By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

As students and practitioners of behavioral finance, we understand how investors can be easily derailed by the recent and sudden volatility in the stock market.

Even the most experienced investors can be caught off guard with quick corrections of this magnitude. It is rare that we would see stock market volatility of this size without first seeing signs of risk in monetary and/or credit conditions, both of which remain in good shape. Despite the fundamental case, stock market volatility tends to persist for weeks or months, so investors should be prepared for more dramatic market swings both up and down.

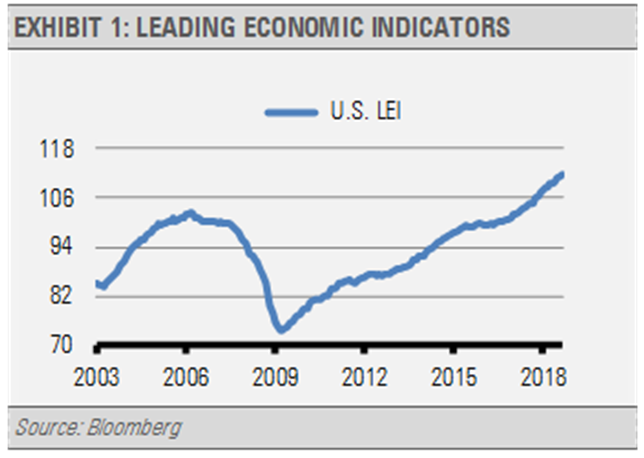

It looks as though the U.S. Federal Reserve (Fed) is poised to continue raising short-term interest rates. Unless long-term bond yields move higher from here, the Fed runs the risk of inverting the yield curve sometime in the next couple of quarters. Note that while an inverted yield curve has historically foreshadowed recessions, it has done so with a year or two lead time. We are also watching liquidity conditions and other leading indicators closely to get a better indication of where the economy is headed in the near-term. Note that the composite of Leading Economic Indicators, which tends to turn down prior to recessions, is actually up over 6% from last year.

In aggregate, our indicators suggest little chance of a recession in the next 12-months, so we expect further economic growth along with higher corporate revenues and earnings, but at a significantly slower pace than has been the case recently. This should lead to higher stock prices over the next year, though it may be a bumpy ride.

We expect the positive effects from tax cuts and increased government spending to fade just as interest rate hikes from the Fed begin to bite. Slower economic growth should keep a lid on long-term interest rates. Slower growth and range-bound or falling long-term interest rates should benefit defensive sectors and longer-duration fixed income holdings, such as taxable munis. In addition, further rate hikes may benefit floating rate funds as well.