term bonds.”

VCIT seeks to track the performance of a market-weighted corporate bond index with an intermediate-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. 5–10 Year Corporate Bond Index, which includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by industrial, utility, and financial companies, with maturities between five and 10 years.

Product summary via Vanguard’s website:

- Seeks to provide a moderate and sustainable level of current income.

- Invests primarily in high-quality (investment-grade) corporate bonds.

- Moderate interest rate risk, with a dollar-weighted average maturity of 5 to 10 years.

Targeted Duration Bonds for Short or Long

Investors looking to tailor their bond allocation to short or long duration have other options from Vanguard. Short duration can hedge rate risk, while long duration can help fixed income investors extract more yield.

For short duration, there’s the Vanguard Short-Term Corporate Bond Index Fund ETF Shares (VCSH), which seeks to track the performance of a market-weighted corporate bond index with a short-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. 1–5 Year Corporate Bond Index.

A long duration option includes the Vanguard Long-Term Corporate Bond Index Fund ETF Shares (VCLT). The fund seeks to track the performance of a market-weighted corporate bond index with a long-term dollar-weighted average maturity.

The fund employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. 10+ Year Corporate Bond Index. This index includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by industrial, utility, and financial companies, with maturities greater than 10 years. Under normal circumstances, at least 80% of the fund’s assets will be invested in bonds included in the index.

For more news, information, and strategy, visit the Fixed Income Channel.