Net ETF inflows of $289 billion in the first half of 2022 (on pace for under $600 billion for the year) might seem disappointing coming on the heels of a record-breaking over $900 billion added to ETFs in 2021. However, there are a lot of positive trends occurring that make the ETF industry an exciting one to be connected with whether you are an advisor or work for an asset manager, index provider, or something closely related.

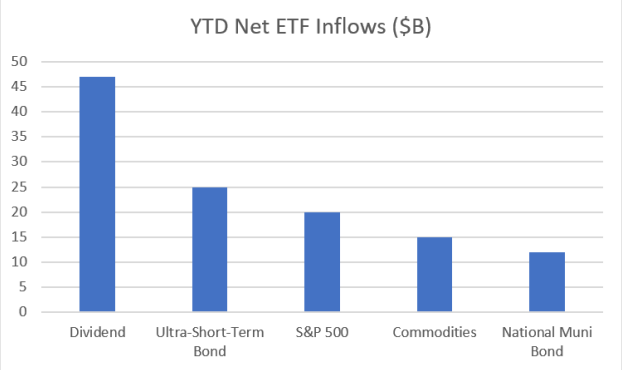

The four market cap-weighted S&P 500 Index-based ETFs gathered $22 billion in the first six months, despite U.S. large-cap equities falling into bear market territory and the S&P 500 Index ending June down 21%. While the SPDR S&P 500 ETF (SPY) had $20 billion in net outflows, the Vanguard S&P 500 ETF (VOO), the iShares Core S&P 500 ETF (IVV), and the SPDR Portfolio S&P 500 ETF (SPLG) pulled in $26 billion, $14 billion, and $2.2 billion, respectively.

Advisors and end clients continue to use these lower-cost, diversified ETFs to gain equity exposure while pulling more than $100 billion from domestic equity mutual funds, according to Investment Company Institute data.

It was not just a tough year for equity investing. The Bloomberg Aggregate Bond index tracked by the iShares Core U.S. Aggregate Bond ETF (AGG) was down 10% in the first half, which would have been the worst performance in its 45-year history had the year ended there. The Federal Reserve’s hiking of interest rates took a toll on many fixed income ETFs. Yet, rather than exit the ETF market and sit on the sidelines, fixed income-focused advisors and investors parked some cash in ultra-short bond ETFs, municipal bond funds, and elsewhere.

Ultra-short-term bond ETFs, which provide downside protection against the current rising interest rate environment, gathered $25 billion in the first half of the year, pushing their combined asset base to $95 billion.

While index-based products like the iShares Short Treasury ETF (SHV), the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL), and the iShares 0-3 Month Treasury Bond ETF (SGOV) gathered the majority of the assets directed to these low-risk bond ETFs, active funds like the JPMorgan Ultra-Short-Term Bond ETF (JPST), the PGIM Ultra Short Bond ETF (PULS), and the Vanguard Ultra-Short Bond ETF (VUSB) experienced strong demand.

National municipal bond ETFs were also popular in the first half of 2022, gathering $12 billion. The iShares National Muni Bond ETF (MUB) and the Vanguard Tax-Exempt Bond ETF (VTEB) received $6.0 billion and $3.9 billion, respectively. This sub-category manages just $83 billion in assets, but advisors have been turning more to this space than they have in the past for fixed income.

However, money also gravitated toward equity ETFs providing an appealing income component. For example, dividend ETFs gathered $47 billion in the first six months of 2022 with a range of products benefitting across the $350 billion suite.

The Schwab US Dividend ETF (SCHD) was most popular, with $7.3 billion of net inflows, but the Vanguard High Dividend Yield Index ETF (VYM), the iShares Core High Dividend ETF (HDV), the SPDR Portfolio High Dividend ETF (SPYD), and the First Trust Rising Dividend Achievers ETF (RDVY) also gathered more than $2 billion.

Money also flowed heavily into the Global X NASDAQ Covered Call ETF (QYLD) and the JPMorgan Equity Premium Income ETF (JEPI), which overlay stock ownership with call options to generate additional income.

While there’s significantly more assets in equity and fixed income categories, commodities ETFs were perhaps the brightest surprise of the first half of 2022, gathering $15 billion. For example, the Invesco Optimum Yield Diversified Commodity Strategy ETF No K-1 ETF (PDBC) and the First Trust Global Tactical Commodity Strategy Fund (FTGC), which provide diversified exposure to commodities, swelled in size. Investors also flocked to gold ETFs like the SPDR Gold Shares (GLD), and the iShares Gold Trust (IAU) gained traction.

While 2021 was the party year of the ETF, so far 2022 is the year where rational advisors and investors have discovered a wide range of great products at their disposal.

To see more of Todd’s research, reports, and commentary on a regular basis, please subscribe here.

For more news, information, and strategy, visit the Fixed Income Channel.