January 2021 will mark the transition to the Biden administration and with it former Chair of the Federal Reserve Janet Yellen as Biden’s nominee for Secretary of the Treasury. With any change in power, there are positives and negatives that need to be considered as the information we have in making investment decisions and managing risk evolves. Since this transition occurs in the midst of the coronavirus pandemic, it will also have implications for those states that are struggling to balance their budgets while keeping their economies growing.

Both Republicans and Democrats have come together this year to quickly direct aid packages to Americans negatively impacted by the pandemic. However, there are some differences of opinion when it comes to aid for states that have not been fiscally responsible prior to the pandemic. The debates between opinions could go on and on, and we have no opinions or political stance. We can, however, objectively look at what the likely nomination of Yellen as Secretary of the Treasury would mean for further coronavirus aid, and how this new information could impact our outlooks and decision making.

Moving forward, the new Treasury Secretary will play an important role and may determine if meaningful aid to states will materialize. With the current nominee for Treasury Secretary, Janet Yellen, it seems the stars are aligned for states to get support in a meaningful way. If Yellen is confirmed, we expect to see a bigger push for state support. Yellen has been a big advocate for both fiscal and monetary policy to battle coronavirus. She is also a big supporter of aid packages for state governments that have taken revenue hits and are being forced to balance their budgets in this difficult time as state spending and employment are big economic drivers. Additionally, she has voiced concern over the safety of communities being compromised due to decreased revenues. As Treasury Secretary, we think Yellen would be in a role to propose and broker a deal that could bail the states out and prop up the economy even further. Additionally, she will have a meaningful influence over other areas such as bank regulation, fiscal policy, and trade.

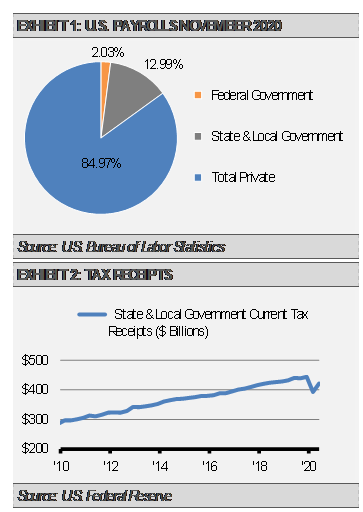

Overall, we see Yellen as a positive step forward in the battle against the coronavirus and believe she will follow through on getting more aid until there is widespread delivery and adoption of a vaccine to allow somewhat of a return to normal. In addition to being a large employer, states and local governments are a major factor to the overall economy and recovery since they make up a healthy portion of GDP. State and local governments are also large employers and depend on tax revenue, which has declined this year due to shutdowns (exhibits 1 and 2). As an advocate for deficit spending during economic crisis, Yellen had previously supported funding of state and local projects during the financial crisis bailout.

We think the confirmation of Janet Yellen as Secretary of the Treasury will be good for economic growth in the near-term as we continue to navigate the pandemic. However, her positioning is more complicated during non-crisis environments since she has previously advocated for balanced budgets, higher taxes, and cuts to spending. These are views that may worry some market participants over the longer-term now that she could be taking on the influential role of Secretary of the Treasury.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.