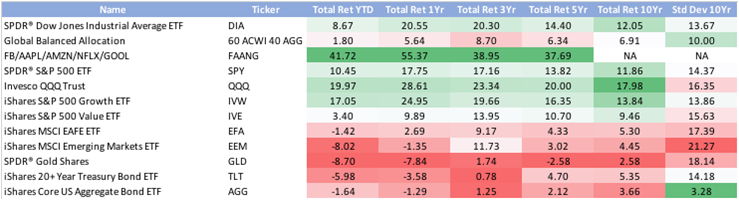

Last week, the Dow Jones Industrial Average (Dow) made headlines for reaching all-time highs on both Monday and Tuesday. The implication is that the average investor is experiencing another spectacular year of returns. Unfortunately, the average global balanced portfolio is up about 1.8% even though the Dow is up 8.67%. In this week’s TETF.index update, we evaluate this disparity in returns and the role and implications for the ETF industry.

![]()

The “Marketing” Indexes are Winning the Performance Game

The ETFthinktank.com research team is no fan of the Dow. Within our ETF security master, we actually assign it almost no investment merit and categorize the Dow as a “Marketing” index. We wrote about the deficiencies of the Dow as an index in this critique of “smart beta”: Now, beyond our theoretical concerns with the Dow, the headlines about record highs have confused the average investor considering every other major asset class is negative YTD 2018. This dislocation drives difficult conversations between Wealth Advisors promoting rational diversification and individual investors chasing headlines.

Source Toroso Security Master as 9-30-18

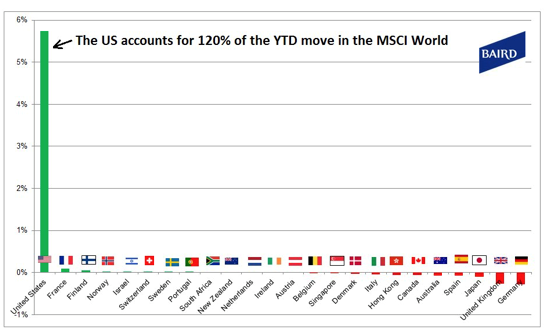

The US is UP, Everyone Else is DOWN

The performance disparity between US large capitalization stocks and other asset classes is extreme in 2018. Within the large cap universe, the returns are obviously tilted toward growth and technology, which is illustrated in the chart above. Additionally, commodities and fixed income are producing negative returns YTD. Other ETF nerds like Meb Faber and Charlie Bilello have recently shared charts showing the massive disparity in returns geographically.

![]()

Provided by Meb Faber’s Idea Farm

Provided by Charlie Bilello Pension Partners

Now that we have looked back at performance, let’s consider more forward-looking indicators like fundamentals: