By Grant Engelbart, CLS Investments

Risk Budgeting focuses on the management of volatility in client portfolios. This manifests itself in the most apparent form for clients during market corrections, where “risk” and “volatility” move from being vague statistical measures to “Wait, how much money did I lose??” As strategic risk managers, CLS strives to keep risk consistent on a relative basis through thick and thin. What can this mean for clients? A smoother ride, a more dependable portfolio, and realistic expectation-setting for both up and down markets.

As we seek to outperform over time, we look at a number of metrics to determine how we should position ourselves (with value being very important). These are intermediate-to-long-term decisions. Risk management, however, is a consistent and frequent endeavor, utilizing statistics with various time frames and signal frequencies. Risk changes every day, and the proper measurement and management of that risk prepares us for any expected or unexpected (usually the case) turbulence. “The pilot has turned off the seat belt sign, but please keep your seat belt buckled in case of unexpected turbulence.” (Try telling that to a two year old…)

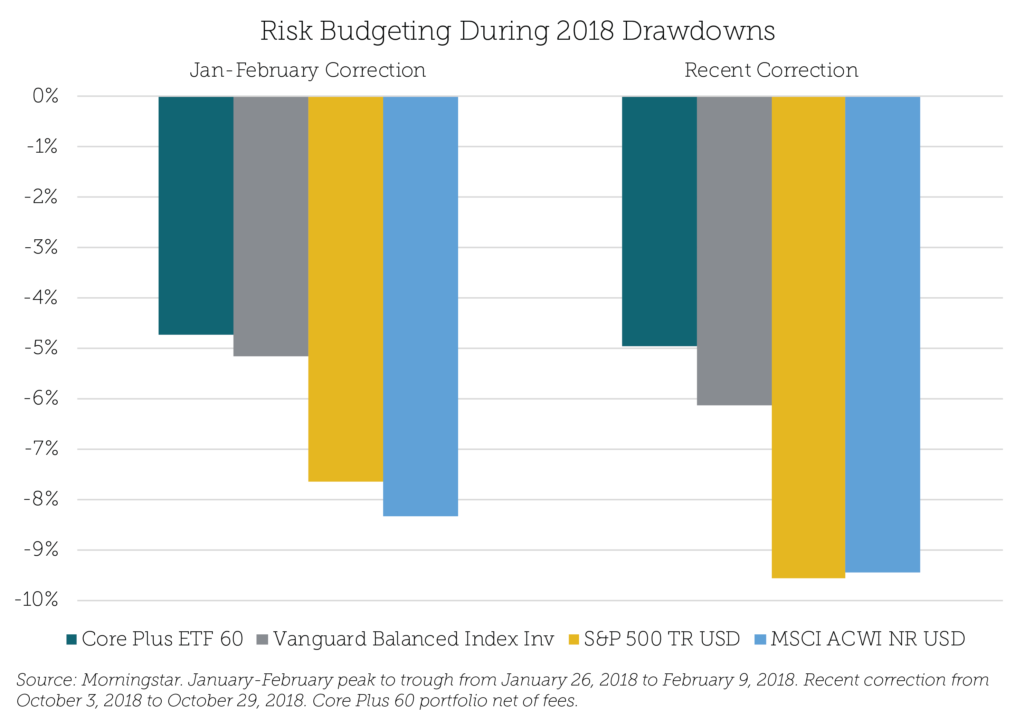

2018 has provided two of the quickest and sharpest downturns we’ve seen in recent years, something that should not be unexpected while the U.S. market is at its current levels. Below, the Core Plus 60 RB portfolio (60% of the risk of the global equity market) is shown against two major indices during this year’s corrections. Performance has been exactly what you’d expect, if not better. This can be applied to any Risk Budgeted strategy – the measurement is the same. The $40 billion Vanguard Balanced Index fund, which has a similar risk profile to a 60 RB CLS portfolio, has seen more downside risk this year, mainly due to lower diversification versus how we build portfolios.

Grant Engelbart is Director of Research/Senior Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.