“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” – Milton Freidman

A year ago, in March 2021, headlines were abuzz with talk of the third round of stimulus, the American Rescue Plan, which was passed by Congress and signed into law. This bill amounted to an additional $1.9 trillion in stimulus, and included direct payments to millions of Americans, changes to several tax provisions, grants to small businesses, and other measures.

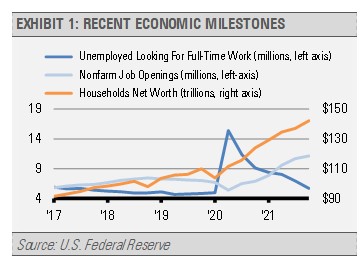

Notably less discussed were a few important economic milestones that were also timely. For example, U.S. household net worth had already reached a new all-time high in the fourth quarter of 2020, months before the added stimulus. Additionally, the number of open jobs in the U.S. economy in March 2021 exceeded the number of Americans looking for full-time work, which reflects a strong labor market.

So, while politicians debated the American Rescue Plan, U.S. households in aggregate became wealthier than ever and there were plentiful jobs. At the same time, the U.S. Federal Reserve continued to inject money into the economy through bond purchases while holding short-term interest rates near zero, and further increasing the money supply.

The inflation that we are experiencing today is exactly what we should expect given Freidman’s insight that inflation is the result of too much money chasing too few goods. With aggregate household net worth at the highest level ever, the demand for goods has seemingly outstripped our economy’s capacity to satiate that demand. This demand pushed the prices for goods higher. In addition, with job openings outnumbering available workers, wages are pushed higher. The result is inflation that will likely remain with us for longer than many policy makers expect.

For more news, information, and strategy, visit the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.