On Thursday, First Trust Advisors L.P., a leading ETF provider and asset manager, announced the launch of a new actively managed ETF, the First Trust Multi-Manager Small Cap Opportunities ETF (NYSE Arca: MMSC). MMSC seeks to provide long-term capital appreciation by investing in equity securities issued by small-capitalization companies.

The fund’s portfolio is managed by First Trust Advisors L.P., with the First Trust Investment Committee handling the selection and ongoing monitoring of the securities in the fund’s portfolio. The First Trust Investment Committee is responsible for selecting and overseeing the sub-advisors. The fund’s assets will be initially allocated between two sub-advisors: Driehaus Capital Management LLC and Stephens Investment Management Group, LLC.

“We are thrilled to work with best-in-class small cap managers, each of which has demonstrated a long-term history of success by employing distinct, complementary investment philosophies,” said Ryan Issakainen, CFA, senior vice president, and ETF strategist at First Trust. A multi-manager approach combines the potential advantages of an actively managed portfolio with the added benefit of diversified expertise from multiple asset management firms, each of which offers its own experience, philosophy, and strategy for investing in equity securities issued by small-capitalization companies. “By combining different small-cap growth strategies that have the potential to perform well in different market environments, this ETF seeks to produce more consistent alpha over time,” said Issakainen.

A Multi-Manager Approach

A Multi-Manager Approach

A multi-manager approach combines the potential advantages of an actively managed portfolio with the added potential benefit of diversified expertise from multiple asset management firms. The fund’s portfolio is managed by First Trust Advisors L.P., with the First Trust Investment Committee handling the selection and ongoing monitoring of the securities in the fund’s portfolio. The First Trust Investment Committee is responsible for selecting and overseeing the sub-advisors, each offering its own experience, philosophy, and strategy for investing in equity securities issued by small-capitalization companies.

Multi-Management Investment Philosophy

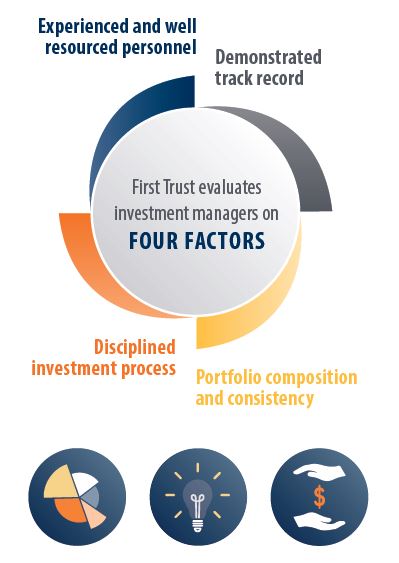

By blending multiple portfolio management teams, First Trust seeks to provide idiosyncratic profiles that complement each other. While there may be periods during which the sub-advisors see opportunity in the same areas, First Trust believes that the diversified investment disciplines may help mitigate some risk over time. First Trust strives to identify high-quality managers with investment strategies that emphasize a long-term outlook and have a consistent track record of success.

The fund’s assets are equally allocated between Driehaus and Stephens at the fund’s inception. The sub-advisor allocations will drift over time due to market conditions and security selection, and First Trust will seek to rebalance the sub-advisors back to equal weight should one sub-advisor reach a certain percentage of the total net assets. Given the complementary investment styles of each sub-advisor, the rebalance is designed to maintain meaningful investment exposure to each sub-advisor’s investment strategy over time to achieve the stated investment objective.

For more news, information, and strategy, visit ETF Trends.

About First Trust

First Trust is a federally registered investment advisor and serves as the fund’s investment advisor. First Trust and its affiliate First Trust Portfolios L.P. (“FTP”), a FINRA registered broker-dealer, are privately held companies that provide a variety of investment services. First Trust has collective assets under management or supervision of approximately $207 billion as of September 30, 2021 through unit investment trusts, exchange-traded funds, closed-end funds, mutual funds and separate managed accounts. First Trust is the supervisor of the First Trust unit investment trusts, while FTP is the sponsor. FTP is also a distributor of mutual fund shares and exchange-traded fund creation units. First Trust and FTP are based in Wheaton, Illinois. For more information, visit https://www.ftportfolios.com.

About Driehaus Capital Management LLC

Founded in 1982, Driehaus is an independent investment advisor, a signatory of the UN-supported Principles for Responsible Investment (PRI), and registered with the SEC. Driehaus manages growth equity and multi-asset alternative strategies including U.S. growth equities, international growth equities, emerging markets and alternative investments on behalf of institutional and wealth management clients.

About Stephens Investment Management Group, LLC

Founded in 2004, SIMG specializes in the management of domestic small and mid-capitalization growth equities. Stephens Investments Holdings LLC owns a controlling interest of Stephens Investment Management Group with affiliated companies founded in the 1930s and minority investments in over 50 private companies in several different industries including life sciences, power and information technology, telecommunication, financial services and consumer products and services.