- Investors’ conviction that the Fed is killing inflation, and will soon end its tightening, drives the rally.

- Our 6-month Equity model forecasts an additional gain of 7.4% despite the market rally in July.

- Accordingly, we keep our strategies in maximum-bullish positioning.

Stocks rebounded strongly in July despite continued Fed tightening and weak economic data. The S&P 500 jumped by 9.1%, its biggest monthly gain since 2020, and the Nasdaq 100 rallied by 12.6%. Instead of economic data or earnings, a conviction that the Fed is winning against inflation, and will soon end its tightening, drives the rally, in my view – see the rationale below.

Our 6-month outlook for the S&P 500 increased to 7.4% from 6.4% on June 30th, despite higher market valuation after the July rally. The June-30th maximum-bullish signal by our models turned out to be very accurate, and our bullish stance continues.

Economic data went from bad to worse in July, and Q2-2022 corporate earnings were generally weak. In addition, the Fed delivered the second 75-basis-point rate hike in July. So, why did stocks rally so strongly? Bear with me to the end of this article for rationale.

The Fed hiked its Funds rate by 0.75% again in July, to 2.5%. Apart from a few months in 2019, the rate is now at its highest since 2008:

The US economy slowed markedly in recent months. This can be seen by the ISM Manufacturing PMI: it fell to around 53 in June and July, pointing to the slowest growth in manufacturing since June of 2020. The level of 50 separates growth from contraction.

Consumer sentiment remains near record low, due primarily to inflation concerns. The University of Michigan’s sentiment index rebounded just slightly, to 51.5 in July from a record low of 50 in June:

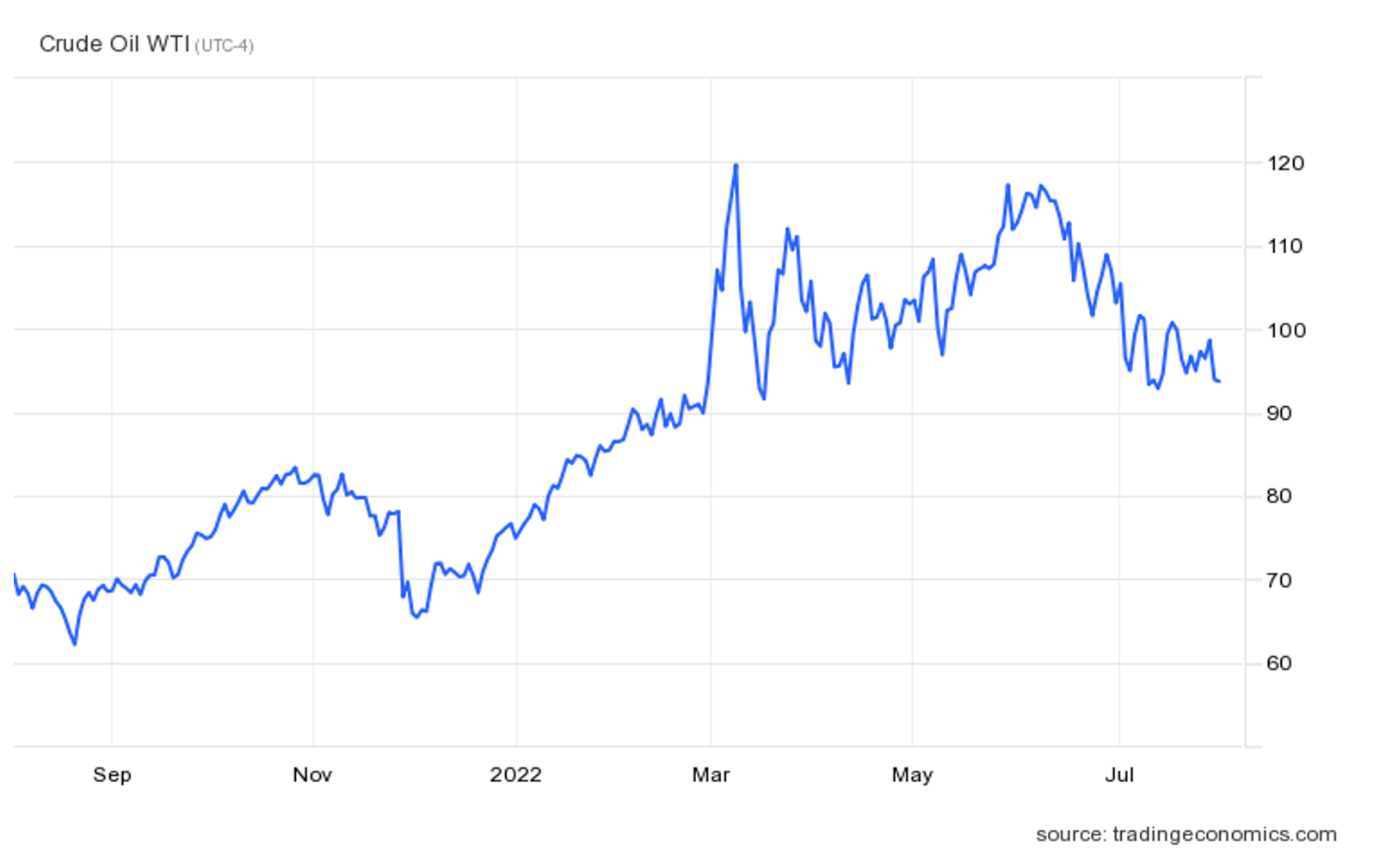

It appears that the Fed’s tightening is beginning to “work.” In addition to economic slowdown, it broke the bull market in commodity prices. Nearly all commodities began to fall. For example, the WTI crude oil fell below $95 per barrel form its $120 peak in June:

Copper, wheat and some other commodities experienced even sharper declines:

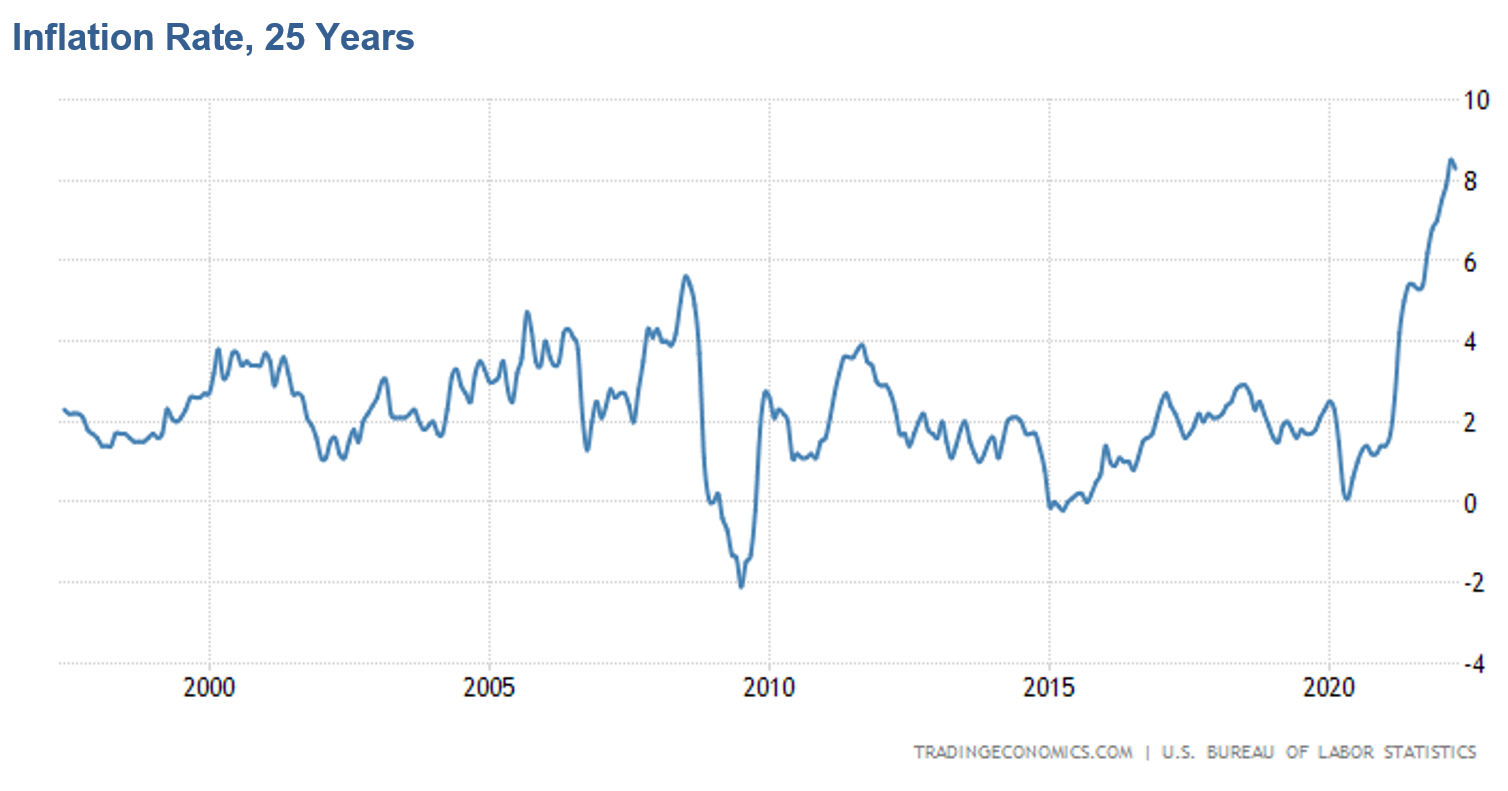

Inflation continued to rise in June, to 9%, a new 41-year high. However, we should understand that inflation rate is backward-looking: it measures the rate of price change compared to a year ago. In addition, it’s reported by the BLS with one-month lag. Inflation has been largely driven by energy and other commodities, and as described above, commodity prices have now begun to fall. This suggests, other things equal, that inflation should begin to ease in a month or two.

Is the Fed nearly done with tightening? Bond investors seem to have already priced-in this scenario – the 10-year Treasury yield fell to 2.63% on August 2nd from its recent peak of 3.5%:

Investors watched how the Fed, determined to control rising inflation, drove the market decline in the first half of 2022. Always forward-looking, they now focus on what the Fed will do next. Commodities and bond markets signal, correctly or not, that the Fed has won the fight against inflation, and will soon end its tightening. It appears that stock investors imagine that with the Fed out of the way, a bull market will resume. They see a reversal of 1H-2022 and are rushing to buy stocks.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment adviser, and is based in Waltham, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services aimed to help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on SMArtX Advisory and Envestnet platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research. MCM’s Form ADV, Part 2A (Brochure) contains further details pertaining to employee training.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. Opinions or information are subject to change with respect to MCM Research.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- “Model Return Forecast” for 6-month S&P 500 return is MCM’s measure of attractiveness of the U.S. equity market obtained by applying MCM’s proprietary statistical algorithm and historical data, but is not promissory, and, by itself, does not constitute an investment recommendation. Model Return Forecasts were calculated and applied by MCM to its research and investment process in real time beginning from 2012. For periods prior to Jan 2012, the results are “back-tested,” i.e., obtained by retroactively applying MCM’s algorithm and historical data available in Jan 2012 or thereafter. Back-tested performance, if any, is presented gross of any advisory fees and trading expenses. Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.