Recession is in the air — even though the data around recession is mixed, many economists think that the U.S. is likely to drift into a downturn. Rates remain elevated, and CPI is still high. Geopolitical issues are still weighing on global markets, and supply chains remain wobbly at best.

In a discussion on CNBC’s “Squawkbox Europe,” Chris Waitling, the chief executive of financial advisory firm Longview Economics, noted that the March 2022 inversion of the Treasury yield curve is historically a solid indicator of recession. “Every time you’ve had that in the U.S., you’ve had a recession. So, I think it’s coming, it’s on its way. It’s just a timing issue,” Watling said.

Get Invested and Stay Invested — Take a Long-Term Approach

One of the most challenging aspects of a recession is separating out emotions while maneuvering a portfolio. It can be easy to get caught up in the gravity of what is happening and make moves just to make moves when holding fast could be the smarter long-term play, especially amid a sell-off.

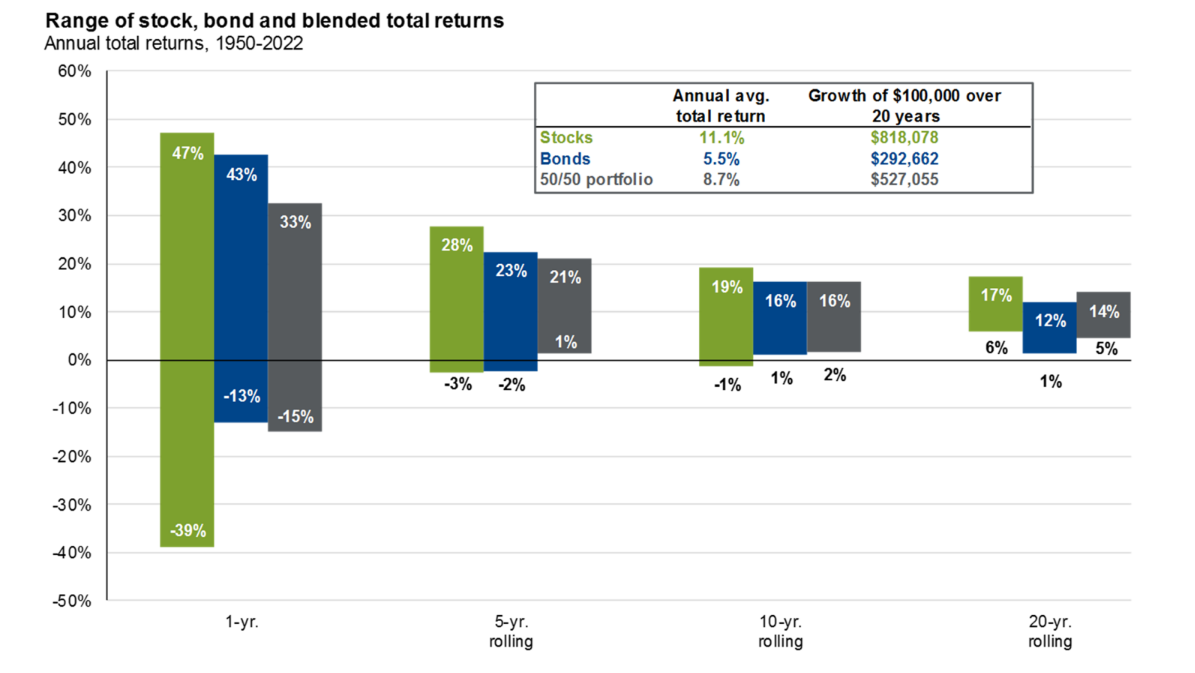

Over time, investing results in returns. Though some years or even stretches of years might look rough, when zoomed out over a long enough time period, both stocks and bonds show positive returns.

Diversification Is Your Friend When Fighting Recessions

In an interview with VettaFi, Ramona Maior said, “One of the most important steps a financial advisor can take to protect a client’s portfolio during a recession is to diversify the investments.”

Diversification is a critical protection tool at your disposal in the event of a recession. You need to make sure you have diversity through different industries, geographic locations, market cap sizes, asset classes, and investment types. The more you are spread out, the more likely your portfolio will be able to sponge the inevitable damage that comes with a recession.

According to VettaFi head of research Todd Rosenbluth, “No two market environments are the same, and investors benefit from a broadly diversified portfolio that offers exposure to a range of investment styles that can counterbalance one another during strong and weak scenarios. Typically, when U.S. equities are out of favor, fixed income and/or commodities hold up better.”

Looking at asset class returns across sectors since 2008, it is easy to see that different investments fare better at different times. Taking a balanced approach across asset classes (see below as “Asset Alloc.”) helps investors to avoid asset class performance swings.

If your portfolio has exposure gaps, you can take advantage of the sales that come with a recession to mend those gaps — which brings us to another critical recession survival strategy.

Take Advantage of the Dip, Tactically

If you are well positioned and have clients with cash on the sidelines, recessions make an excellent “buy on the dip” opportunity, as valuations tend to cheapen. This is not without risk, however, as it can be nigh impossible to time a purchase properly. Buy the dip only with money that your clients are comfortable gambling with, as it could end up getting lost amid the volatility of a recession.

Every Recession Is Different, but Don’t Discount the Usual Strong Performers

There are certain things that everyone needs, despite a recession. Of course, as 2020 proved, not all recessions are the same. That said, utilities, healthcare, and consumer staples — though not the most glamorous investment exposures out there — historically outperform during recessions. This is largely because people need to keep their power on, go to the doctor, and eat no matter what the market is doing.

Because every recession is different, it’s critical to understand which performers are likely to show strength and where there could be challenges. Your Dedicated Fiduciary’s Vance Barse said in an interview with VettaFi, “It’s important for advisors to understand the historical behavior of certain sectors within fixed income during recessions, because some types of bonds have the propensity to display equity-like behavior in a credit crunch.”

How to Prepare Yourself for a Recession

The most important tool your clients have for fighting recession is you — their financial advisor. To stay sharp, advisors should look at their historical patterns during recessions with a sober eye. What did you do that worked, and what did you do that didn’t? Do you have any behavior patterns that don’t serve you or your clients?

While the markets are in the calm before the storm, now is the ideal time to assess your historical performance with a critical eye and mentally prepare yourself. Though recessions are challenging for both you and your clients, you have an opportunity to level up your game and avoid falling into repeated traps.

In an interview with VettaFi, Alpha Architect’s Jess Bost shared, “For advisors who are concerned about whether or not their investment models are prepared for an economic downturn, I cannot recommend enough for them to find someone who they trust that will give them a second opinion on their portfolio models.”

The Big Picture

Amid a recession, lots of voices will be competing for attention. Rather than listening to folks who might be pitching their particular solution, advisors could do well by listening to the people who have a track record of educating themselves and trying to share information with the rest of the advisor and investor community.

Bost noted, “What I have ultimately found to be successful is to first seek out people/companies who have a business of educating others on how and why investing works the way that it does. Second is to further sift out the educators who have a background of research and deep knowledge of market trends, who are continuing to educate themselves on why markets respond the way that they do (not just marketing companies that report on current trends and market data.) Third, look for the helpers — those who apply this education and knowledge beyond the scope of the investment quants and into the areas of financial professionals who work with the consumers.”

For more news, information, and analysis, visit the Financial Literacy Channel.