ProShares has rolled out the first bond ETF that focuses solely on S&P 500 issuers to help investors gain exposure to some of the highest quality and most liquid corporate debt on the market.

On Thursday, ProShares launched the ProShares S&P 500 Bond ETF (NYSEArca: SPXB), which has a 0.15% expense ratio.

“The S&P 500® served as the basis for the first ETF over 25 years ago. Today’s launch of a bond ETF tied to the S&P 500 is another important moment in the evolution of ETFs,” Michael Sapir, co-founder and CEO of ProShare Advisors (the advisor to Proshares), said in a note. “We believe SPXB will be an attractive option to investors considering bond ETFs. SPXB offers the most liquid, high quality bonds issued by companies in the S&P 500, the widely known and most-used securities benchmark.”

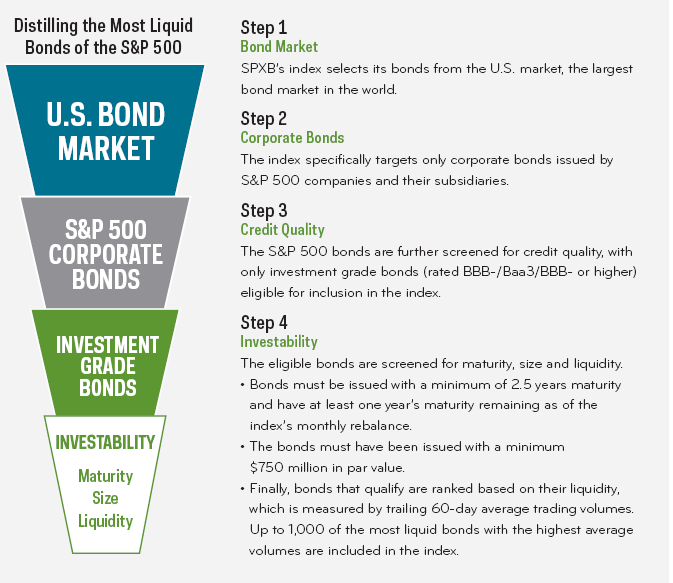

The new ProShares S&P 500 Bond ETF tries to reflect the performance of the S&P 500/MarketAxess Investment Grade Corporate Bond Index, which consists exclusively of investment grade bonds issued by companies in the S&P 500, the most widely-used U.S. equity benchmark, according to a prospectus sheet.

“As more and more investors embrace ETFs for their bond portfolios, we believe their familiarity with the S&P 500 will ease the transition,” said Steve Cohen, ProShares managing director. “We are pleased to offer SPXB, the first ETF investing exclusively in the bonds of the iconic S&P 500.”

The smart beta indexing component is also incorporated in the screening process. From over 5,000 bonds issued by S&P 500 companies, the underlying index selects and weights up to 1,000 of the most liquid investment grade bonds based on a number of criteria.

![]()