By Chris Konstantinos, CFA

Our View of Volatile Stocks and the Message of Markets

Markets took a dizzying wobble this past week as lots of micro news assaulted a market which had become accustomed to a pretty consistent macro narrative of ‘TINA’ (there is no alternative) to stocks.

Specifically, the NYSE set new all-time highs in volume (shares traded) as a frenzy of individual investors, fueled by stock tips on public social media platforms like Reddit, dramatically bid up shares of beleaguered retailer GameStop (GME) and other companies where bearish institutional investors had accumulated large ‘short’ positions. A short is a bet that a stock will go down… and when that stock rises, a short seller is forced to post collateral to cover any losses or close out their positions. Short sellers make money when a stock falls; however, when a stock rises, their losses can be unlimited.

A large ‘short squeeze’, which is a coordinated effort to force short-sellers to cover their positions, can have ripple effects in other areas of the market since the short-sellers may be forced to sell other holdings to raise cash. While this squeeze drove GME stock price up dramatically, hedge funds holding short shares were forced to indiscriminately sell many other holdings to fund margin calls, cascading losses across many parts of the broader equity market. (Note: For those unfamiliar with market terms such as ‘short-selling’ and ‘margin’, we’ve published an Appendix to this Weekly View where we go into greater detail on some of these strategies)

A Couple Thoughts on Recent Retail Speculation in Stocks

To be clear, RiverFront does not utilize options or short selling in any of its strategies, nor do we leverage our long positions using margin debt. Nonetheless, as investors and fiduciaries it is important that we contemplate this recent bout of volatility and work to understand some of its downstream implications on investors of all stripes. While we have no fundamental view on GME or any of the other stocks buzzed about this week, we do have some thoughts about perhaps what all of this retail speculation may mean on a broad level.

First, dismiss the ‘Smart Money’ narrative.

We find the traditional Wall Street narrative of institutions being the ‘smart money’ insulting and frankly misguided. The ‘pros’ are not always right and can be just as prone to biases as anyone else- confirmation bias, hubris, and emotionality among them. One pertinent example is the fact that GME stock had more than 100% of its shares outstanding held short as of two weeks ago– a rare condition that suggests the stock could be quite vulnerable to a short squeeze run. Many of the institutions shorting the stock either did not see the risks or ignored them. A number of astute retail investors found this anomaly, illuminated it, and exploited it, beating the ‘pros’ at their own game.

In fact, we believe that the playing field is becoming more level between retail and institutional investors. Between Reg FD (rule requiring equal dissemination of news), the crack-down on ‘expert networks’ (a criticized venue for inside information), the rise of ETFs (democratized asset classes and investment strategies), and low fee trading platforms; retail investors are on the most equal footing to institutional investors in history, in our view.

However, given the high profile of the headlines, it is natural that regulators will be closely analyzing last week’s events. Financial regulators’ top priority is to protect the integrity of the stock market and thus make markets safe for investors, particularly individual investors. One thing regulators will likely be looking for is evidence that online posters were recommending one action (buy shares) while doing the opposite (selling shares). Our advice to anyone trading these names is to please tread carefully. Don’t bet money you can’t afford to lose and recognize that you may not know the motivations of other investors you interact with online.

Second, we believe that broad retail investor participation may be a positive, not a negative sign for the broad stock market.

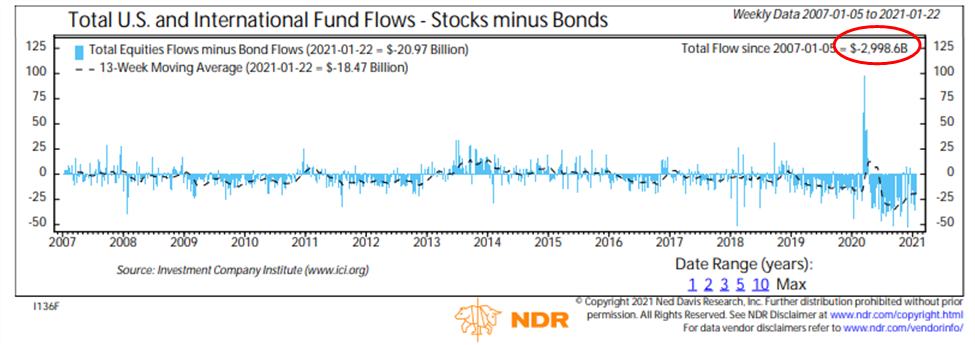

The current narrative in the press mostly revolves around how retail speculation is the newest sign of the coming bear market in stocks. However, our philosophy of ‘devil’s advocacy’ challenges us to consider whether greater retail interest in stock markets may actually be a positive indicator for the market. For much of last decade, stock flows were tepid as investors speculated in pretty much everything but public stocks including, real estate, cryptocurrencies, and even bonds. While record volume stock days have been making the headlines recently, it is worth considering that bond flows have dwarfed stock flows for years, as this Ned Davis Research chart below captures. Since 2007, total bond fund flows are cumulatively almost $3T higher than stock flows (see data in red circle – includes both mutual funds and ETF flows). The fact that investor participation is broadening may actually provide volume fuel to power the next leg of the new cyclical bull market that we believe began in March 2020.

Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.

In some ways, while the level of speculation may have echoes of the late 1990s, we think there is a greater similarity to the increasing level of interest in stocks during the mid-1990s. We are reminded of Alan Greenspan’s December 1996 ‘irrational exuberance’ speech, when the former Fed Chair warned that stocks were becoming frothy and the market dipped temporarily. However, shortly thereafter the S&P 500 continued its climb, nearly doubling over the next three years.

Third, the current ‘message of the market’ does not yet suggest a meltdown is imminent, in our view.

In times like these, sometimes it is hard to see the forest through the trees. When we pull back the lens and look at the forest, what we see is a stock market that, in our opinion, has been exhibiting signs of improving technical strength recently. In the last six months, the vaccine-induced rally has increasingly broadened to include the average stock – which tend to be smaller, more value-oriented, and more cyclical than the current top holdings. According to an analysis by Ned Davis Research (NDR), the percentage of S&P 500 stocks above their 10 and 30-week moving averages is currently high, a condition that has historically been positive for stocks. In fact, NDR found that this condition has historically led to annualized outperformance of 4.5% relative to bonds.

Staying Focused on the Forest

As we wrote in our 2021 Outlook, when you take a step back from all the headlines this week, we believe the backdrop for investing in equities remains attractive. Reasons include the unprecedented level of fiscal and monetary stimulus in the system and our opinion that stock valuations remain reasonable given the ultra-low interest rate environment. We also believe that the Federal Reserve is likely to stay accommodative for the foreseeable future due to high unemployment, especially in hospitality-related areas of the economy.

Our View of Important Technical Levels in The Market

Disclosures: Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

RiverFront’s risk management process is intended to be both proactive and reactive. The reactive portion of the

process tries to mitigate adverse outcomes during unforeseen events. For example, our Outlook 2021 did not envision a scenario where targeted short squeezes could affect the broad market. For now, we are closely monitoring the situation but do not yet feel the need to significantly adjust our portfolio’s positioning. However, if the facts change so will we. This risk management philosophy is embedded in all we do here at RiverFront and is particularly relevant for our shorter investment-horizon, more risk-adverse asset allocation portfolios.

&P 500 price levels we are watching closely for clues to a potential trend change include 3560 (roughly a 50% retracement of the recent rally). Below that level, the market would enter what we view as a ‘decision box’, with support generally between 3240-3560 (between the green lines on chart). The 200-day moving average (200dma) is currently within this box at around 3369 (red line). The current distance between the market and its moving average underlines to us that the market has moved up a long way in a short time. Routine pullbacks back towards an upward-sloping 200dma are relatively frequent should generally be viewed as routine. They are usually hard to time -and thus successfully trade – but shouldn’t necessarily suggest the cyclical bull market is over.

Conclusion: When the Going Gets Weird, the Wise Stay Focused

The events of last week remind us how fast markets move, and how important it is to have a sound financial plan focused on seeing the forest through the trees. Our broader analysis suggests the stock market remains in an uptrend, but if the facts change, so will we.

We believe successful investors, whether individual or institutional, have a few things in common: they generally stay unemotional, do not bet more than they can afford to lose, have a risk management plan, and do not become too anchored on any one forecast (including their own). In other words, we think the investment ‘process’ is more important than the ‘prediction’.

APPENDIX:

Markets are not casinos…but they can sometimes seem that way. The past few weeks underscore this idea as several stocks with significant levels of short interest have experienced meteoric rises due to buying coordinated by social media sites and message boards. The Wall Street Journal recently reported that traders, including individual investors, are buying and selling stock options at a record pace. Some of these traders may be inexperienced with sophisticated financial derivatives such as options and may not realize the inherent risk in some trading strategies using options.

Beware of investing in a way that downside is unlimited:

Short-selling or writing naked options (calls) entail unlimited downside. Theoretically, there is no limit to how high a stock price can go. Thus, someone who is short a stock (short seller agrees to buy back a stock at a later date) is on the hook to fund the rise in a stock price no matter whether it is justified or not.

The events of the last few weeks have been stark reminders that ‘markets can be irrational longer than one can be solvent’. For this reason, short selling is far more complicated than just identifying stocks that should fall in price. Short sellers must pay borrowing fees for the period of time they are short. These borrowing fees can be hefty for highly shorted stocks and can significantly raise the break-even level. Short sellers also must recognize the risk of a ‘short squeeze’ caused by quickly rising stock prices. In a short squeeze, short-sellers are required to post margin frequently, often multiple times in a day, or else their broker-dealer will close out the short position by purchasing the underlying shares to mitigate the losses.

RiverFront does not utilize options or short selling any of its asset allocation portfolios.

Be careful with margin:

Margin is the practice of borrowing to invest. Margin is leverage and will multiply gains and losses. Margin also requires a regular ‘true-up’ on losses. Therefore, holdings purchased on margin are path dependent, meaning that the stock price in the long run may not matter if the investor is unable to maintain their position throughout the journey.

RiverFront does not utilize margin in any of its asset allocation portfolios.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

RiverFront does not have any exposure to GameStop (GME) In any of Its portfolios or sub-advised ETFs or mutual funds.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1505492