WHAT’S THE DIFFERENCE?

By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

ETFs share many similarities to the more established mutual fund industry, and a few important differences. Both investment vehicles are normally registered with the SEC and subject to significant government oversight and regulatory limitations. Also, ETFs and mutual funds usually offer diversification benefits to an investor by owning a basket of hundreds or thousands of securities, typically stocks and/or bonds. As a result, a single ETF or mutual fund can offer more diversification than an individual investor may be able to afford if they attempted to purchase each of the underlying holdings individually. Additionally, both investment vehicles have a net asset value (NAV), which allows investors to quickly and easily determine the value of their holdings.

![]() One key distinction is the process through which investors purchase and sell shares of ETFs and mutual funds. Mutual funds are bought and sold directly through the fund company that creates and redeems shares at the closing NAV each trading day. However, ETFs are traded throughout the day at the current market price, like a stock, and may trade at a price that is more or less than the NAV.

One key distinction is the process through which investors purchase and sell shares of ETFs and mutual funds. Mutual funds are bought and sold directly through the fund company that creates and redeems shares at the closing NAV each trading day. However, ETFs are traded throughout the day at the current market price, like a stock, and may trade at a price that is more or less than the NAV.

Within the ETF ecosystem there are also entities called authorized participants (APs). The APs’ roll is to help facilitate efficient ETF trading and step into the market to keep an ETF’s market price from deviating significantly from its NAV. During periods of extreme market movements, these deviations, known as discounts and premiums, can become significant for short periods of time. When more normal trading activity resumes, these discounts and premiums tend to dissipate.

WHAT’S THE BIG DEAL?

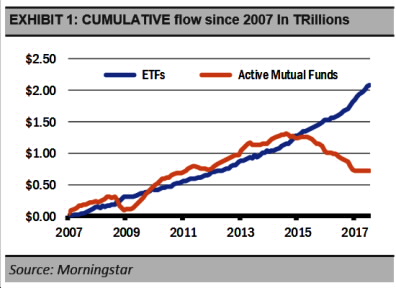

Some suggest that the growth of ETF assets pose a new threat to financial market stability as their inflows have significantly outpaced their mutual fund counterparts for several years.

However, as exhibit 1 shows, flows into ETFs and actively managed mutual funds were similar until 2015. Since then, flows into actively managed mutual funds have declined, while flows into ETFs have accelerated. The relative change is as much about investors moving away from actively managed mutual funds as it is about investors moving into ETFs.

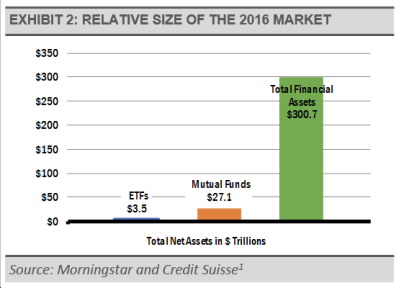

Still, ETFs are a very small portion of the total size of the global liquid financial assets market. For instance, in 2016 ETFs had approximately $3.5 trillion in total assets worldwide, whereas mutual funds had an estimated $27.1 trillion in total assets. In relation to the entire global market of financial assets, those figures equate to ETFs holding roughly 1.17% of the market and mutual funds roughly 9.03%.

Despite the headlines on ETF growth, we do not view ETFs as much of a risk to the market. ETFs are simply another investment vehicle that makes market access easier for individual investors, and these market evolutions have been going on for many years. For example, decades ago mutual funds themselves were a new and different investment vehicle that allowed individual investors instant and convenient diversification.

Furthermore, the rise of passive strategies, including index mutual funds, has been putting downward pressure on expenses for years, as did the deregulation of commissions in the 1970s. Combined, these evolutions have been disruptive to the industry, but have had little actual effect on the markets. In short, the rise of ETFs is just the latest evolution of the democratization of the financial markets and not something to fear as a new market risk.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management LLC and has not been verified or audited by an independent accountant.

1Shorrocks, Anthony and Davies, James and Lluberas, Rodrigo, Credit Suisse Global Wealth Databook 2016 (November 2016).