By Brendan Ryan, Beaumont Capital

Investors of balanced strategic portfolios as well as effective tactical portfolios are now well aware of the benefits of reduced risk during times of market duress. While volatile markets may encourage investors to seek the historical “safe havens” of fixed income and lower risk investments, an unfortunately timed rebalance or re-allocation towards fixed income can be particularly risky in today’s environment.

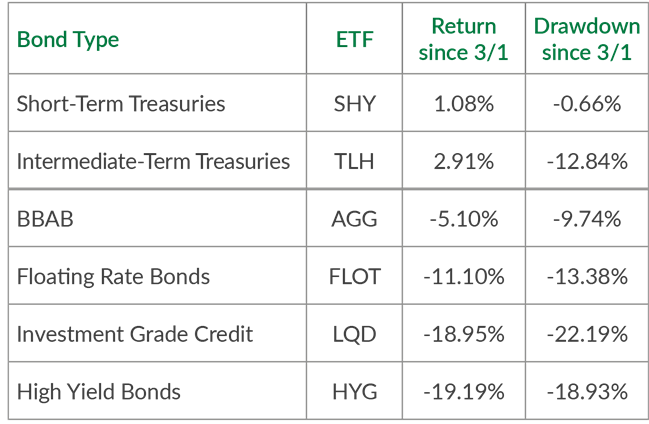

Source: Bloomberg, Beaumont Capital Management (BCM). Data is for the period 3/1/2020 through 3/20/2020.

With the VIX, the CBOE’s volatility index based on the S&P 500’s index options, sitting at 66.92 as of 3/20 close, the options market is currently expecting DAILY moves of just over 4% in the U.S. equity markets. With the 10-year U.S. Treasury currently yielding just 0.92%, being out of the equity markets for just one day could mean missing out on the equivalent of over 4 years’ worth of coupons. With bond credit spreads near-perfectly correlated with equity markets, investors tempted to pursue higher-yielding fixed income should use caution as the below drawdowns indicate:

Source: Bloomberg, Beaumont Capital Management (BCM). Data is for the period 3/1/2020 through 3/20/2020.

Although most of BCM’s investment systems are sitting firmly in a more defensive posture in their equity allocations, some are not completely risk-off (with the implication being they are somewhat leery of fixed income). With this in mind, we wanted to explore how different the fixed income environment may be now than in prior market drawdowns.

We currently sit in the midst of the worst month for global equities in recent memory, but what is particularly striking is how much of the downside bonds have captured. Even in the only similarly bad month for equities (October 2008), U.S. fixed income suffered just 10% of the downside. We can extend the list out to all of the “bad” (>5% decline) months since 2005, and March 2020 is the worst relative month for fixed income. As the data below shows, on average amongst these months, bonds have actually been directly additive to performance of a strategic portfolio.

Source: Bloomberg, Beaumont Capital Management (BCM).

After a 39-year bond bull market, investors have used bonds as a reasonable “safe haven,” especially when equity markets are in duress. While certain bond markets should always provide a relative safe haven, we believe the low interest rate, more volatile bond environment is playing a major role in why some of our own investment systems were less inclined to abandon volatile equity markets for fixed income than we might have expected. In fact, in some instances our models have even begun to look to foreign currencies as a portfolio risk reducer instead. With the opportunity cost of being out of the equity markets potentially so high and the reward in fixed income potentially so weak, we would caution prudent investors from deviating significantly from their planned asset allocation in the current environment.

This article was contributed by Brendan Ryan, Assistant Portfolio Manager at Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosure:

Copyright © 2020 Beaumont Capital Management (BCM). All rights reserved.

The views and opinions expressed throughout this presentation are those of the author as of March 26, 2020. The opinions and outlooks may change over time with changing market conditions or other relevant variables.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person.

The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector investments concentrate in a particular industry, and the investments’ performance could depend heavily on the performance of that industry and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

Past performance is no guarantee of future results. ETF performance shown is gross of fees and expenses. An investment cannot be made directly in an index. Individual securities mentioned may be held in client accounts. Index performance is gross.

Down capture ratio is a statistical measure of an investment’s overall performance in down-markets. It is used to evaluate how well an investment performed relative to an index (or another investment) during periods when that index has dropped. The ratio is calculated by dividing the investment’s returns by the returns of the index (or other investment) during the down-market and multiplying that factor by 100.

All BCM strategies invest solely in long-only ETFs.