Thought to ponder…

“…be patient toward all that is unsolved in your heart and try to love the questions themselves like locked rooms and like books that are written in a very foreign tongue. Do not seek the answers which cannot be given you because you would not be able to live them. And the point is, to live everything. Live the questions now. Perhaps you will then gradually, without noticing it, live alone some distant day into the answer.”

Rainer Maria Rilke Letters To A Young Poet

The View from 30,000 feet

Last week’s market action was dominated by monitoring fallout of the banking system crisis and policy makers’ reactions. The Fed followed through with an anticipated 25 basis point hike and stepped down projections for further increases. Questioning was focused on if policy tools employed will be sufficient to stop the budding liquidity crisis from cascading into a solvency and confidence crisis. The banking crisis has changed the Fed’s reaction function, forcing them to balance the effects of tightening credit conditions in commercial banking system with the Fed’s hiking and quantitative tightening campaign. The Fed’s job for titrating policy measures and distribution of outcomes as broadened with the Fed, equity markets and fixed income markets each pricing different outcomes.

- Fed meeting with a different tone, and a familiar market reaction – not listening to the Fed

- Increased probability of a material slowdown, and a review of what it has historically meant for equity prices

- Are we on the path to 2008/2009 style credit crisis or something different?

- The most Frequently Asked Question from client’s this week: How will the Fed measure the impact on the banking system?

Fed meeting with a different tone, and a familiar market reaction – not listening to the Fed

Main themes of the Fed release and press conference:

- The policy statement contained an important shift from noting an environment where ongoing rate hikes will be appropriate to an environment where some additional policy firming may be appropriate.

- Powell began and ended the press conference with the Fed’s focus – a commitment to return inflation to their long-run target of 2.0%. Indicating, they believe they have ringfenced the financial stability issue and will continue to emphasize the inflation crusade.

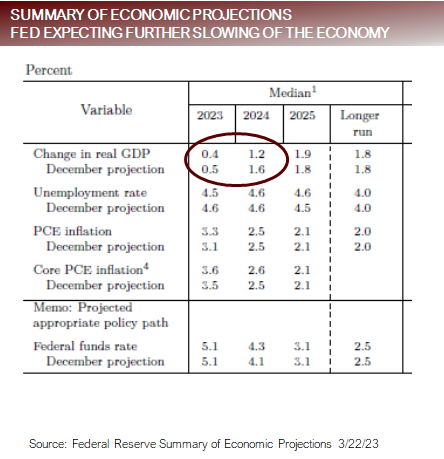

- Downgraded GDP projections and increased inflation projections. Indicating longer more difficult battle with inflation ahead.

- Highlighted that the Fed does not expect rate cuts this year. 17 out of 18 Fed Presidents expect further hikes this year.

- Acknowledged that the banking crisis will result in credit tightening that will act as substitute for rate hikes, lessening the need for path torates with a 6 handle, but noted that there is not enough data yet determine how much credit tightening will impact the economy.

- Admitted that the banking crisis and expected tighter credit conditions will make it more difficult to attain a soft landing.

- Did his best to reassure market participants that the Fed will safeguard deposits, without explicitly committing to guaranteeing assets.Market takeaways and focus from Fed statements

- Questioning was focused on gaining assurance of the Fed’s commitment to backstopping the banking system. Market reaction to Powell’s comments indicated satisfaction with his answers but simultaneously Yellen was giving testimony in front of Congress and stated there would no be “blanket” guarantees, which drove a selloff in risk assets.

- Although the Fed was clear that they have no intention of cutting rates in 2023, equity and fixed income markets have priced alternative scenarios, with Fed Fund futures pricing 75 basis points of rate cuts in 2023 and 125 basis point of cuts in 2024.Bottom line

- The financial markets are expecting a slowdown, disinflation and rates cuts beginning in Q2 2023, counter to Fed policy guidance.

- Equities are staging a rally based on rate cut expectations but may not be adequately reflecting the impact of the slowdown on earningsshould the slowdown transpire.

Fed expecting slowing without cuts, but markets have other ideas in mind

Increased probability of a material slowdown, historical impact of recessions on S&P500

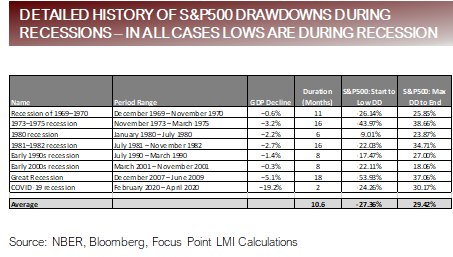

• Update and review of our previous Special Report on S&P500 performance before and during recessions, published in November 2022.

- In 100% of the last 8 recessions the S&P500 bottomed during the recession and traded higher off that bottom while the economy was still in recession.

- Extrapolating Fed GDP projections with the Atlanta Fed GDPNow data, the Fed expects a recession to begin sometime after Q2 2023.

- The average drawdown after the recession began was -27.4%.

- The average appreciation off the maximum drawdown during the recession, while still in the recession, was 29.4%.

- The following observations relate to the 7 recessions prior to the pandemic.

- In all but one instance (1969 – 1970), inflation continued to rise during the recession, not peaking till mid-way through there recession, making the current cycle very unusual because we are not in a recession and inflation appears to have peaked and is rolling over.

- About half the time ISM Manufacturing New Orders dipped below 50 before the recession, but in 100% instances, it dipped below 50during the recession. We are below 50 today.

- In recessions after 1980, once the ISM Manufacturing New Orders dipped below 50, it continued the run downward and dipped below 40in all instances, not bottoming until near the end of the recessions. The most recent reading was 47.0, which would indicate if we areheaded to a recession there’s substantial downside to New Orders.

- The Conference Board Leading Economic Indicators fell below zero in 100% of instances, typically signaling recession 4 to 12 monthsbefore the recession. We have been below zero for the past 8 months.

- In 100% of instances the 3 month / 10 Year Yield Curve has been consistently inverted for five months. It typically inverts well before therecession, leading by as much as 18 months, but more frequently inverts six to nine months before the recession.

Hard to fit a pattern because the recession has yet to show in the GDP

Are we on the path to 2008/2009 style credit crisis or something different?

- We’ve fielded a lot of questions over the two weeks regarding if Silicon Valley Bank is another Lehman Moment, or if perhaps it’s the canary in the coal mine like Bear Stearns was.

- The current banking crisis is nothing like Bear Stearns or Lehman.

- The Bear Stearns failure was set off by losses at a structured credit fund run by Bear Stearns that was using aggressive leverage on low quality Collateralized Debt Obligations (CDOs) that were being hedged with Credit Default Swaps (CDS). When defaults began to increase, the CDOs began falling and the CDS hedges were in adequate. The spiral started because the credit risk in the CDOs was not correctly accounted for, and as a result the CDS hedges were much too small to cover the portfolio losses. Fate was sealed because of the losses combined with massive leverage.

- The Lehman failure was precipitated by Lehman’s aggressive acquisition of mortgage lenders who specialized in Alt-A loans. Although the loans were mostly above subprime, the lending standards and documentation of the loans were lax creating credit quality issues. Lehman combined their low-quality credit problem with massive leverage, exceeding 30:1. When the housing market collapsed, a spiral began driven by the credit problem and was quickly amplified by the overuse of leverage.

- In both the Bear Stearns and Lehman failures the culprits were credit quality and leverage.

- The current banking crisis is not being driven by credit quality. The current banking crisis began when rapid depositor flight forced banks to mark-to-market and write down, money good bonds. The Fed was able to prevent the write downs from becoming a systemic risk by creating a facility that allowed banks to lend money good bonds back to the Fed at par, reducing the impact on bank Balance Sheets, while the FDIC was able to prevent the run on deposits from becoming systemic by relying on emergency authority to guarantee deposits above the FDIC limit.

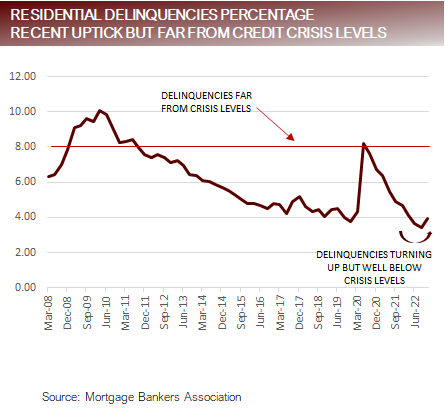

- The looming issue is if there is hidden credit quality problem on bank Balance Sheets related to commercial real estate or bank loans that is yet to be quantified.

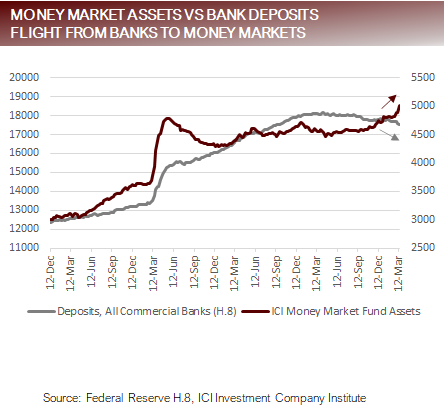

Flow of assets out of banks to money markets, not credit concerns driving banking issues

FAQ: How will the Fed measure the impact on the banking system?

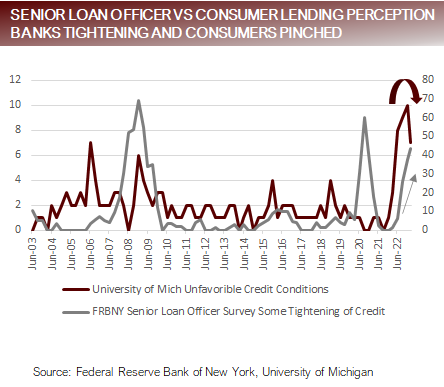

- The Fed’s hypothesis is that the banking crisis will force banks to tighten credit availability, removing liquidity from the system. Based on the adjustment they made to their interest rate policy forecasts, they expect the credit tightening effect to account for one to two 25 basis point interest rate hikes.

- Banks will be forced to tighten lending standards and limit credit availability because of structural changes.

- The flight of deposits in search of higher yields

- Being forced to compete with money markets and Treasury rates to attract deposits

- Falling demand for loans from companies and real estate based on expectations for a slowing economy

- Tighter credit standards being employed by loan officers

- Cost of increased regulatory inquiries, hedges and systems needed to monitor impacts of market conditions on capital ratios

- The tools the Fed will use to monitor the impact of the banking crisis on bank health and impact to the economy:

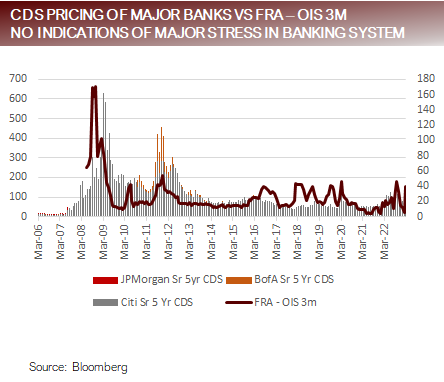

- CDS pricing for major banks will indicate market perception of risk to banking system, currently low

- The TED Spread, which measured the difference between T-Bills and LIBOR, which was used in prior decades has been replaced by thedifference between Forward Rate Agreements and Overnight Interest Rate Swaps or 3-month Repos and Overnight Interest Rate Swaps

- Senior loan officer survey data indicating tightness of lending standards

- Business survey data indicating perceptions of availability of credit from banks

- Measuring the health of the banking system and stress on major banks may provide a false sense of security because major vulnerabilities may be in the less regulated and reported on regional, small bank and credit union markets.

Large bank and banking system stable, lending conditions becoming definitively tighter

Putting it all together

- The Fed has been forced to contend with a banking crisis set off by an unprecedented flight of deposits in search of higher yield and safety, inflamed by the impact of the rapid change in rates to longer duration bonds.

- Emergency policy measures appear to have ringfenced the banking problems, but the fallout is expected to result in tighter bank lending policies and less demand for credit. The Fed is attempting to factor the fallout from the banking crisis rate cuts and stepping down their expectations for rate increases, while acknowledging that their battle with inflation is far from over.

- Data over the coming weeks will send mixed messages because many of the data being reported will be for the period before the banking crisis, so market participants will be balancing stale data with high frequency and price-based data which will create cross currents.

- The Fed, equity markets and fixed income markets are forecasting different outcomes:

- Fed: Banking crisis has been ringfenced, inflation is still a problem that needs policy solution, albeit less aggressive policy than before the banking crisis. A continued path of higher rates, pronounced slowdown in the economy and low probability of rate cuts in 2023.

- Fixed Income: Expecting a sharp slowdown in the economy, a precipitous drop in inflationary pressures, beginning in the next three months, and a dramatic policy shift to a rate cutting campaign.

- Equities: Soft land, characterized by continued strength in corporate earnings and the job market, with disinflationary pressures emerging that provides off ramp for Fed to begin lowering rates.

- With the range of market and policy expectations being so wide and the markets lingering around key technical levels, market action is prone to chop as short-term data drives market sentiment to shift rapidly between narratives.

For more news, information, and analysis, visit VettaFi | ETF Trends.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

Important Disclosures

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied. FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.