In case you missed the news, the Fed is now going to be directly buying corporate bonds, muni bonds, and treasuries. But they’re also throwing ETFs into the ring. From the structuring documents for the new Secondary Market Corporate Credit Facility (SMCCF):

“Eligible ETFs. The Facility also may purchase U.S.-listed ETFs whose investment objective is to provide broad exposure to the market for U.S. investment grade corporate bonds.

Limits per Issuer/ETF: The maximum amount of bonds that the Facility will purchase from any eligible issuer will be capped at 10 percent of the issuer’s maximum bonds outstanding on any day between March 22, 2019, and March 22, 2020. The facility will not purchase more than 20 percent of the assets of any particular ETF as of March 22, 2020. Pricing: The Facility will purchase eligible corporate bonds at fair market value in the secondary market. The Facility will avoid purchasing shares of eligible ETFs when they trade at prices that materially exceed the estimated net asset value of the underlying portfolio.”

On the one hand, this is great. But there’s one area of concern here. As I’ve been writing about for weeks at this point, the fundamental problem here isn’t that “bonds sold off.” It’s that the pricing services used to calculate index values (and that are used for virtually all bond NAVs). Those services are lagged. What I mean by that is it takes them days, sometimes longer, to adjust for what’s happening in the world of cash bonds. We’ve seen this time and time again since the first Bond ETFs hit the street 20 years or so ago. The bond market has an event, and days later, NAVs finally start coming down to earth. For example:

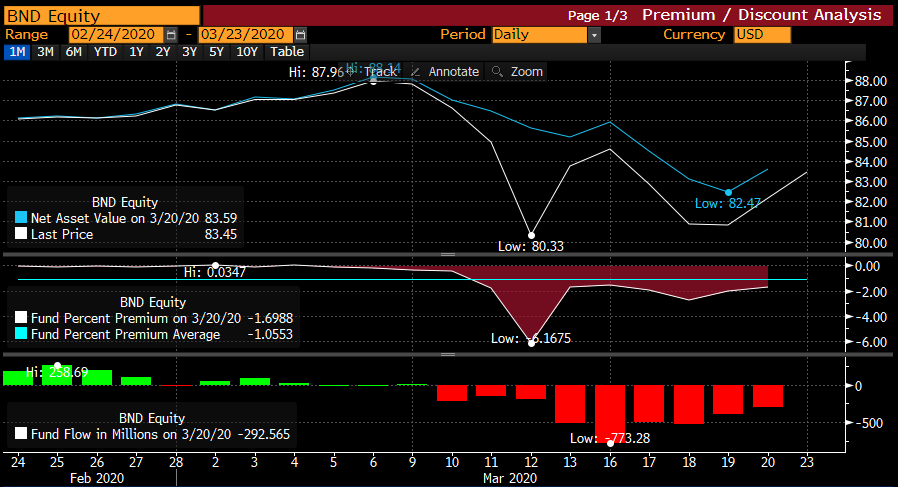

Here’s what happened with iShares Short Maturity Bond ETF (NEAR) last week. Traded down hard, and slowly, the NAV started responding. Of course, by that time, the market had started bidding NEAR back up as well. Or here’s what’s been happening with Vanguard Total Bond Market ETF (BND).

Again, the ETF priced down, and slowly the NAV came down to meet it. That blue line might as well represent what’s happened with the Mutual Fund share class of the same fund. Artificially high NAVs are allowing some investors to head for the exit.

Two Problems

The way NAV comes back down to reality is that the underlying bonds that represent NAV have to be repriced. The way they get repriced is by actually trading. As broken as the NAV pricing models for bonds are, they do at least start with the input of the most recent trade in each security. After all, if all the securities traded at 4 PM, you’d know the actual cash-money value of each security, and bond pricing services wouldn’t be necessary.

The way it’s been working is that as bond funds and ETFs handle redemptions, the funds themselves (or APs who are taking delivery of bonds in ETF redemptions) are forcing NAV down as they go into the market and sell. In ETFs, this creates no structural issues — it just accelerates the marking of the bonds to the right prices. In mutual funds, however, it can create a real problem.

If an investor redeems, say, $1 million out of a bond mutual fund, the fund has to make that redemption. If they have cash, great, if they are fully invested, they generally tap a line of credit, and then in the next days trading, they sell enough securities to pay back the LOC. So what do they sell? What they can! That means the most liquid, generally least risky bonds. That leaves the junkiest, illiquid stuff still mismarked in the portfolio, and the liquid, highest quality stuff marked correctly (from their own sale).

Related: Bond ETFs: Not Mispricing (That Would Be The Mutual Funds)

Now imagine you have another $1m redemption. See the problem? Each day, the fund gets worse and worse, degrading its own liquidity and risk profile, all while delaying the inevitable repricing of the bottom tier. This is precisely what caused Third Avenue, so may problems five years ago. I suspect we’re headed for similar this time, and some bond mutual funds will soon be closing their redemption windows out of necessity. That’s the mutual fund death spiral folks are worried about. And let’s be super clear, that’s not an ETF problem.

But the second problem could come if the Fed mishandles this massive new program. If they simply wade into the ETF market, buying up every ETF that’s at a discount, well, great. That buying pressure will, of course, bring discounts up, but it will be artificial unless they are also buying the underlying bonds. It’s critical that broad swaths of the corporate and muni space be targeted at the individual issuance level. Without doing that, the pricing signals will never get back into NAVs correctly, and all we’ll do is “re-inflate” the price of the ETFs up to the bogus NAV numbers. The restrictions on bond ETFs make sense; however, the bond ETF market is still tiny compared to the broader bond market.

Let’s just hope they get this right.

For more market trends, visit ETF Trends.