As the Fed mulls over mull slowing down its bond-buying program, how can bond investors benefit?

Last year, the Fed instituted a bond-buying spree amid the market tumult. That included purchasing risky bond assets like high yield exchange traded funds (ETF) to stymie the risk of defaults in the debt market.

Now, as the vaccine deployment starts to bring down Covid-19 cases, the Fed may be looking to scale back on its bond-buying amid a recovering economy. A counteracting force on bond prices is that yields could tick higher, pushing bonds lower.

“Federal Reserve officials were optimistic about the economy at their April policy meeting as government aid and business reopenings paved the way for a rebound — so much so that ‘a number’ of them began to tiptoe toward a conversation about dialing back some support for the economy,” a New York Times article said.

“Fed policymakers have said they need to see ‘substantial’ further progress toward their goals of inflation that averages 2 percent over time and full employment before slowing down their $120 billion in monthly bond purchases,” the article explained. “The buying is meant to keep borrowing cheap and bolster demand, hastening the recovery from the pandemic recession.”

Two Options to Consider

Investors still have two Vanguard bond ETF options to get aggregate exposure to the bond market and stymie the effects of rising rates.

To get complete bond exposure domestically, investors can opt for the Vanguard Total Bond Market Index Fund ETF Shares (BND). BND seeks the performance of Bloomberg Barclays U.S. Aggregate Float Adjusted Index. The Bloomberg Barclays U.S. Aggregate Float Adjusted Index represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year.

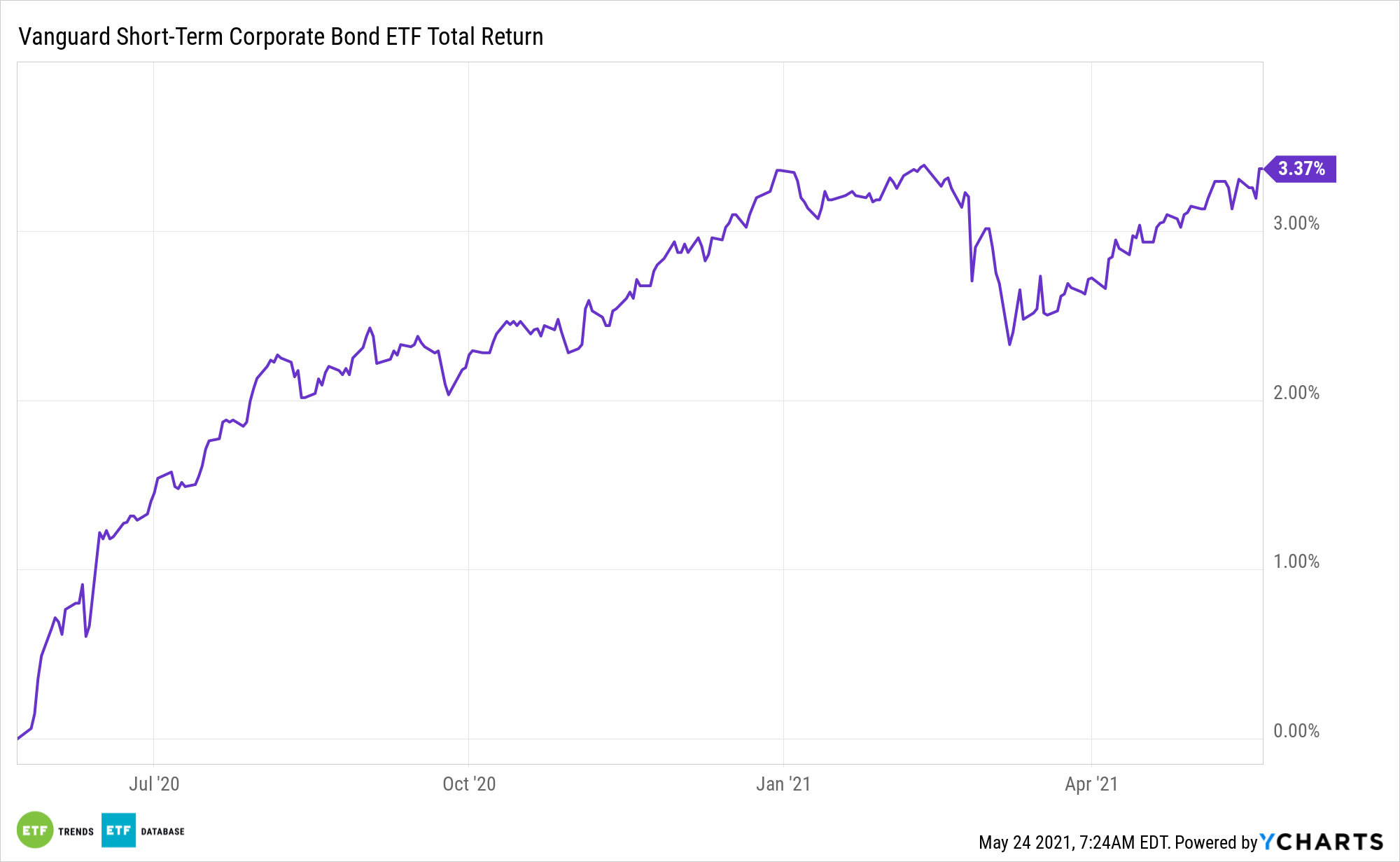

If rates should rise, investors looking to limit their duration in corporate bonds can opt for the Vanguard Short-Term Corporate Bond Index Fund ETF Shares (VCSH). VCSH seeks to track the performance of a market-weighted corporate bond index with a short-term dollar-weighted average maturity, and also employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. 1-5 Year Corporate Bond Index.

For more news, information, and strategy, visit the Fixed Income Channel.