With a rise in interest rates forthcoming, fixed income investors are flocking to dividend-paying stocks that can add more yield than safer haven government bonds.

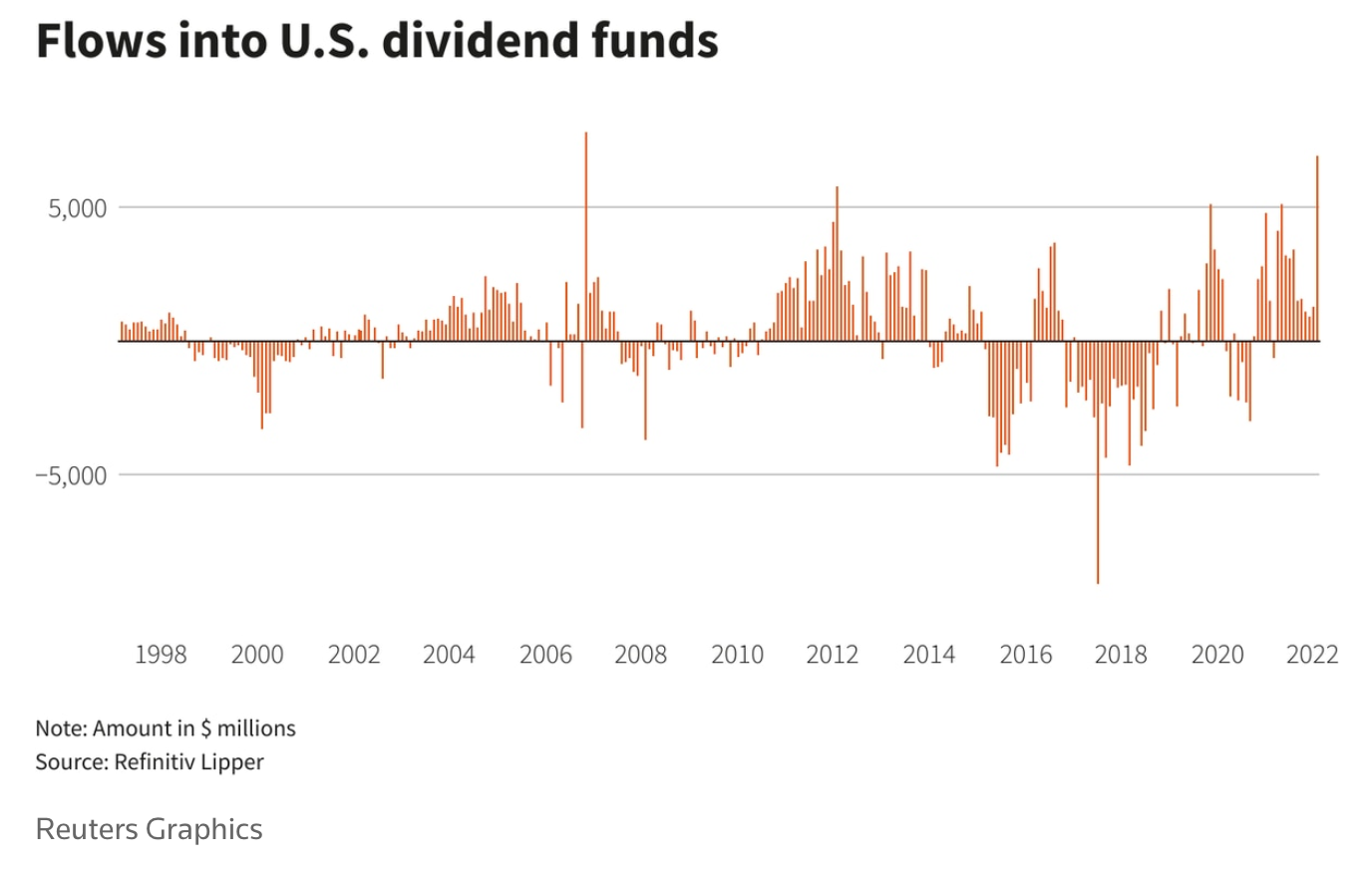

The inflows into dividend-paying funds have been substantial, particularly within the past month. A volatile January for equities saw investors seek these funds as the capital markets expect rate hikes from the Federal Reserve as inflation continues to run hot.

“U.S. investors are snapping up funds that invest in dividend-paying stocks as they search for stable income from alternatives to bond markets, which are being roiled by the prospect of rate rises,” a Reuters report says. “According to Refinitiv Lipper, investors bought $6.9 billion in U.S. dividend funds in January, the highest net purchases since October 2006.”

2 ETFs for Dividend-Paying Exposure

Investors looking to get dividend-paying exposure via an ETF wrapper have a pair of options from Vanguard to consider. One of those is the Vanguard Dividend Appreciation Index Fund ETF Shares (VIG).

VIG seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that have a record of increasing dividends over time. The fund employs an indexing investment approach designed to track the performance of the Nasdaq US Dividend Achievers Select Index, which consists of common stocks of companies that have a record of increasing dividends over time.

The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index. Cost-conscious investors will like the fact that VIG has a low expense ratio of 0.06%.

Another option for yield-hungry investors is the Vanguard High Dividend Yield Index Fund ETF Shares (VYM). The fund employs an indexing investment approach designed to track the performance of the FTSE High Dividend Yield Index, which consists of common stocks of companies that pay dividends that generally are higher than average.

Like VIG, the advisor attempts to replicate the target index by investing all, or substantially all, of their assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index. VYM also comes with a low expense ratio of 0.06%.

For more news, information, and strategy, visit the Fixed Income Channel.