Extracting maximum yield without a heavy dose of risk can be a challenge in any market environment, but it doesn’t have to be with the right exchange traded fund (ETF).

“As an income investor, it is a delicate balancing act to construct a dividend portfolio with a high-enough yield to cover your expenses and still ensure that your dividend income will be sustainable,” a Motley Fool article said. “In an environment with the S&P 500 yielding a paltry 1.3%, this can tempt investors into picking a stock whose dividend is on shaky ground, otherwise known as a yield trap.”

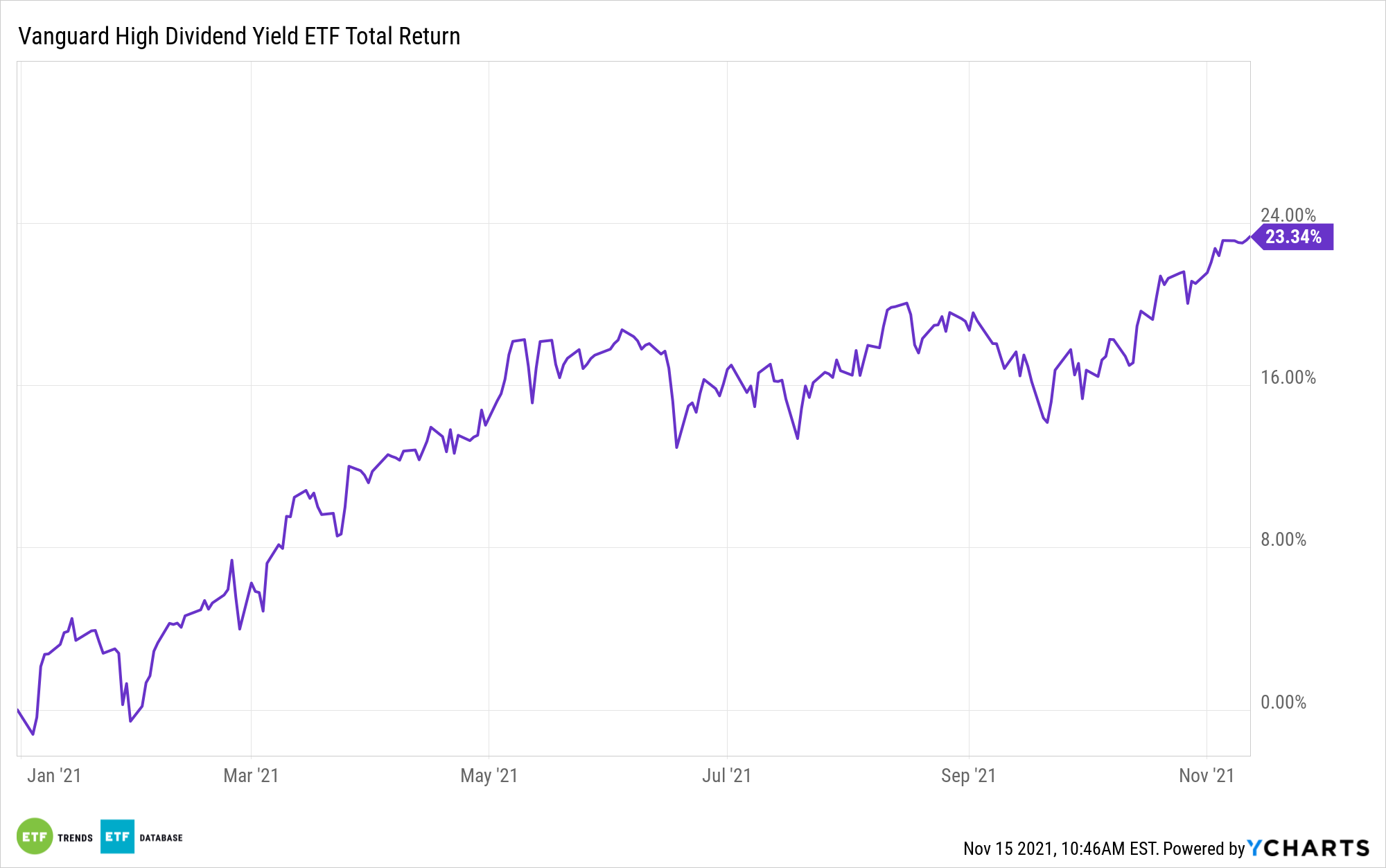

Investors looking to get higher-than-average yield can opt for the Vanguard High Dividend Yield Index Fund ETF Shares (VYM). Risk-averse investors will like the fact that the fund focuses on quality yields.

Higher-Than-Average Yield

Dividends are an alternate route to high-yield debt with ETFs like VYM. The fund employs an indexing investment approach designed to track the performance of the FTSE High Dividend Yield Index, which consists of common stocks of companies that pay dividends that are generally higher than average.

The advisor attempts to replicate the target index by investing all, or substantially all, of their assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

“This ETF is linked to the FTSE High Dividend Yield Index, which offers exposure to dividend paying large-cap companies that exhibit value characteristics within the U.S. equity market,” an ETF Database analysis says. “Investors with a longer-term horizon should consider the importance of large cap value stocks and the benefits they can add to any well-balanced portfolio including dividends and rock solid stability.”

“Companies within this segment are often considered some of the safest firms in the world and tend to be in more stable industries as well, potentially skewing some portfolios that are heavy in value securities,” the analysis says further.

In summary, VYM:

- Seeks to track the performance of the FTSE High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high dividend yields.

- Provides a convenient way to track the performance of stocks that are forecasted to have above-average dividend yields.

- Follows a passively managed, full-replication approach.

For more news, information, and strategy, visit the Fixed Income Channel.