Understanding how ETF distributions are categorized can alleviate a lot of hassle and potential headaches come tax season. ETF distributions are varied, as are their tax treatments, and there are several exceptions to each category. We’ll step through each of the broad categories in turn.

What Kinds of ETF Distributions Are There?

The broad categories of ETF distributions include:

- Dividends (both qualified and unqualified)

- Return of capital distributions

- Tax-free distributions

Another primary type of distribution is the capital gains distribution, though we aren’t reviewing the nuances of capital gains today. (Learn more about capital gains distributions and ETF taxation here.)

What Are Qualified Dividend Distributions?

Dividends from corporations are a common source of income distribution in ETFs. It’s important to understand the distinction between qualified and unqualified dividends, since the two categories have significant tax differences.

The IRS defines “qualified dividends” as those issued from U.S. corporations or certain qualified foreign corporations, as well as dividends not specifically listed with the IRS as unqualified dividends. In addition, shareholders of the underlying security that issued the dividend must have held the security for at least 60 days before the ex-dividend date for at least 60 days in a given 121-day period.

If a dividend meets all three requirements and isn’t associated with hedging activity, then it is considered a qualified dividend and taxed at long-term capital gains rates. For 2023, that’s between 0% to 20%, depending on your income tax bracket.

For example, stock dividends from corporations like Apple (AAPL) and Microsoft (MSFT) can be considered qualified dividends, if they meet the 60-day holding rule.

Many income-focused ETFs offer qualified dividend income (QDI), and for better tax savings, it’s best to seek out ETFs with higher QDI percentages, which can often be found on the issuer’s website. The iShares Core High Dividend ETF (HDV) offered 100% QDI as of the end of 2021, while the SPDR S&P Dividend ETF (SDY) offered 100% QDI as of January 2023.

What Are Unqualified Dividend Distributions?

Unqualified, or ordinary, dividends are taxed at ordinary income rates. These range from 10%–37% in 2023, depending on your income bracket.

A number of asset classes generate distributions that are treated as ordinary income, including REITs and some MLPs, because they are structured as pass-through entities; bonds; many options-based ETFs (due to their hedging application); and dividends from foreign corporations and any companies that do not meet the above-mentioned qualified status.

ETFs that offered non-qualified dividend distributions include the iShares Core U.S. REIT ETF (USRT) and the Schwab U.S. REIT ETF (SCHH).

What Are Return of Capital Distributions?

Return of capital distributions occur when a distribution is paid out as a return on the equity used in the original investment instead of as profit made on that investment. As the name suggests, it’s essentially the company returning capital to the shareholder.

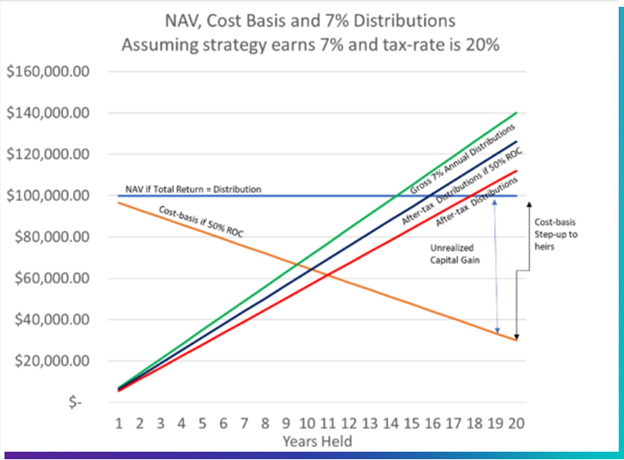

As such, return on capital distributions offer tax deferment benefits. Because the distribution being issued isn’t generated from profits but instead is a return of the original money used to purchase the shares, it isn’t taxed at the time of distribution, only when the shares are sold. When that happens, capital gains taxation may occur, depending on how long the shares were held, if gains were accrued, and so on.

ROC distributions from ETFs allow advisors to defer capital gains taxes while also lowering the cost basis of the original investment.

Image source: Nasdaq

ETFs that utilize return of capital distributions include the Alerian MLP ETF (AMLP) and the Global X S&P 500 Covered Call ETF (QYLD), which offers ROC distributions alongside ordinary dividend distributions.

Which ETF Category Offers Tax-Free Distributions?

In a high-risk environment, municipal bonds are particularly appealing for their lower risk profiles as well as their tax advantages for investors because municipal bond distributions are free from federal taxes. Some are tax-free at the state level as well, though this varies by state and depends on where the muni bond is issued as well as the state of residence of the investor purchasing.

While a buy-and-hold strategy directly in municipal bonds can open up investors to interest rate risks, gaining exposure through a muni ETF that buys and sells municipal bonds as interest rates rise eliminates much of that risk, making them tax-advantaged, lower interest rate risk vehicles than direct investment.

Popular muni ETFs with tax-free distributions include the Vanguard Tax-Exempt Bond ETF (VTEB) as well as the iShares National Muni Bond ETF (MUB).

For more news, information, and analysis, visit the Financial Literacy Channel.

VettaFi LLC (“VettaFi”) is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing or trading of AMLP.