Our work suggests that the U.S. Federal Reserve (Fed) is likely done raising short-term interest rates for the current business cycle. Although the Fed has made clear that they expect to increase interest rates an additional 25 basis points (0.25%) this year and then hold them at that level for some time, we expect the Fed to begin cutting interest rates later this year.

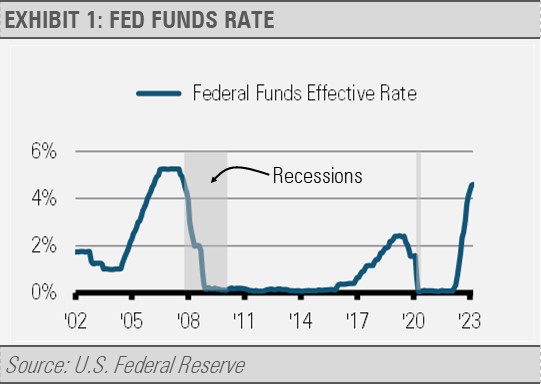

The Fed has already increased interest rates at the fastest pace in decades and to the highest level since 2007 (exhibit 1). Combined with also taking steps to reduce the size of its balance sheet prior to the recent banking industry challenges, their actions amount to a massive amount of monetary policy tightening over a very short period in our view.

The Fed has already increased interest rates at the fastest pace in decades and to the highest level since 2007 (exhibit 1). Combined with also taking steps to reduce the size of its balance sheet prior to the recent banking industry challenges, their actions amount to a massive amount of monetary policy tightening over a very short period in our view.

Given that shifts in monetary policy effect the economy with long and varying time lags, we do not think that the full impact of the Fed’s policy tightening over the last year has been fully realized. For example, it took about a year for inflation to really take off in response to the government’s massive stimulus enacted during the COVID-19 pandemic. We expect a similar time lag resulting from the Fed’s moves to fight that inflationary impulse.

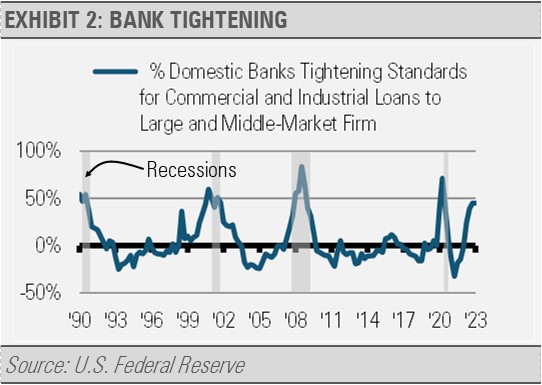

In addition to the Fed’s policy tightening, the banking sector had already begun to tighten lending standards prior to the latest bank failures (exhibit 2).

As banks tighten lending standards, businesses and individuals have more difficulty borrowing funds for everything from purchasing new plant and equipment to buying a car or house. That leads to less money in the economy, which slows economic growth and inflation as well as potentially steering into a recession.

Combined with other economic factors, tightening from the Fed as well as private sector banks have already reduced the amount of broad money in the economy as measured by M2 (exhibit 3). M2 includes currency, checking accounts, and savings account deposits, as well as money market funds, and other similar instruments. From its peak of $22 trillion in April 2022, broad money has declined by approximately $900 billion.

We think that the reduced amount of money in the economy will be a key driver in decreasing inflation over the months and years ahead.

As a result of these and other factors, our work suggests that the rate of headline inflation with fall precipitously in the coming months. Faced with falling inflationary pressures and slowing economic growth, we expect the Fed to begin reducing short-term interest rates rather than leaving them higher for as long as they currently project.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.